SPX: general analysis

17 May 2018, 10:04

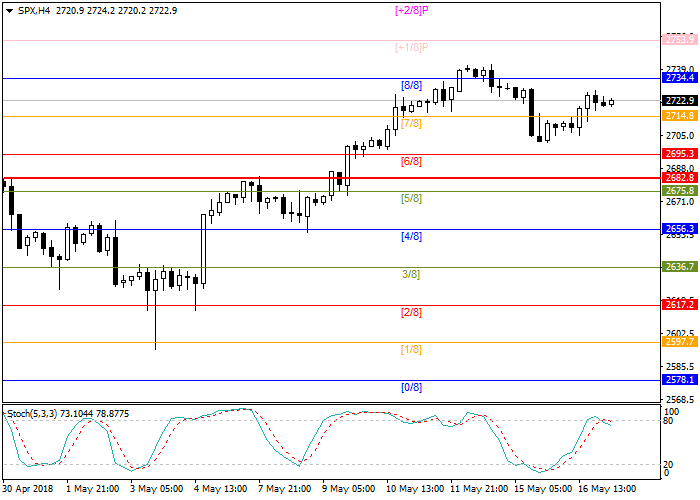

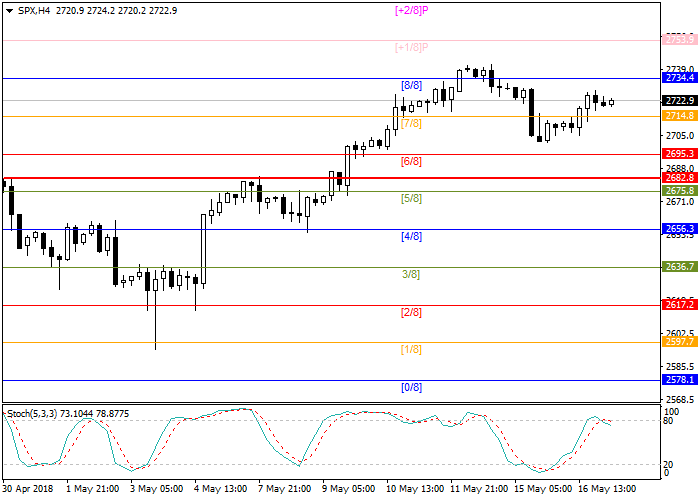

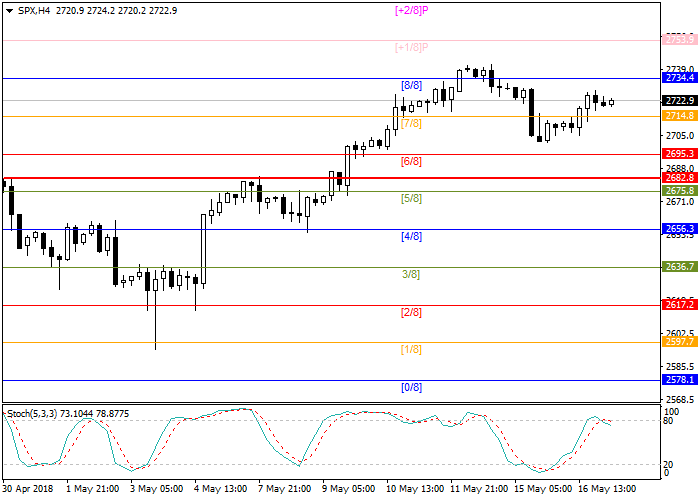

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL LIMIT |

| Entry Point | 2734.4 |

| Take Profit | 2695.3 |

| Stop Loss | 2753.9 |

| Key Levels | 2695.3, 2714.8, 2734.4, 2753.9 |

Current trend

The S&P 500 index is trading near an important resistance level of 8/8 Murray (2734.4), and if we see a breakout, then the next target will be 2753.9.

On the other hand, the yield of 10-year treasury bonds has overcome a threshold of 3%, which may entail a large-scale correction in the stock market. If the dividend yield also falls below 2-year debt securities, then shares as risk-weighted investments will completely lose appeal to large players such as pension funds and insurance companies.

The second negative factor for the market is the unresolved issue regarding the policy of protectionism between the US and China. Market participants hope that the meeting of vice premiers in Washington will be able to move the issue from the dead spot.

Today, the major releases are initial jobless claims and the production index in the United States.

Support and resistance

Stochastic is at the level of 92 and signals a possible correction.

Resistance levels: 2734.4, 2753.9.

Support levels: 2714.8, 2695.3.

Trading tips

Short positions can be opened above the resistance level of 8/8 Murray (2734.4) with a stop loss at 2753.9 and take profit at 2695.3.

The S&P 500 index is trading near an important resistance level of 8/8 Murray (2734.4), and if we see a breakout, then the next target will be 2753.9.

On the other hand, the yield of 10-year treasury bonds has overcome a threshold of 3%, which may entail a large-scale correction in the stock market. If the dividend yield also falls below 2-year debt securities, then shares as risk-weighted investments will completely lose appeal to large players such as pension funds and insurance companies.

The second negative factor for the market is the unresolved issue regarding the policy of protectionism between the US and China. Market participants hope that the meeting of vice premiers in Washington will be able to move the issue from the dead spot.

Today, the major releases are initial jobless claims and the production index in the United States.

Support and resistance

Stochastic is at the level of 92 and signals a possible correction.

Resistance levels: 2734.4, 2753.9.

Support levels: 2714.8, 2695.3.

Trading tips

Short positions can be opened above the resistance level of 8/8 Murray (2734.4) with a stop loss at 2753.9 and take profit at 2695.3.

No comments:

Write comments