EUR/USD: the Euro remains under pressure

16 May 2018, 10:26

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY LIMIT |

| Entry Point | 1.1800 |

| Take Profit | 1.1900, 1.1945, 1.2000 |

| Stop Loss | 1.1750 |

| Key Levels | 1.1711, 1.1755, 1.1800, 1.1860, 1.1900, 1.1945, 1.2000 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1790 |

| Take Profit | 1.1755, 1.1711, 1.1700 |

| Stop Loss | 1.1850 |

| Key Levels | 1.1711, 1.1755, 1.1800, 1.1860, 1.1900, 1.1945, 1.2000 |

Current trend

EUR decreased against USD on Tuesday, leveling all attempts at instrument growth from the middle of last week and returning to local lows since the beginning of the year.

The decrease is due to the number of negative economic factors. German Q1 GDP was below the expectations. QoQ index reached 0.3% (against the expected 0.4%), and YoY one – 2.3% (against the expected 2.4%). The growth of March EU Industrial Production index did not meet the expectations. MoM growth reached 0.5% (against 0.7%), and YoY one – 3.0% (against 3.7%). EU GDP stayed on the level of 0.4% MoM and 2.5% YoY, which was ignored by the market. Poor EU economic data make the investors fear that ECB will prolong the assets buyback program and even more postpone the termination of monetary stimulus.

Support and resistance

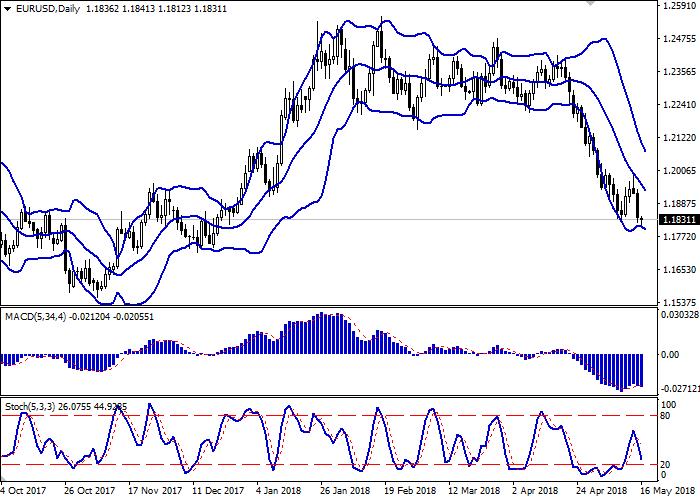

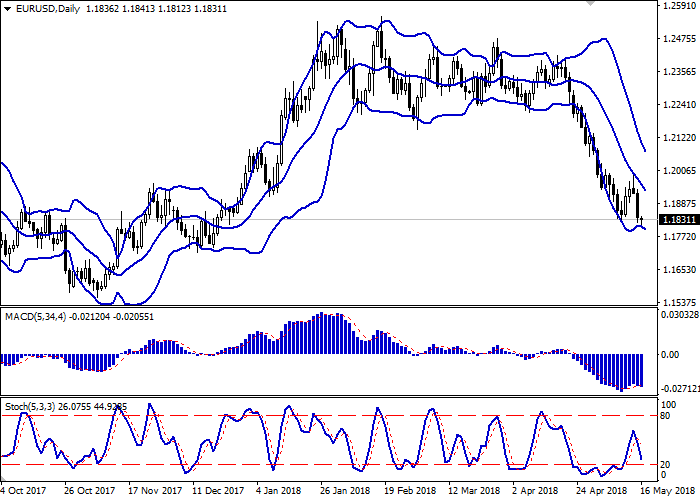

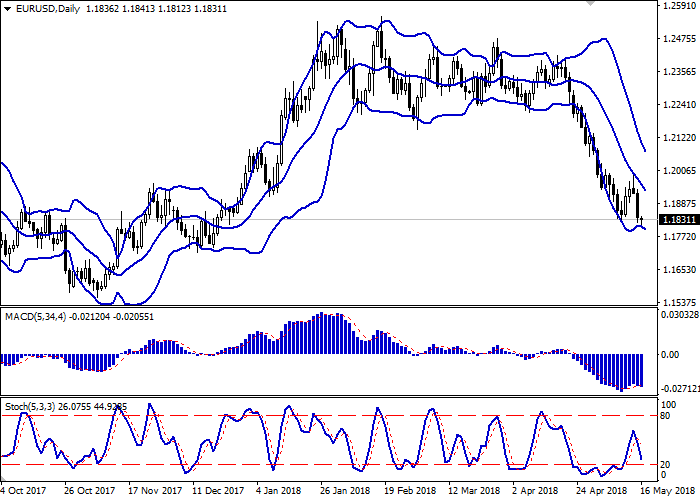

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is narrowing, reflecting a tendency for appearance of the flat dynamics of trading in the short term.

