GBP/USD: the pound is consolidating

29 May 2018, 10:15

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3355 |

| Take Profit | 1.3450, 1.3500, 1.3535 |

| Stop Loss | 1.3280 |

| Key Levels | 1.3176, 1.3228, 1.3286, 1.3350, 1.3400, 1.3448, 1.3535 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL |

| Entry Point | 1.3280 |

| Take Profit | 1.3200, 1.3176 |

| Stop Loss | 1.3350 |

| Key Levels | 1.3176, 1.3228, 1.3286, 1.3350, 1.3400, 1.3448, 1.3535 |

Current trend

Yesterday, GBP traded in different directions against USD and closed with a minimal "bearish" advantage. American and British markets were closed due to holidays, so the dynamic was weak and ambiguous.

Investors are focused on Brexit negotiations. Michel Barnier said that the EU is not satisfied with the progress, as Britain refuses to say what it wants after leaving the EU. The UK authorities cannot find an agreement. According to The Telegraph, Foreign Minister Boris Johnson stated that the country should leave the customs union, and the first minister of Scotland, Nicola Sturgeon, at the meeting with Michel Barnier in Brussels.

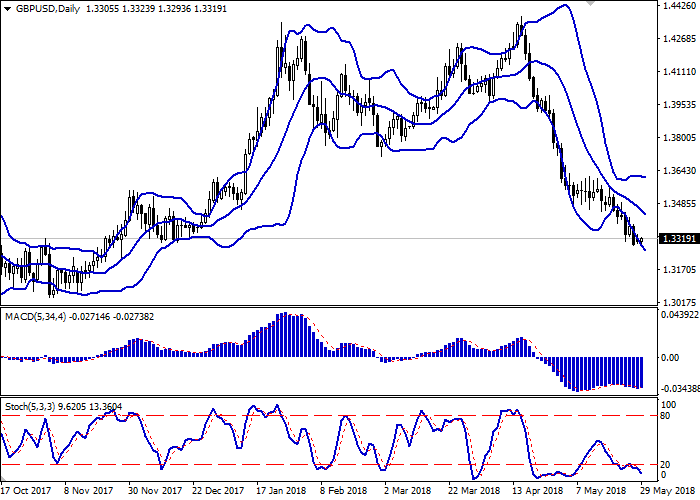

Support and resistance

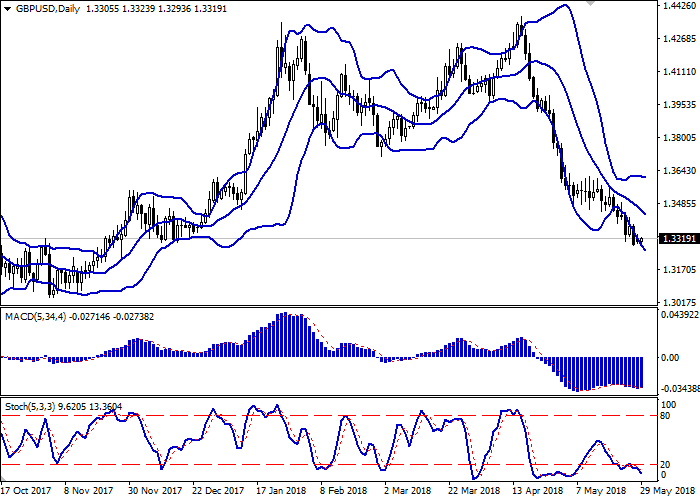

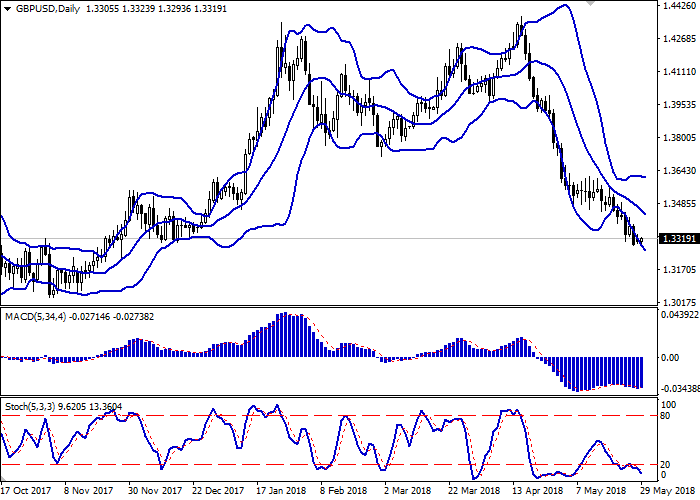

On the daily chart, Bollinger bands are actively falling. The price range is slightly widening, opening the way to new lows since November 2017. MACD is trying to reverse upwards up and is preparing to give a buy signal (the histogram should be above the signal line). Stochastic is near its lows, reflecting than GBP is oversold in the short term.

