EUR/USD: the Euro remains under pressure

29 May 2018, 10:11

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1655, 1.1680 |

| Take Profit | 1.1800 |

| Stop Loss | 1.1600 |

| Key Levels | 1.1500, 1.1552, 1.1605, 1.1672, 1.1741, 1.1800, 1.1860 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL |

| Entry Point | 1.1594 |

| Take Profit | 1.1500 |

| Stop Loss | 1.1672 |

| Key Levels | 1.1500, 1.1552, 1.1605, 1.1672, 1.1741, 1.1800, 1.1860 |

Current trend

EUR declined against USD on Monday, noting a new local minimum since November 9, 2017.

A worsening government crisis in Italy affects the currency negatively. President Sergio Mattarella refused to approve consistent Eurosceptic and critic of the EU budget policy economist Paolo Savona as Economy and Finance Minister. In reply, coalition Prime Minister Giuseppe Conte refused to head the government. The leaders of the 5 stars and League parties accused President Mattarella that he succumbed to the pressure of the ruling elite of the EU, and demanded his impeachment. The development of Italy political confrontation inside will affect EUR negatively.

The traders today focus on statistics on private loans in the EU for April, as well as statements by ECB representatives Mersch and Lautenschläger.

Support and resistance

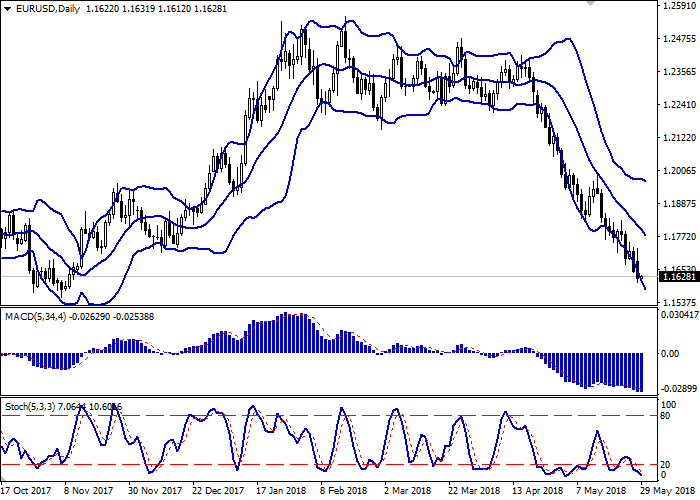

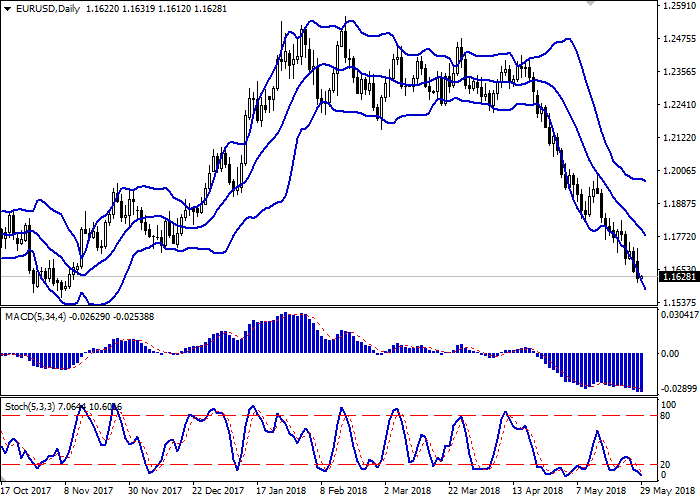

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range expands, making way for new local lows for the instrument.

MACD is going down preserving a moderate sell signal (histogram is located below the signal line).

Stochastic also maintains a downtrend but is located in close proximity to its minimum levels, which indicates oversold EUR in the short term.

The current showings of the indicator do not contradict the further development of the downtrend in the short term. However, the corrective growth still may appear.

Resistance levels: 1.1672, 1.1741, 1.1800, 1.1860.

Support levels: 1.1605, 1.1552, 1.1500.

