GBP/USD: the pair shows mixed trend

17 May 2018, 10:13

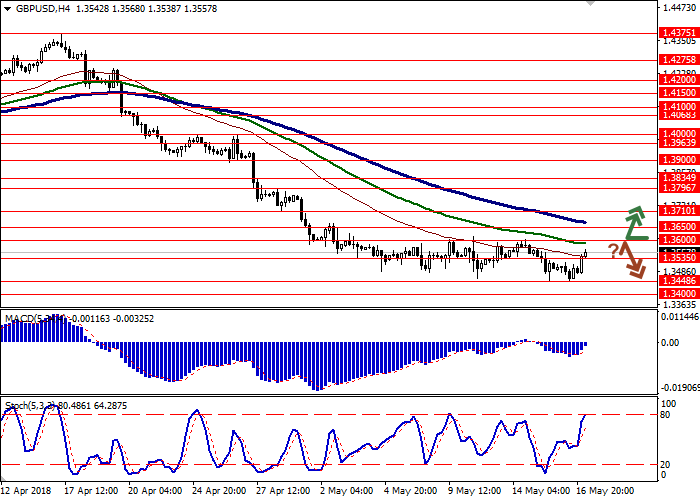

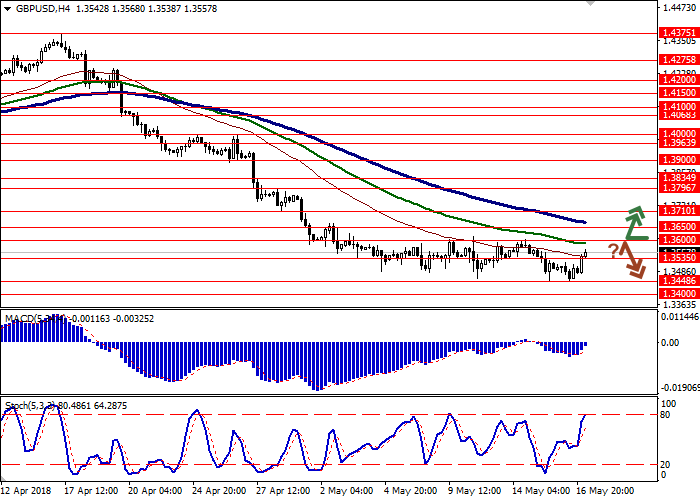

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3610 |

| Take Profit | 1.3710, 1.3750 |

| Stop Loss | 1.3535 |

| Key Levels | 1.3350, 1.3400, 1.3448, 1.3535, 1.3600, 1.3650, 1.3710, 1.3796 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL |

| Entry Point | 1.3500 |

| Take Profit | 1.3450 |

| Stop Loss | 1.3550 |

| Key Levels | 1.3350, 1.3400, 1.3448, 1.3535, 1.3600, 1.3650, 1.3710, 1.3796 |

Current trend

GBP slightly decreased against USD on Wednesday, closing in the vicinity of local lows from the beginning of the year, updated on Tuesday.

As there is lack of key UK economy releases, the traders are focused on Brexit situation. As expected, the Scottish Parliament rejected London Brexit low, as it restricted the rights of local parliamentarians. On Wednesday, Prime Minister Theresa May had a speech in the Parliament and was strictly criticized by the head of the Labor Party Jeremy Corbyn. He noted that May could not make her ministers agree upon Brexit position, which affects the national economy negatively: it created a risk of the working places decrease, as a lot of large companies began to transfer its offices and production abroad.

Today, the instrument demonstrates corrective growth. The investors will focus on the speech by Andy Haldane, the Committee for Monetary Policy of the Bank of England representative.

