WTI Crude Oil: general review

22 May 2018, 15:18

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 72.65 |

| Take Profit | 73.43, 75.00 |

| Stop Loss | 72.20 |

| Key Levels | 68.75, 70.30, 71.87, 73.43, 75.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 71.80 |

| Take Profit | 70.31 |

| Stop Loss | 72.20 |

| Key Levels | 68.75, 70.30, 71.87, 73.43, 75.00 |

Current trend

This week, oil quotes continued to grow, the price reached 72.60 mark, primarily due to geopolitics.

On Monday, US Secretary of State Michael Pompeo announced 12 conditions, after which Iran can count on a new agreement. In particular, the Islamic Republic was offered to stop enriching uranium, reprocessing plutonium, developing ballistic missiles, and actually refusing to spread its influence over the region. Iran has predictably refused to fulfill these conditions, and now the market is waiting for new sanctions.

Another factor of the growth were new US sanctions against Venezuela. On Sunday, after Nicholas Maduro won the elections, operations with Venezuela's government debt obligations were banned. These sanctions also hit the papers of the state-owned company Petroleos de Venezuela, which could lead to the reduction in oil production. According to IEA, in April, it has already fallen by 50K barrels per day and is now about 1.42 million barrels a day.

In the evening on Tuesday and Wednesday, the market awaits the data on oil reserves in the US from API and EIA. If they recede, oil quotes will receive additional support.

Support and resistance

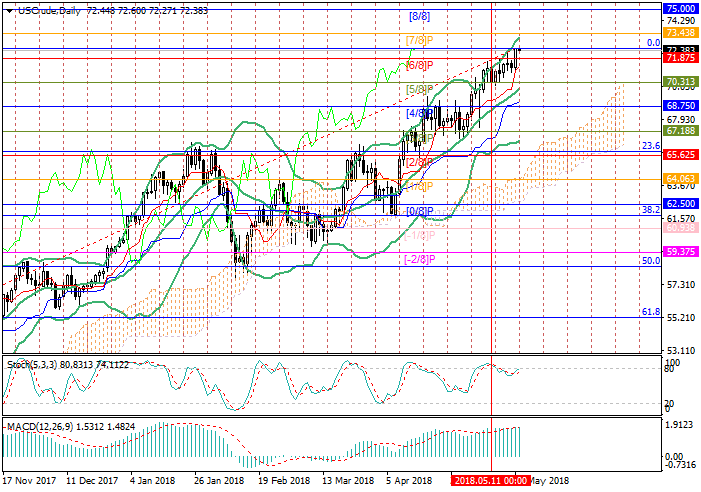

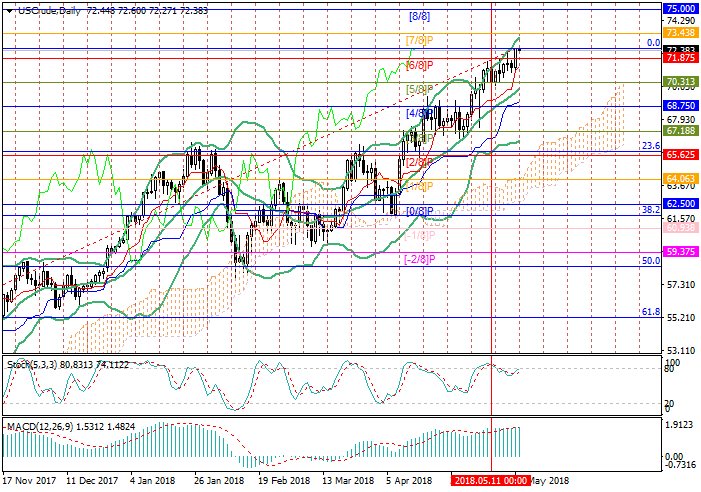

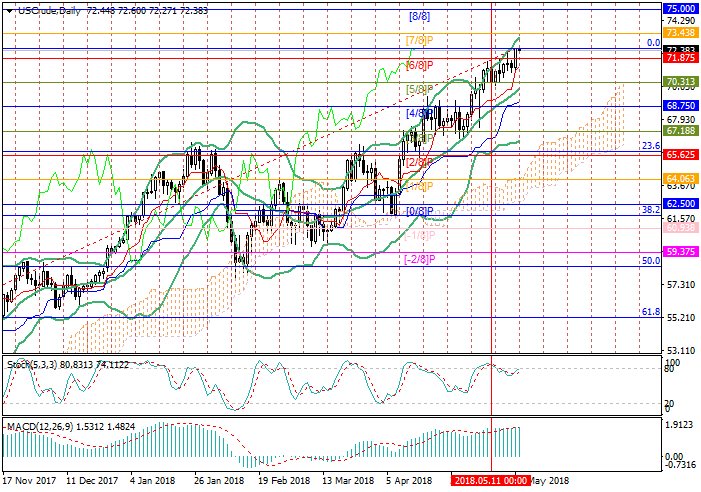

Currently, the price at the level of 72.50 and can continue rising to 73.43 (Murray [7/8]) and 75.00 (Murray [8/8]). The price consolidation below 71.87 mark (Murray [2/8]) can lead to a correction to the level of 70.31 (Murray [5/8], midline of Bollinger Bands).

Indicators show growth: Bollinger Bands are directed upwards, MACD histogram grows in the positive zone.

Support levels: 71.87, 70.30, 68.75.

Resistance levels: 73.43, 75.00.

Trading tips

Buy positions should be opened above 72.60 with targets at 73.43, 75.00 and stop-loss at 72.20.

Sell positions may be opened below 71.87 with the target at 70.31 and stop-loss at 72.20.

Implementation time: 5-7 days.

This week, oil quotes continued to grow, the price reached 72.60 mark, primarily due to geopolitics.

On Monday, US Secretary of State Michael Pompeo announced 12 conditions, after which Iran can count on a new agreement. In particular, the Islamic Republic was offered to stop enriching uranium, reprocessing plutonium, developing ballistic missiles, and actually refusing to spread its influence over the region. Iran has predictably refused to fulfill these conditions, and now the market is waiting for new sanctions.

Another factor of the growth were new US sanctions against Venezuela. On Sunday, after Nicholas Maduro won the elections, operations with Venezuela's government debt obligations were banned. These sanctions also hit the papers of the state-owned company Petroleos de Venezuela, which could lead to the reduction in oil production. According to IEA, in April, it has already fallen by 50K barrels per day and is now about 1.42 million barrels a day.

In the evening on Tuesday and Wednesday, the market awaits the data on oil reserves in the US from API and EIA. If they recede, oil quotes will receive additional support.

Support and resistance

Currently, the price at the level of 72.50 and can continue rising to 73.43 (Murray [7/8]) and 75.00 (Murray [8/8]). The price consolidation below 71.87 mark (Murray [2/8]) can lead to a correction to the level of 70.31 (Murray [5/8], midline of Bollinger Bands).

Indicators show growth: Bollinger Bands are directed upwards, MACD histogram grows in the positive zone.

Support levels: 71.87, 70.30, 68.75.

Resistance levels: 73.43, 75.00.

Trading tips

Buy positions should be opened above 72.60 with targets at 73.43, 75.00 and stop-loss at 72.20.

Sell positions may be opened below 71.87 with the target at 70.31 and stop-loss at 72.20.

Implementation time: 5-7 days.

No comments:

Write comments