EUR/USD: the euro is growing within the correction

11 May 2018, 10:06

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1950 |

| Take Profit | 1.2030, 1.2053 |

| Stop Loss | 1.1900 |

| Key Levels | 1.1800, 1.1822, 1.1860, 1.1900, 1.1945, 1.2000, 1.2030, 1.2053 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL |

| Entry Point | 1.1893 |

| Take Profit | 1.1822, 1.1800 |

| Stop Loss | 1.1950 |

| Key Levels | 1.1800, 1.1822, 1.1860, 1.1900, 1.1945, 1.2000, 1.2030, 1.2053 |

Current trend

Yesterday the European currency was steadily growing against the US dollar, stepping off the local lows, renewed on Wednesday.

In the absence of significant European economic statistics, and also because Thursday was a day off in a number of Eurozone countries, investors are focused on news from the US and Great Britain. EUR grew in view of weak inflationary data from the US (the basic consumer price index remained at 2.1% in April) and the decision of the Bank of England to leave the key interest rate at 0.5%.

On Friday, investors are waiting for ECB President Mario Draghi's comments, which will deliver a speech in Florence. Market participants traditionally expect to hear hints of further actions of the European regulator.

Support and resistance

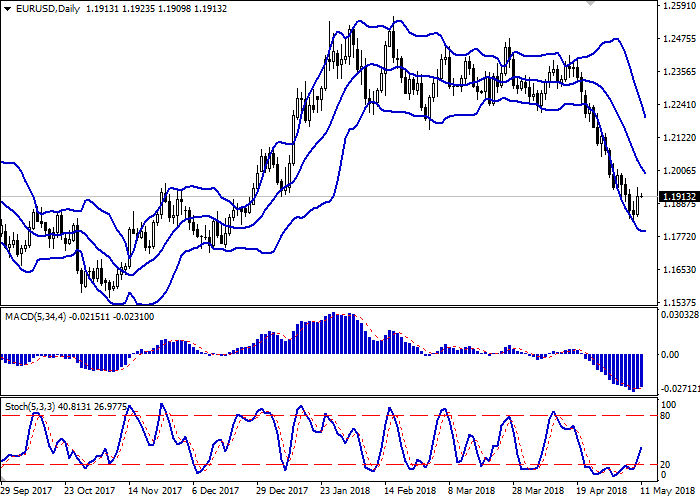

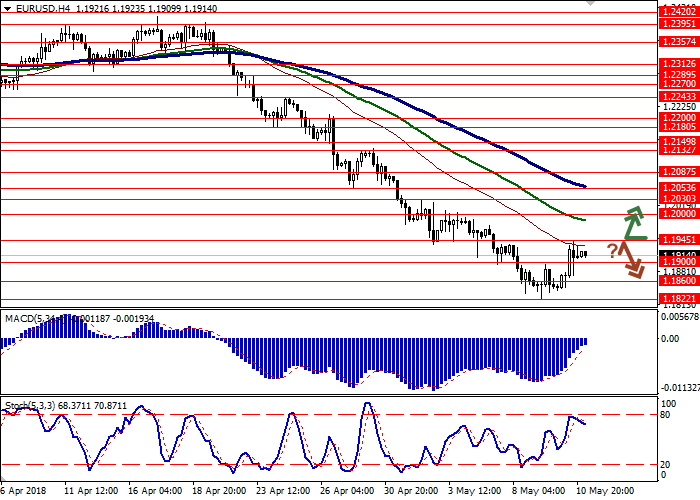

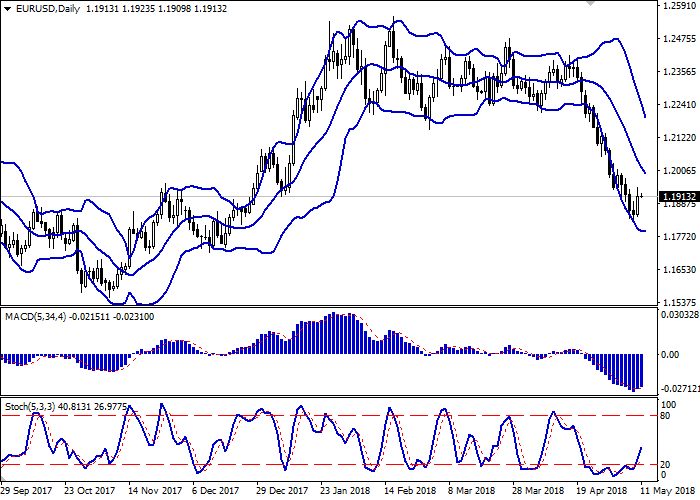

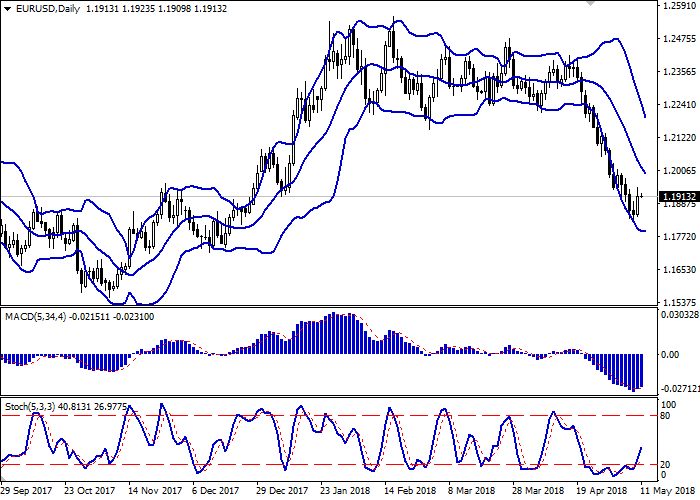

On the daily chart, Bollinger Bands are steadily falling. The price range is narrowing, reflecting the attempts of a correctional growth of the euro in the short term.

MACD has reversed upwards and formed a quite strong buy signal (the histogram is above the signal line).

Stochastic’s dynamic is the same but it has begun to grow earlier.

Current readings of the technical indicators do not contradict the correctional growth development in the sort and very short term. However, it is better to be careful while opening new long positions at the end of the current trading week and to start actions at the beginning of the next one.

Resistance levels: 1.1945, 1.2000, 1.2030, 1.2053.

Support levels: 1.1900, 1.1860, 1.1822, 1.1800.

Trading tips

