NZD/USD: the instrument is consolidating

14 May 2018, 10:08

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6990, 0.7010 |

| Take Profit | 0.7070, 0.7100 |

| Stop Loss | 0.6950 |

| Key Levels | 0.6896, 0.6913, 0.6943, 0.6982, 0.7000, 0.7036, 0.7051 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6940, 0.6915 |

| Take Profit | 0.6880, 0.6850 |

| Stop Loss | 0.6960, 0.6980 |

| Key Levels | 0.6896, 0.6913, 0.6943, 0.6982, 0.7000, 0.7036, 0.7051 |

Current trend

NZD is under pressure against USD but is trading mostly flat, stepping off the local lows at the end of the last trading week, when the investors negatively met quite a positive New Zealand macroeconomic data, and the growth of the instrument was significantly restricted.

April NZ Manufacturing PMI grew from 53.1 to 58.9 points. PMI Service decreased from 58.6 to 55.9 points, which was a bit worse than the analysts expected.

The investors are waiting for the new drivers to appear; however, today the volatility will barely increase, as in the macroeconomic calendar there are only US Fed’s representatives’ speeches.

Support and resistance

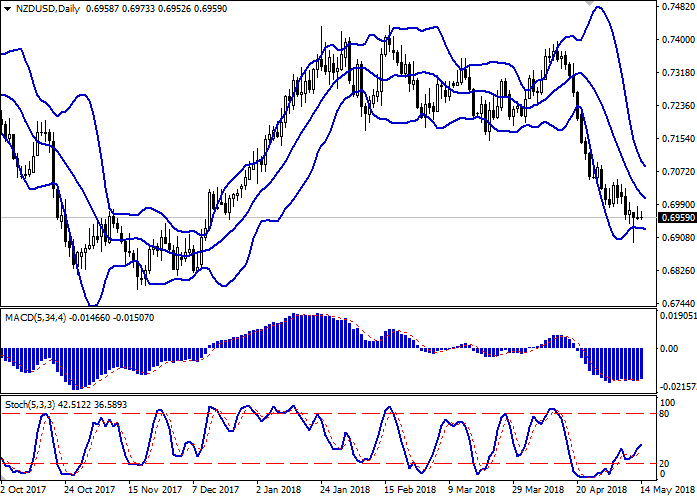

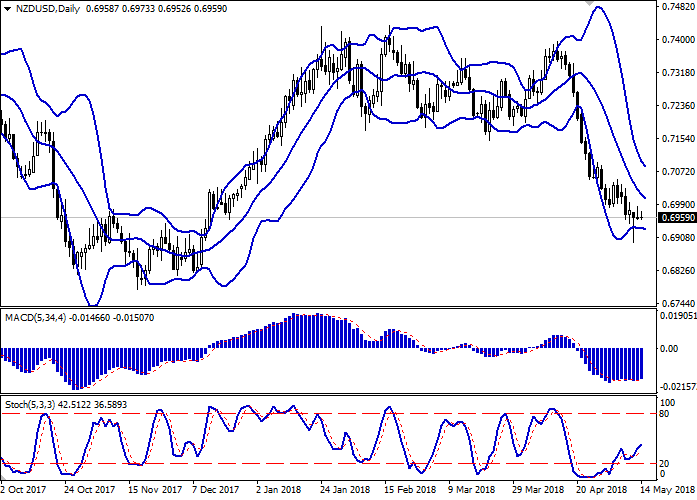

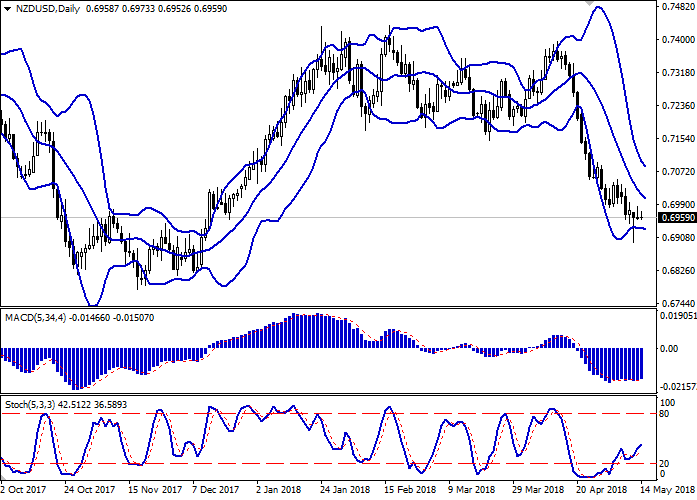

On the daily chart, Bollinger Bands are slightly reversing into the flat. The price range is actively narrowing, reflecting the mixed trade dynamic of the recent days. MACD is growing, keeping a weak buy signal (the histogram is above the signal line). Stochastic’s dynamics is the same; it is steadily growing after a short Thursday’s decreaseне.