Support and resistance

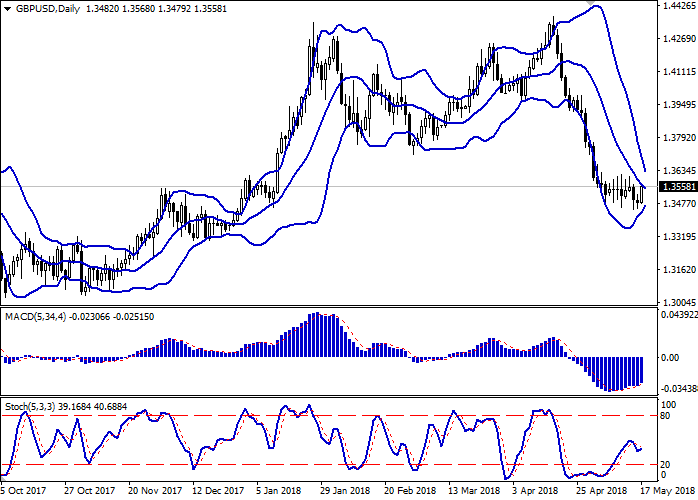

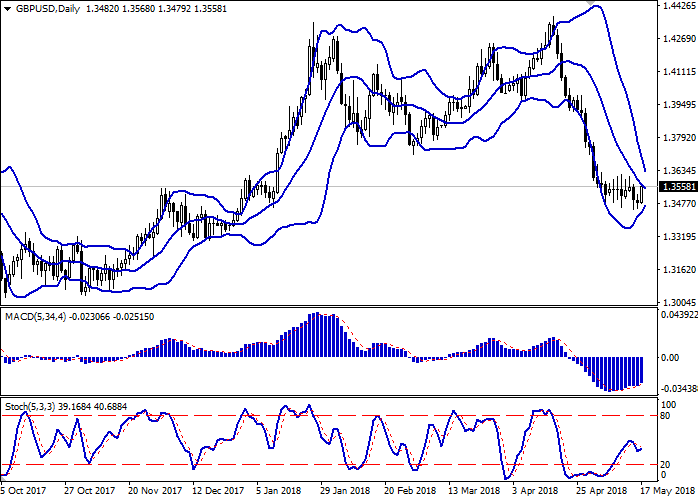

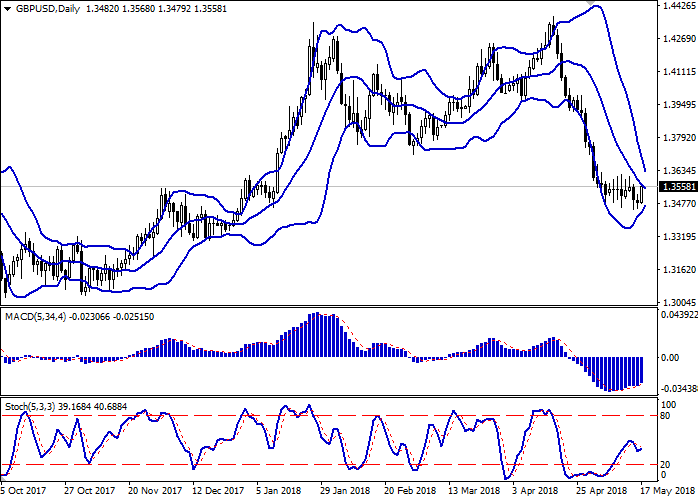

On the D1 chart, the Bollinger Bands are gradually reversing horizontally. The price range is narrowing, reflecting the mixed nature of trading in the short term.

MACD indicator is growing preserving a moderate buy signal (the histogram is above the signal line).

Stochastic shows similar dynamics, recovering after a short decline since earlier this week.

It is worth looking into the possibility of corrective growth in the short and/or ultra-short term.

Resistance levels: 1.3600, 1.3650, 1.3710, 1.3796.

Support levels: 1.3535, 1.3448, 1.3400, 1.3350.

Trading tips

To open long positions, one can rely on the breakout of 1.3600 mark. Take-profit — 1.3710 or 1.3750. Stop-loss — 1.3535. Implementation period: 2-3 days.

A rebound from the level of 1.3600, as from resistance, followed by a breakdown of 1.3535 mark, may become a signal for corrective sales with the target at 1.3450. Implementation period: 2-3 days.

GBP slightly decreased against USD on Wednesday, closing in the vicinity of local lows from the beginning of the year, updated on Tuesday.

As there is lack of key UK economy releases, the traders are focused on Brexit situation. As expected, the Scottish Parliament rejected London Brexit low, as it restricted the rights of local parliamentarians. On Wednesday, Prime Minister Theresa May had a speech in the Parliament and was strictly criticized by the head of the Labor Party Jeremy Corbyn. He noted that May could not make her ministers agree upon Brexit position, which affects the national economy negatively: it created a risk of the working places decrease, as a lot of large companies began to transfer its offices and production abroad.

Today, the instrument demonstrates corrective growth. The investors will focus on the speech by Andy Haldane, the Committee for Monetary Policy of the Bank of England representative.

Support and resistance

On the D1 chart, the Bollinger Bands are gradually reversing horizontally. The price range is narrowing, reflecting the mixed nature of trading in the short term.

MACD indicator is growing preserving a moderate buy signal (the histogram is above the signal line).

Stochastic shows similar dynamics, recovering after a short decline since earlier this week.

It is worth looking into the possibility of corrective growth in the short and/or ultra-short term.

Resistance levels: 1.3600, 1.3650, 1.3710, 1.3796.

Support levels: 1.3535, 1.3448, 1.3400, 1.3350.

Trading tips

To open long positions, one can rely on the breakout of 1.3600 mark. Take-profit — 1.3710 or 1.3750. Stop-loss — 1.3535. Implementation period: 2-3 days.

A rebound from the level of 1.3600, as from resistance, followed by a breakdown of 1.3535 mark, may become a signal for corrective sales with the target at 1.3450. Implementation period: 2-3 days.

No comments:

Write comments