It is better to wait until the correctional growth signal forms. It is better to keep some of the short positions in the short and very short term.

Resistance levels: 1.3350, 1.3400, 1.3448, 1.3535.

Support levels: 1.3286, 1.3228, 1.3176.

Trading tips

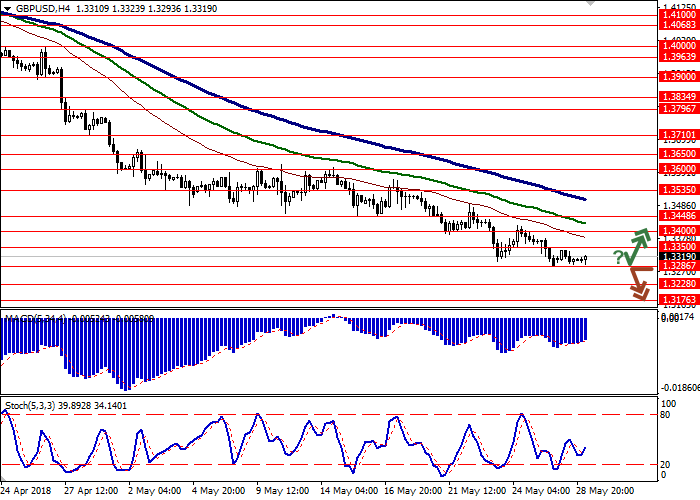

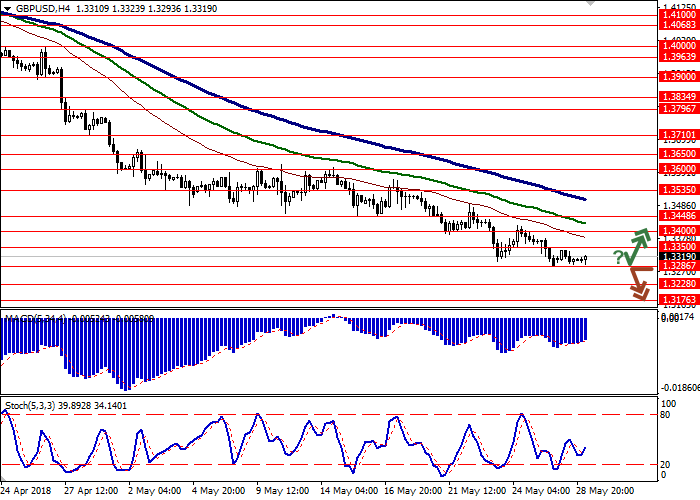

Long positions can be opened after a rebound from the level of 1.3286 and breakout of the level of 1.3350 with the targets at 1.3450 or 1.3500–1.3535 and stop loss 1.3280.

Short positions can be opened after the breakdown of the level of 1.3286 with the target at 1.3200 or 1.3176 and stop loss 1.3350.

Implementation period: 2–3 days.

Yesterday, GBP traded in different directions against USD and closed with a minimal "bearish" advantage. American and British markets were closed due to holidays, so the dynamic was weak and ambiguous.

Investors are focused on Brexit negotiations. Michel Barnier said that the EU is not satisfied with the progress, as Britain refuses to say what it wants after leaving the EU. The UK authorities cannot find an agreement. According to The Telegraph, Foreign Minister Boris Johnson stated that the country should leave the customs union, and the first minister of Scotland, Nicola Sturgeon, at the meeting with Michel Barnier in Brussels.

Support and resistance

On the daily chart, Bollinger bands are actively falling. The price range is slightly widening, opening the way to new lows since November 2017. MACD is trying to reverse upwards up and is preparing to give a buy signal (the histogram should be above the signal line). Stochastic is near its lows, reflecting than GBP is oversold in the short term.

It is better to wait until the correctional growth signal forms. It is better to keep some of the short positions in the short and very short term.

Resistance levels: 1.3350, 1.3400, 1.3448, 1.3535.

Support levels: 1.3286, 1.3228, 1.3176.

Trading tips

Long positions can be opened after a rebound from the level of 1.3286 and breakout of the level of 1.3350 with the targets at 1.3450 or 1.3500–1.3535 and stop loss 1.3280.

Short positions can be opened after the breakdown of the level of 1.3286 with the target at 1.3200 or 1.3176 and stop loss 1.3350.

Implementation period: 2–3 days.

No comments:

Write comments