The development of the correctional growth is possible in the short or very short term.

Resistance levels: 0.6982, 0.7000, 0.7036, 0.7051.

Support levels: 0.6943, 0.6913, 0.6896.

Trading tips

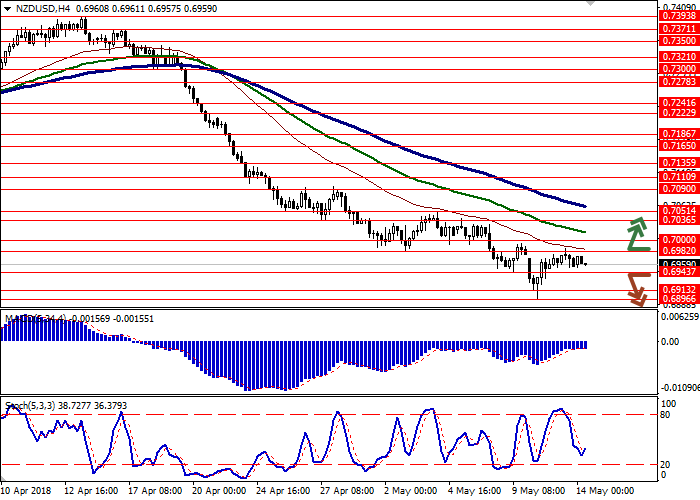

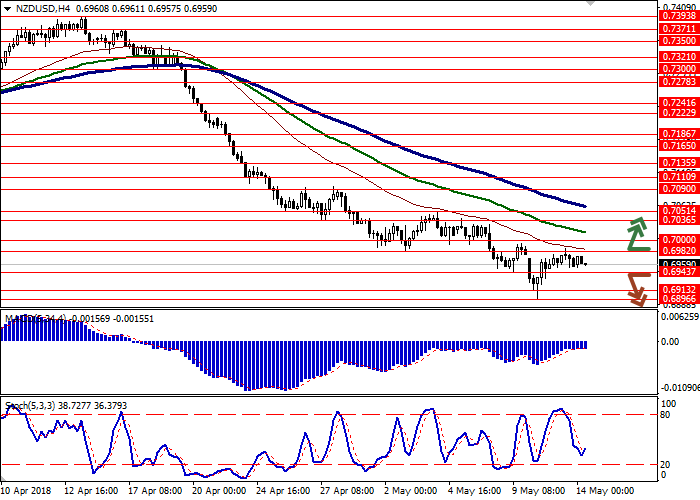

Long positions can be opened after the breakout of the levels of 0.6982 or 0.7000 with the targets at 0.7070 or 0.7100 and stop loss 0.6950.

Short positions can be opened after the breakdown of the levels of 0.6943–0.6920 with the targets at 0.6880–0.6850 and stop loss 0.6960–0.6980.

Implementation period: 2–3 days.

NZD is under pressure against USD but is trading mostly flat, stepping off the local lows at the end of the last trading week, when the investors negatively met quite a positive New Zealand macroeconomic data, and the growth of the instrument was significantly restricted.

April NZ Manufacturing PMI grew from 53.1 to 58.9 points. PMI Service decreased from 58.6 to 55.9 points, which was a bit worse than the analysts expected.

The investors are waiting for the new drivers to appear; however, today the volatility will barely increase, as in the macroeconomic calendar there are only US Fed’s representatives’ speeches.

Support and resistance

On the daily chart, Bollinger Bands are slightly reversing into the flat. The price range is actively narrowing, reflecting the mixed trade dynamic of the recent days. MACD is growing, keeping a weak buy signal (the histogram is above the signal line). Stochastic’s dynamics is the same; it is steadily growing after a short Thursday’s decreaseне.

The development of the correctional growth is possible in the short or very short term.

Resistance levels: 0.6982, 0.7000, 0.7036, 0.7051.

Support levels: 0.6943, 0.6913, 0.6896.

Trading tips

Long positions can be opened after the breakout of the levels of 0.6982 or 0.7000 with the targets at 0.7070 or 0.7100 and stop loss 0.6950.

Short positions can be opened after the breakdown of the levels of 0.6943–0.6920 with the targets at 0.6880–0.6850 and stop loss 0.6960–0.6980.

Implementation period: 2–3 days.

No comments:

Write comments