GBP/USD: the instrument is correcting

25 May 2018, 09:30

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3410, 1.3455 |

| Take Profit | 1.3535, 1.3550 |

| Stop Loss | 1.3400 |

| Key Levels | 1.3228, 1.3300, 1.3350, 1.3400, 1.3448, 1.3535, 1.3600 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3340 |

| Take Profit | 1.3228, 1.3200 |

| Stop Loss | 1.3400, 1.3420 |

| Key Levels | 1.3228, 1.3300, 1.3350, 1.3400, 1.3448, 1.3535, 1.3600 |

Current trend

GBP grew moderately against USD on Thursday, partially regaining its losses of the previous day and departing from local lows of December 18, 2017.

GBP was supported by optimistic retail sales data in the UK. In April, their volume grew significantly more than expected and amounted to 1.6% MoM and 1.4% YoY. However, as noted by the Office of National Statistics, this growth was achieved due to the sale of gasoline and Internet trading. Offline stores sales remained at about the same level.

On Friday, investors expect comments from the Bank of England's head Mark Carney, who will speak at a conference in Stockholm. He can comment on the state and prospects of the British economy and the further actions of the regulator. The publication of a preliminary report on UK GDP for Q1 2018 is also expected.

Support and resistance

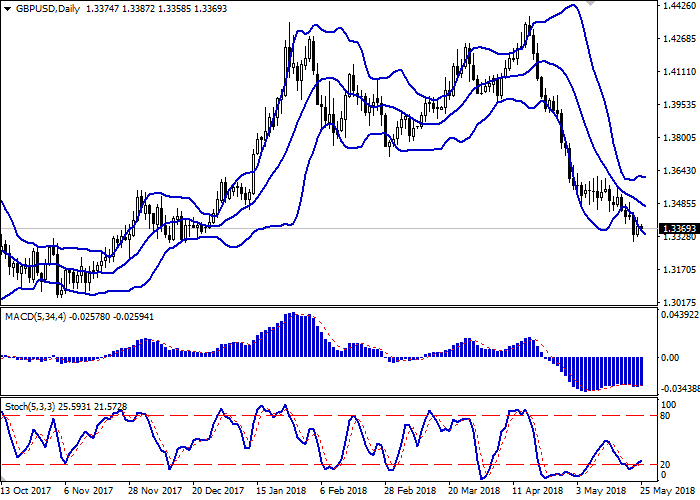

Bollinger Bands in D1 chart decrease. The price range expands from below, making way to local lows for the "bears".

MACD indicator is trying to reverse upwards and form a buy signal (it should consolidate above the signal line).

Stochastic shows a similar dynamics, moving away from the mark "20", a formal margin of the instrument oversold.

Technical indicators do not contradict the development of correctional growth in the short and/or ultra-short term.

Resistance levels: 1.3400, 1.3448, 1.3535, 1.3600.

Support levels: 1.3350, 1.3300, 1.3228.

Trading tips

To open long positions one can rely on the breakout of the level of 1.3400 or 1.3448, while maintaining "bullish" signals from technical indicators. Take-profit — 1.3535, 1.3550. Stop-loss — 1.3400, 1.3350.

The return of "bearish" trend with the breakdown of the level of 1.3350 may become a signal for new sales with the targets at 1.3250 or 1.3228, 1.3200. Stop-loss — 1.3400, 1.3420.

Implementation period: 2-3 days.

GBP grew moderately against USD on Thursday, partially regaining its losses of the previous day and departing from local lows of December 18, 2017.

GBP was supported by optimistic retail sales data in the UK. In April, their volume grew significantly more than expected and amounted to 1.6% MoM and 1.4% YoY. However, as noted by the Office of National Statistics, this growth was achieved due to the sale of gasoline and Internet trading. Offline stores sales remained at about the same level.

On Friday, investors expect comments from the Bank of England's head Mark Carney, who will speak at a conference in Stockholm. He can comment on the state and prospects of the British economy and the further actions of the regulator. The publication of a preliminary report on UK GDP for Q1 2018 is also expected.

Support and resistance

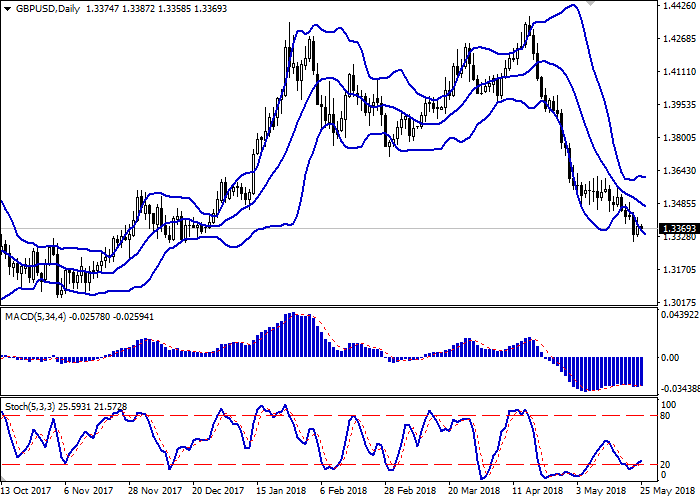

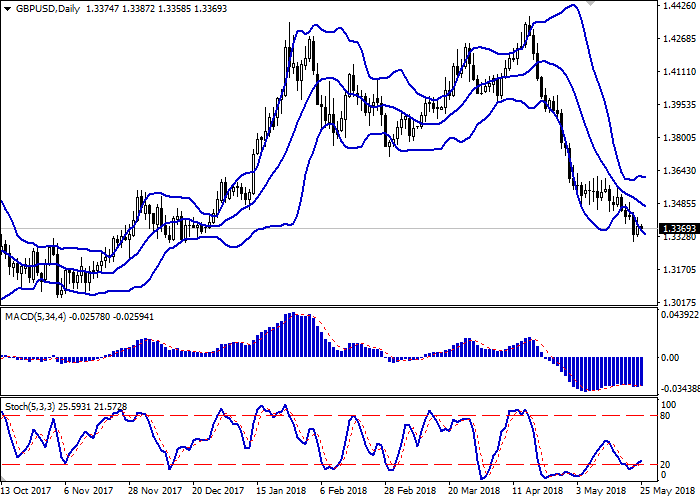

Bollinger Bands in D1 chart decrease. The price range expands from below, making way to local lows for the "bears".

MACD indicator is trying to reverse upwards and form a buy signal (it should consolidate above the signal line).

Stochastic shows a similar dynamics, moving away from the mark "20", a formal margin of the instrument oversold.

Technical indicators do not contradict the development of correctional growth in the short and/or ultra-short term.

Resistance levels: 1.3400, 1.3448, 1.3535, 1.3600.

Support levels: 1.3350, 1.3300, 1.3228.

Trading tips

To open long positions one can rely on the breakout of the level of 1.3400 or 1.3448, while maintaining "bullish" signals from technical indicators. Take-profit — 1.3535, 1.3550. Stop-loss — 1.3400, 1.3350.

The return of "bearish" trend with the breakdown of the level of 1.3350 may become a signal for new sales with the targets at 1.3250 or 1.3228, 1.3200. Stop-loss — 1.3400, 1.3420.

Implementation period: 2-3 days.

No comments:

Write comments