GBP/USD: general analysis

24 May 2018, 15:18

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.3360 |

| Take Profit | 1.3305, 1.3244 |

| Stop Loss | 1.3400 |

| Key Levels | 1.3244, 1.3305, 1.3366, 1.3427, 1.3488, 1.3550 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3430 |

| Take Profit | 1.3488, 1.3550 |

| Stop Loss | 1.3400 |

| Key Levels | 1.3244, 1.3305, 1.3366, 1.3427, 1.3488, 1.3550 |

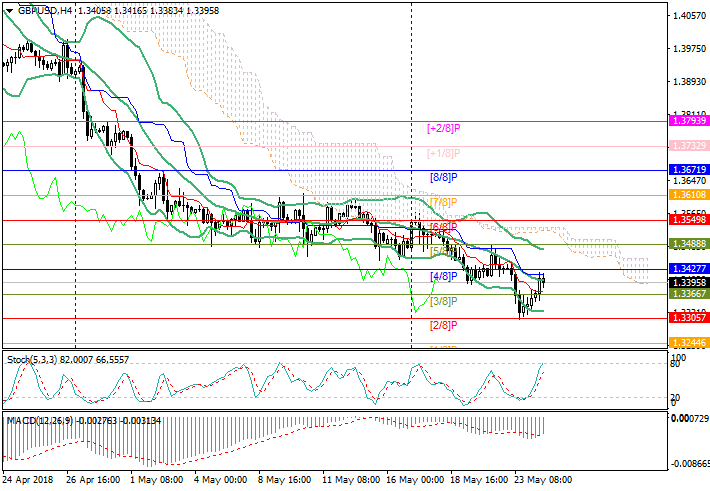

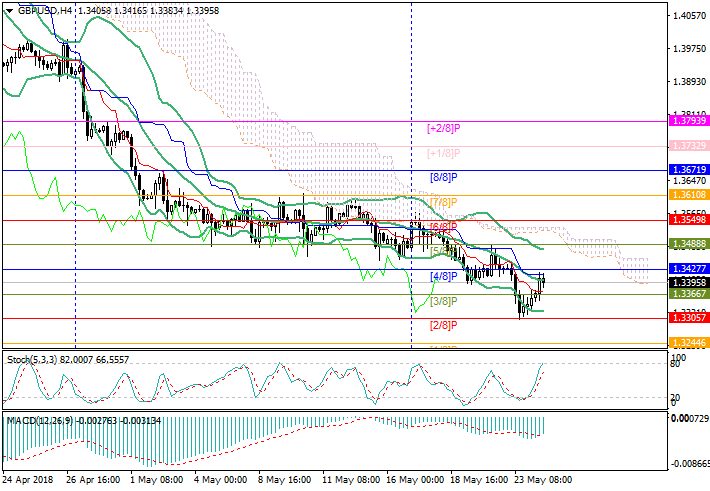

Current trend

On Wednesday, weak inflation data had pressured the British currency. The consumer price index continued to decline for the third month in a row and in April amounted to 2.4%. The basic consumer price index fell more strongly than expected and amounted to 2.1%. The Office of National Statistics of Great Britain notes that the decrease in inflation could be more significant, but it was compensated by the increase in the cost of fuel, the price of which reached a maximum for 3.5 years. Rapid approximation of the inflation rate to the target (2.0%) removes the need to raise the interest rate from the Bank of England. Under the current conditions, many market participants are waiting for it not earlier than by autumn.

Today, the price reversed around 1.3305 (Murray [2/8]) and entered the correction due to positive April Retail Sales, which grew more than expected, and reached 1.6% MoM and 1.4% YoY. However, it is due to the sale of gasoline and Internet sales, as store sales remained the same.

Support and resistance

The key “bullish” level is 1.3427 (Murray [2/8], middle line of Bollinger bands). The breakout will let the price grow to 1.3488 (Murray [5/6]) and 1.3550 (Murray [6/8]). Otherwise, the price can return to 1.3305 (Murray [2/8]) and fall to 1.3244 (Murray [1/8]). Technical indicators reflect the increase. Stochastic is directed upwards, MACD decreases in the negative zone.

Resistance levels: 1.3427, 1.3488, 1.3550.

Support levels: 1.3366, 1.3305, 1.3244.

Trading tips

Short positions can be opened below the level of 1.3366 with the targets at 1.3305, 1.3244, and stop loss 1.3400.

Long positions can be opened after the price is set above the level of 1.3427 with the targets at 1.3488, 1.3550 and stop loss 1.3400.

Implementation period: 5–7 days.

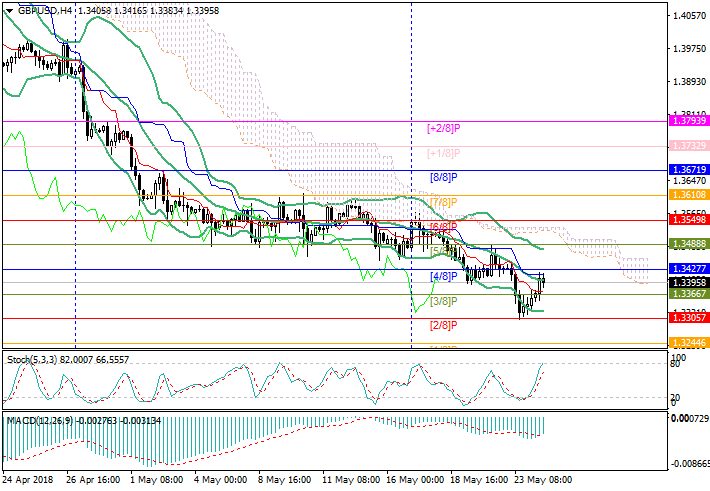

On Wednesday, weak inflation data had pressured the British currency. The consumer price index continued to decline for the third month in a row and in April amounted to 2.4%. The basic consumer price index fell more strongly than expected and amounted to 2.1%. The Office of National Statistics of Great Britain notes that the decrease in inflation could be more significant, but it was compensated by the increase in the cost of fuel, the price of which reached a maximum for 3.5 years. Rapid approximation of the inflation rate to the target (2.0%) removes the need to raise the interest rate from the Bank of England. Under the current conditions, many market participants are waiting for it not earlier than by autumn.

Today, the price reversed around 1.3305 (Murray [2/8]) and entered the correction due to positive April Retail Sales, which grew more than expected, and reached 1.6% MoM and 1.4% YoY. However, it is due to the sale of gasoline and Internet sales, as store sales remained the same.

Support and resistance

The key “bullish” level is 1.3427 (Murray [2/8], middle line of Bollinger bands). The breakout will let the price grow to 1.3488 (Murray [5/6]) and 1.3550 (Murray [6/8]). Otherwise, the price can return to 1.3305 (Murray [2/8]) and fall to 1.3244 (Murray [1/8]). Technical indicators reflect the increase. Stochastic is directed upwards, MACD decreases in the negative zone.

Resistance levels: 1.3427, 1.3488, 1.3550.

Support levels: 1.3366, 1.3305, 1.3244.

Trading tips

Short positions can be opened below the level of 1.3366 with the targets at 1.3305, 1.3244, and stop loss 1.3400.

Long positions can be opened after the price is set above the level of 1.3427 with the targets at 1.3488, 1.3550 and stop loss 1.3400.

Implementation period: 5–7 days.

No comments:

Write comments