EUR/USD: long upward correction

22 May 2018, 13:23

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 1.1819 |

| Take Profit | 1.1690, 1.1500 |

| Stop Loss | 1.1940, 1.2050 |

| Key Levels | 1.1500, 1.1575, 1.1600, 1.1665, 1.1690, 1.1715, 1.1730, 1.1775, 1.1800, 1.1820, 1.1840, 1.1900, 1.1950, 1.1980, 1.2000, 1.2030 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL LIMIT |

| Entry Point | 1.1950, 1.2000 |

| Take Profit | 1.1690, 1.1500 |

| Stop Loss | 1.2050 |

| Key Levels | 1.1500, 1.1575, 1.1600, 1.1665, 1.1690, 1.1715, 1.1730, 1.1775, 1.1800, 1.1820, 1.1840, 1.1900, 1.1950, 1.1980, 1.2000, 1.2030 |

Current trend

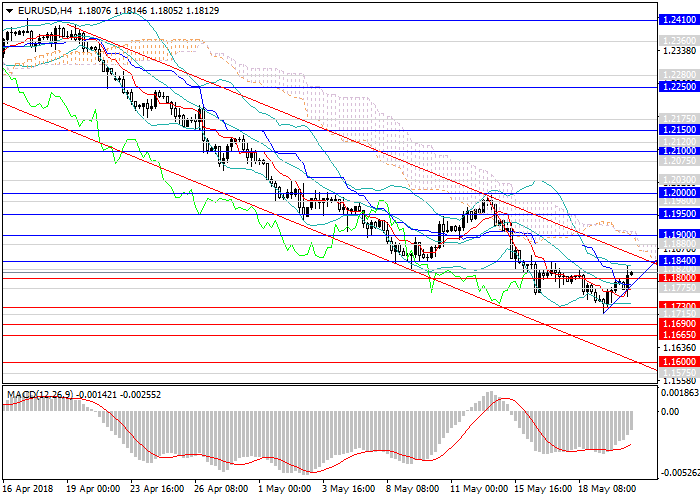

The European currency is falling against the dollar. The momentum decreases, and the trend becomes slighter. Since mid-April to early May, the pair has been falling without a correction but was corrected by more than 150 points. Yesterday, the instrument tested a new local minimum at 1.1715 and went up due to the fall of USD. Investors began to withdraw assets from the dollar, expecting an upward correction or a reversal.

The level 1.1715 (the local lows of early October and mid-December 2017) is a strong support, but the movement will be affected by the key EU indices, German GDP and FOMC Minutes publication. In the second quarter, US strong main sectors releases will be published, which will let the regulator tight the monetary policy and increase rates in the near future, which will strengthen USD.

Support and resistance

The pair can grow to key resistance levels of 1.1950, 1.2000, but then will test the local lows. Otherwise, the downward movement will restore from the upper border of the current channel at the level of 1.1840.

Technical indicators confirm the fall, MACD maintains a high volume of short positions, and Bollinger bands are directed downwards.

Resistance levels: 1.1820, 1.1840, 1.1900, 1.1950, 1.1980, 1.2000, 1.2030, 1.2075, 1.2100.

Support levels: 1.1800, 1.1775, 1.1730, 1.1715, 1.1690, 1.1665, 1.1600, 1.1575, 1.1500.

Trading tips

It is relevant to increase the volumes of short positions from the current level and open pending short positions from levels 1.1950, 1.2000 with the target of 1.1690 in the short term and 1.1500 in the medium term. Stop loss is around 1.2050.

The European currency is falling against the dollar. The momentum decreases, and the trend becomes slighter. Since mid-April to early May, the pair has been falling without a correction but was corrected by more than 150 points. Yesterday, the instrument tested a new local minimum at 1.1715 and went up due to the fall of USD. Investors began to withdraw assets from the dollar, expecting an upward correction or a reversal.

The level 1.1715 (the local lows of early October and mid-December 2017) is a strong support, but the movement will be affected by the key EU indices, German GDP and FOMC Minutes publication. In the second quarter, US strong main sectors releases will be published, which will let the regulator tight the monetary policy and increase rates in the near future, which will strengthen USD.

Support and resistance

The pair can grow to key resistance levels of 1.1950, 1.2000, but then will test the local lows. Otherwise, the downward movement will restore from the upper border of the current channel at the level of 1.1840.

Technical indicators confirm the fall, MACD maintains a high volume of short positions, and Bollinger bands are directed downwards.

Resistance levels: 1.1820, 1.1840, 1.1900, 1.1950, 1.1980, 1.2000, 1.2030, 1.2075, 1.2100.

Support levels: 1.1800, 1.1775, 1.1730, 1.1715, 1.1690, 1.1665, 1.1600, 1.1575, 1.1500.

Trading tips

It is relevant to increase the volumes of short positions from the current level and open pending short positions from levels 1.1950, 1.2000 with the target of 1.1690 in the short term and 1.1500 in the medium term. Stop loss is around 1.2050.

No comments:

Write comments