Long positions can be opened after the breakout of the level 1.1945 with the targets at 1.2030–1.2053 and stop loss 1.1900. Implementation period: 1–2 days.

Short positions can be opened after the rebound at the level of 1.1945 and the breakdown of the level 1.1900 with the targets at 1.1822–1.1800 and stop loss 1.1950. Implementation period: 2–3 days.

Yesterday the European currency was steadily growing against the US dollar, stepping off the local lows, renewed on Wednesday.

In the absence of significant European economic statistics, and also because Thursday was a day off in a number of Eurozone countries, investors are focused on news from the US and Great Britain. EUR grew in view of weak inflationary data from the US (the basic consumer price index remained at 2.1% in April) and the decision of the Bank of England to leave the key interest rate at 0.5%.

On Friday, investors are waiting for ECB President Mario Draghi's comments, which will deliver a speech in Florence. Market participants traditionally expect to hear hints of further actions of the European regulator.

Support and resistance

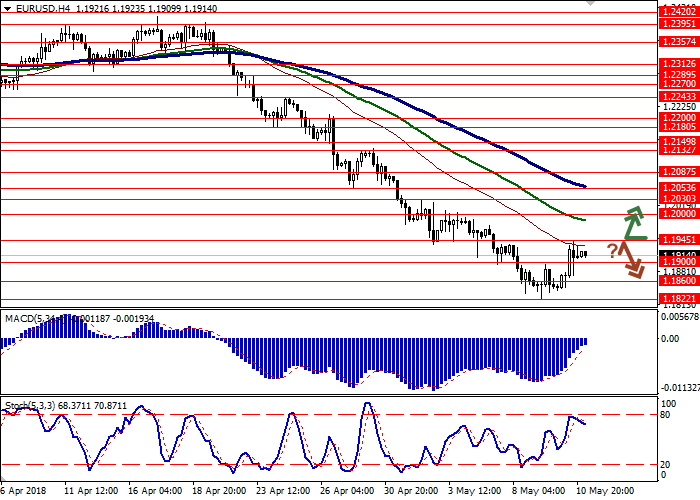

On the daily chart, Bollinger Bands are steadily falling. The price range is narrowing, reflecting the attempts of a correctional growth of the euro in the short term.

MACD has reversed upwards and formed a quite strong buy signal (the histogram is above the signal line).

Stochastic’s dynamic is the same but it has begun to grow earlier.

Current readings of the technical indicators do not contradict the correctional growth development in the sort and very short term. However, it is better to be careful while opening new long positions at the end of the current trading week and to start actions at the beginning of the next one.

Resistance levels: 1.1945, 1.2000, 1.2030, 1.2053.

Support levels: 1.1900, 1.1860, 1.1822, 1.1800.

Trading tips

Long positions can be opened after the breakout of the level 1.1945 with the targets at 1.2030–1.2053 and stop loss 1.1900. Implementation period: 1–2 days.

Short positions can be opened after the rebound at the level of 1.1945 and the breakdown of the level 1.1900 with the targets at 1.1822–1.1800 and stop loss 1.1950. Implementation period: 2–3 days.

No comments:

Write comments