GBP/USD: the pair shows mixed trend

11 May 2018, 10:02

| Scenario | |

|---|---|

| Timeframe | Intraday |

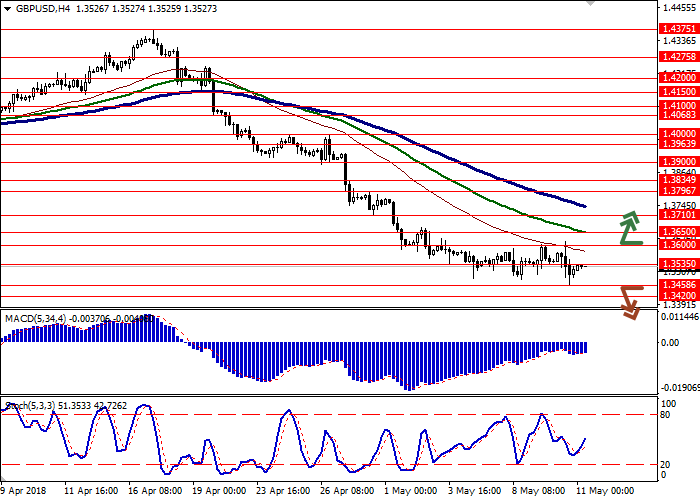

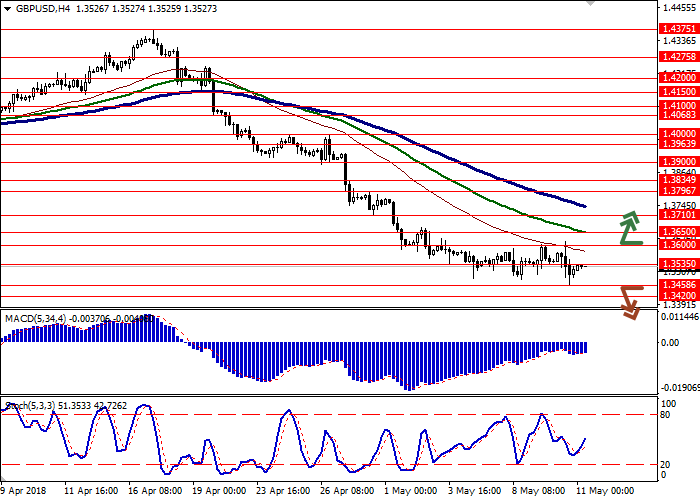

| Recommendation | BUY STOP |

| Entry Point | 1.3610 |

| Take Profit | 1.3710, 1.3750 |

| Stop Loss | 1.3550 |

| Key Levels | 1.3400, 1.3420, 1.3458, 1.3535, 1.3600, 1.3650, 1.3710 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3450 |

| Take Profit | 1.3400, 1.3350 |

| Stop Loss | 1.3500 |

| Key Levels | 1.3400, 1.3420, 1.3458, 1.3535, 1.3600, 1.3650, 1.3710 |

Current trend

GBP continues trading in mixed directions against USD, remaining in the area of lows since the beginning of the year.

On Thursday, the pound fell sharply after BoE's decision to leave the interest rate at around 0.5%. This was to be expected, given the latest negative economic statistics from the UK. In addition, the accompanying statement noted that inflation in the next two years will stabilize at the target level of 2.0%, which may require raising the rate by 0.25% once each year. Also, the Bank of England lowered the forecast for the growth of the British economy: in 2018, it could reach 1.4% (previously expected growth of 1.8%).

The British economic statistics published on Thursday proved to be weak. The volume of industrial production in March instead of growth remained at the same level of 0.1% MoM and did not reach the forecasts, amounting to 2.9% YoY. The deficit in the balance of trade in goods increased from 10.414 billion to 12.287 billion pounds.