Trading tips

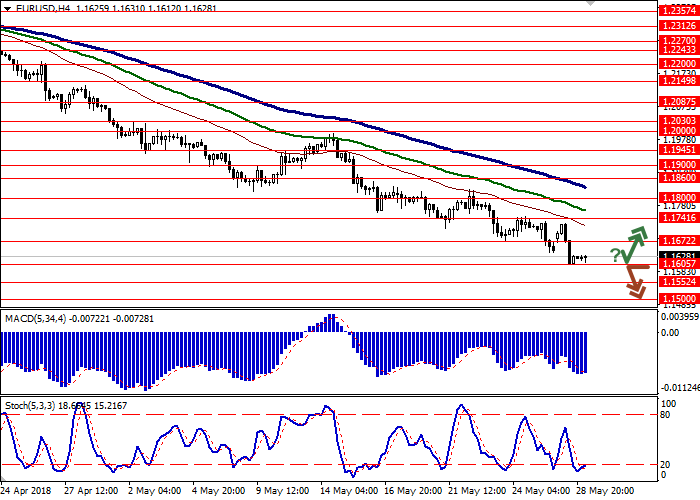

Long positions may be opened if the instrument rebounds from the level of 1.1605 followed by the breakout of 1.1650–1.1672 mark. Take-profit – 1.1800. Stop-loss – 1.1600. Implementation period: 2-3 days.

The breakdown of 1.1605 mark may serve as a signal to further sales with the target at 1.1500. Stop-loss — 1.1672. Implementation period: 2 days.

EUR declined against USD on Monday, noting a new local minimum since November 9, 2017.

A worsening government crisis in Italy affects the currency negatively. President Sergio Mattarella refused to approve consistent Eurosceptic and critic of the EU budget policy economist Paolo Savona as Economy and Finance Minister. In reply, coalition Prime Minister Giuseppe Conte refused to head the government. The leaders of the 5 stars and League parties accused President Mattarella that he succumbed to the pressure of the ruling elite of the EU, and demanded his impeachment. The development of Italy political confrontation inside will affect EUR negatively.

The traders today focus on statistics on private loans in the EU for April, as well as statements by ECB representatives Mersch and Lautenschläger.

Support and resistance

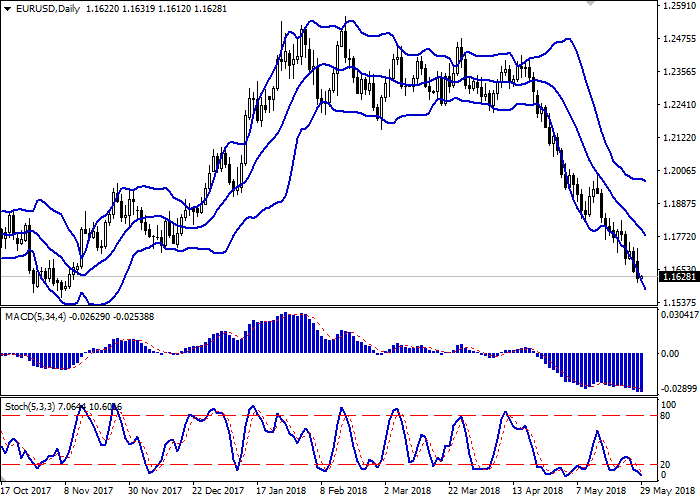

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range expands, making way for new local lows for the instrument.

MACD is going down preserving a moderate sell signal (histogram is located below the signal line).

Stochastic also maintains a downtrend but is located in close proximity to its minimum levels, which indicates oversold EUR in the short term.

The current showings of the indicator do not contradict the further development of the downtrend in the short term. However, the corrective growth still may appear.

Resistance levels: 1.1672, 1.1741, 1.1800, 1.1860.

Support levels: 1.1605, 1.1552, 1.1500.

Trading tips

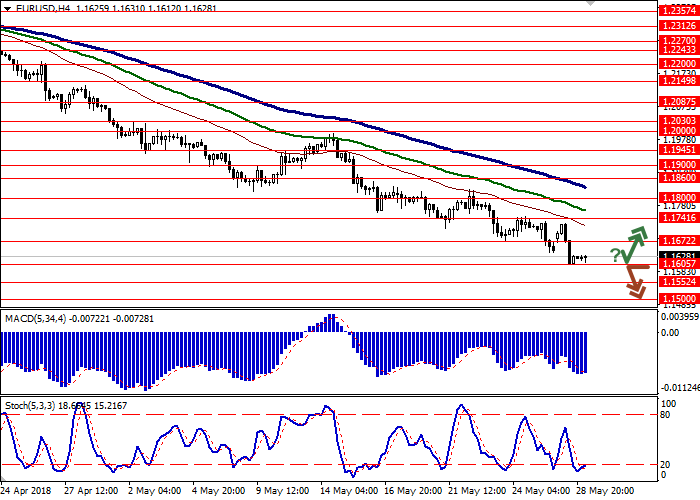

Long positions may be opened if the instrument rebounds from the level of 1.1605 followed by the breakout of 1.1650–1.1672 mark. Take-profit – 1.1800. Stop-loss – 1.1600. Implementation period: 2-3 days.

The breakdown of 1.1605 mark may serve as a signal to further sales with the target at 1.1500. Stop-loss — 1.1672. Implementation period: 2 days.

No comments:

Write comments