AUD/USD: the possibility of fall is high

24 May 2018, 13:43

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 0.7556 |

| Take Profit | 0.7310, 0.7250 |

| Stop Loss | 0.7740 |

| Key Levels | 0.7350, 0.7370, 0.7410, 0.7450, 0.7480, 0.7500, 0.7505, 0.7530, 0.7560, 0.7610, 0.7650, 0.7680, 0.7700, 0.7770 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL LIMIT |

| Entry Point | 0.7680 |

| Take Profit | 0.7310, 0.7250 |

| Stop Loss | 0.7740 |

| Key Levels | 0.7350, 0.7370, 0.7410, 0.7450, 0.7480, 0.7500, 0.7505, 0.7530, 0.7560, 0.7610, 0.7650, 0.7680, 0.7700, 0.7770 |

Current trend

AUD continues to decline against USD.

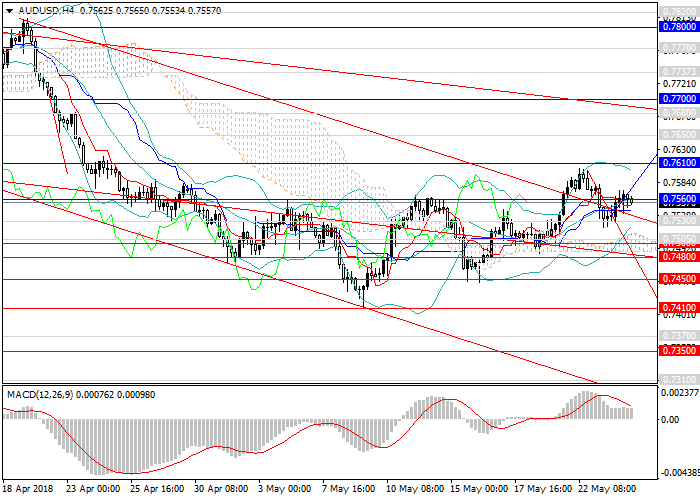

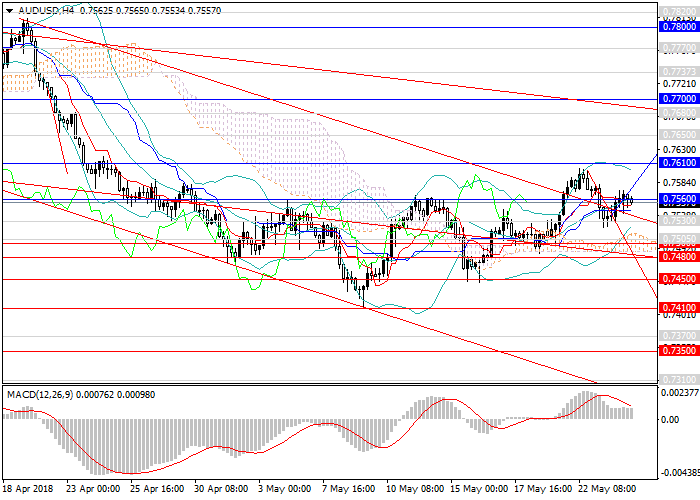

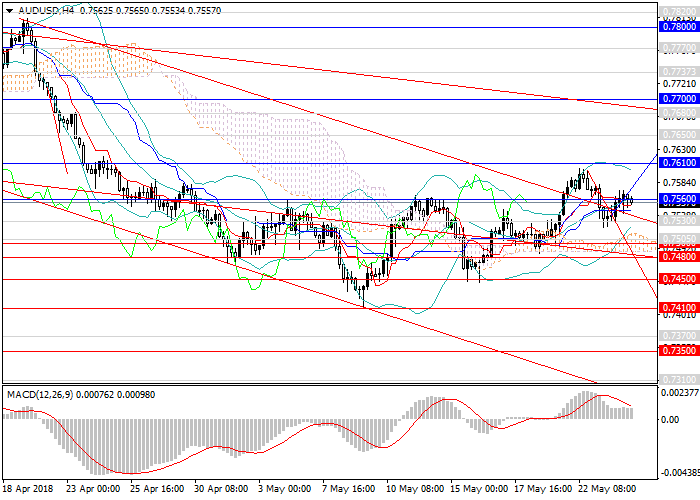

After the breakdown of the lower boundary of the downwards channel, the momentum was expected to increase, but the price returned into the range. An upward correction by more than 200 points is due to a fall of USD investment attractiveness. The pair stopped at the strong resistance level of 0.7610 and went down again, as USD was supported by positive key indices data. FOMC Minutes did not bring any news: the regulator states it is necessary to increase the rates in the near future was noted, but names no specific terms.

At the end of this week, the US employment market data and Durable Goods Orders will be published, which can support USD additionally.

Support and resistance

In the short term, the channel may change to a steeper one, and the pair can form a new downward wave from the key resistance level of 0.7610 (the upper border of the new channel). Otherwise, the upward correction will develop to the upper border of the previous channel at the level of 0.7680, and then the instrument will decrease. The price stays in a downward trend.

On the daily and weekly chart, technical indicators confirm the medium-term fall, MACD keeps a high volume of short positions, Bollinger bands are pointed downwards.

Resistance levels: 0.7560, 0.7610, 0.7650, 0.7680, 0.7700, 0.7770.

Support levels: 0.7530, 0.7505, 0.7500, 0.7480, 0.7450, 0.7410, 0.7370, 0.7350.

Trading tips

It is relevant to increase the volume of short positions at the current level and open pending orders at the level of 0.7680 with the targets at 0.7310, 0.7250 and stop loss 0.7740.

AUD continues to decline against USD.

After the breakdown of the lower boundary of the downwards channel, the momentum was expected to increase, but the price returned into the range. An upward correction by more than 200 points is due to a fall of USD investment attractiveness. The pair stopped at the strong resistance level of 0.7610 and went down again, as USD was supported by positive key indices data. FOMC Minutes did not bring any news: the regulator states it is necessary to increase the rates in the near future was noted, but names no specific terms.

At the end of this week, the US employment market data and Durable Goods Orders will be published, which can support USD additionally.

Support and resistance

In the short term, the channel may change to a steeper one, and the pair can form a new downward wave from the key resistance level of 0.7610 (the upper border of the new channel). Otherwise, the upward correction will develop to the upper border of the previous channel at the level of 0.7680, and then the instrument will decrease. The price stays in a downward trend.

On the daily and weekly chart, technical indicators confirm the medium-term fall, MACD keeps a high volume of short positions, Bollinger bands are pointed downwards.

Resistance levels: 0.7560, 0.7610, 0.7650, 0.7680, 0.7700, 0.7770.

Support levels: 0.7530, 0.7505, 0.7500, 0.7480, 0.7450, 0.7410, 0.7370, 0.7350.

Trading tips

It is relevant to increase the volume of short positions at the current level and open pending orders at the level of 0.7680 with the targets at 0.7310, 0.7250 and stop loss 0.7740.

No comments:

Write comments