Support and resistance

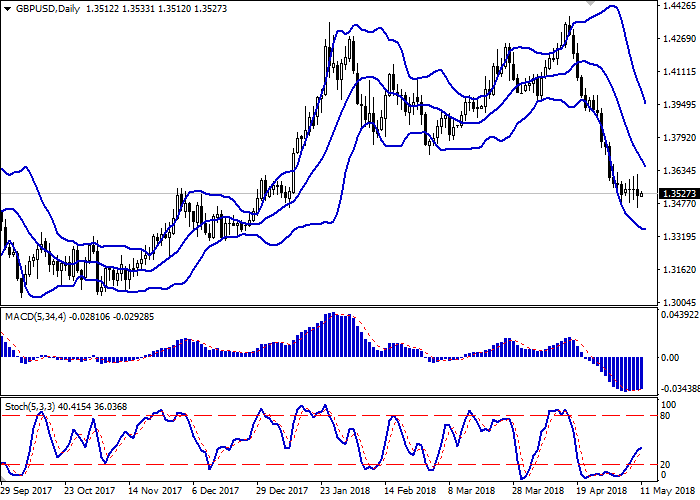

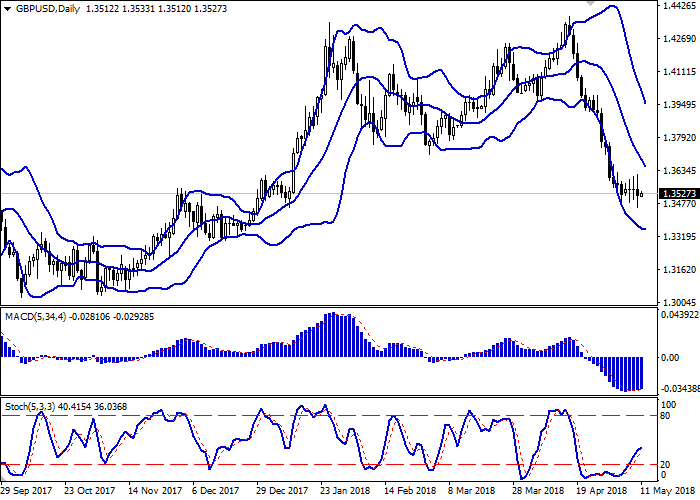

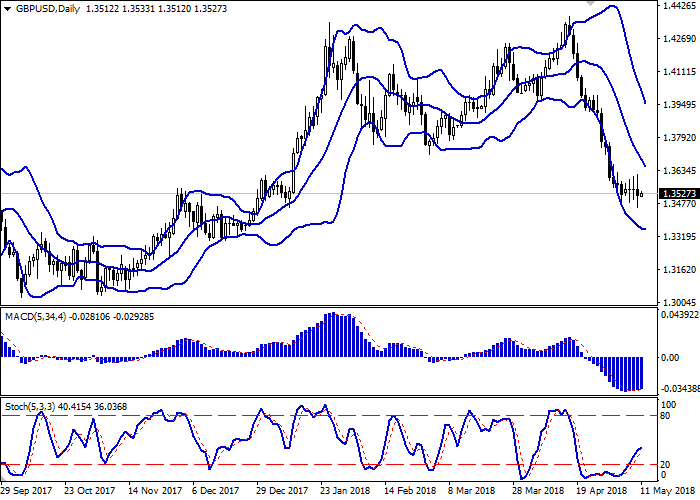

Bollinger Bands in D1 chart demonstrate a decrease. The price range is narrowing from below, reflecting the mixed dynamics of trading.

MACD indicator grows preserving a weak buy signal (located above the signal line).

Stochastic grows more confidently, but may reverse into a horizontal plane.

Technical indicators do not contradict the further growth of the instrument in the short term.

Resistance levels: 1.3535, 1.3600, 1.3650, 1.3710.

Support levels: 1.3458, 1.3420, 1.3400.

Trading tips

To open long positions, one can rely on the breakout of 1.3600 mark. Take-profit – 1.3710, 1.3750. Stop-loss — 1.3550. Implementation period: 2-3 days.

The breakdown of 1.3458 mark may be an alternative. In this case, the target of the "bears" may be located around 1.3400 or 1.3350 marks. Stop-loss — 1.3500. Implementation period: 2-3 days.

GBP continues trading in mixed directions against USD, remaining in the area of lows since the beginning of the year.

On Thursday, the pound fell sharply after BoE's decision to leave the interest rate at around 0.5%. This was to be expected, given the latest negative economic statistics from the UK. In addition, the accompanying statement noted that inflation in the next two years will stabilize at the target level of 2.0%, which may require raising the rate by 0.25% once each year. Also, the Bank of England lowered the forecast for the growth of the British economy: in 2018, it could reach 1.4% (previously expected growth of 1.8%).

The British economic statistics published on Thursday proved to be weak. The volume of industrial production in March instead of growth remained at the same level of 0.1% MoM and did not reach the forecasts, amounting to 2.9% YoY. The deficit in the balance of trade in goods increased from 10.414 billion to 12.287 billion pounds.

Support and resistance

Bollinger Bands in D1 chart demonstrate a decrease. The price range is narrowing from below, reflecting the mixed dynamics of trading.

MACD indicator grows preserving a weak buy signal (located above the signal line).

Stochastic grows more confidently, but may reverse into a horizontal plane.

Technical indicators do not contradict the further growth of the instrument in the short term.

Resistance levels: 1.3535, 1.3600, 1.3650, 1.3710.

Support levels: 1.3458, 1.3420, 1.3400.

Trading tips

To open long positions, one can rely on the breakout of 1.3600 mark. Take-profit – 1.3710, 1.3750. Stop-loss — 1.3550. Implementation period: 2-3 days.

The breakdown of 1.3458 mark may be an alternative. In this case, the target of the "bears" may be located around 1.3400 or 1.3350 marks. Stop-loss — 1.3500. Implementation period: 2-3 days.

No comments:

Write comments