MACD is reversing downwards forming a new sell signal (the histogram is located below the signal line).

Stochastic shows a similar dynamics, but at the moment it is approaching its minimum marks.

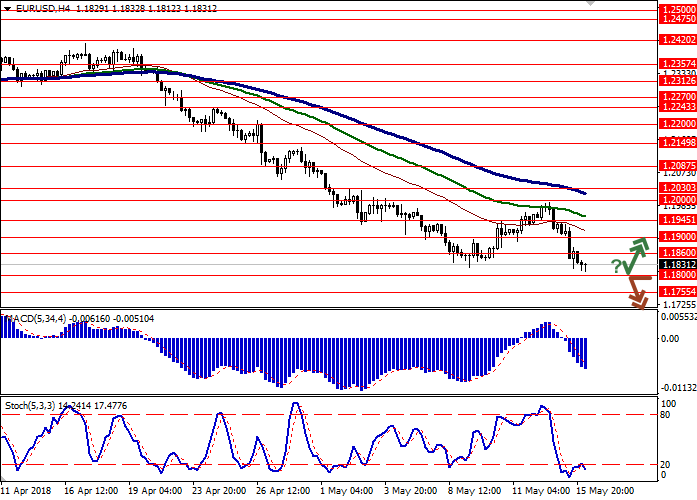

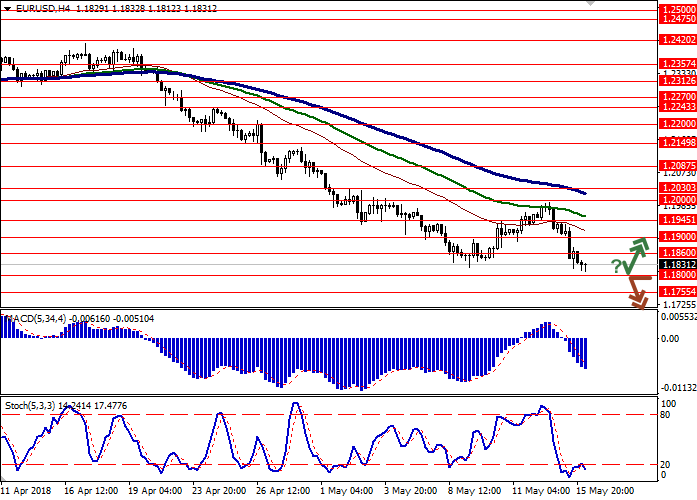

One should consider short positions in the short and ultra-short term.

Resistance levels: 1.1860, 1.1900, 1.1945, 1.2000.

Support levels: 1.1800, 1.1755, 1.1711.

Trading tips

To open long positions, one can rely on the rebound from the support level of 1.1800, provided that the showings of technical indicators do not contradict the development of the "bullish" trend. Take-profit — 1.1900 or 1.1945, 1.2000. Stop-loss – 1.1750. Implementation period: 2-3 days.

A breakdown of the level of 1.1800 may be a signal to further sales with targets at 1.1755 or 1.1711, 1.1700 marks. Stop-loss – 1.1850. Implementation period: 1-2 days.

EUR decreased against USD on Tuesday, leveling all attempts at instrument growth from the middle of last week and returning to local lows since the beginning of the year.

The decrease is due to the number of negative economic factors. German Q1 GDP was below the expectations. QoQ index reached 0.3% (against the expected 0.4%), and YoY one – 2.3% (against the expected 2.4%). The growth of March EU Industrial Production index did not meet the expectations. MoM growth reached 0.5% (against 0.7%), and YoY one – 3.0% (against 3.7%). EU GDP stayed on the level of 0.4% MoM and 2.5% YoY, which was ignored by the market. Poor EU economic data make the investors fear that ECB will prolong the assets buyback program and even more postpone the termination of monetary stimulus.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is narrowing, reflecting a tendency for appearance of the flat dynamics of trading in the short term.

MACD is reversing downwards forming a new sell signal (the histogram is located below the signal line).

Stochastic shows a similar dynamics, but at the moment it is approaching its minimum marks.

One should consider short positions in the short and ultra-short term.

Resistance levels: 1.1860, 1.1900, 1.1945, 1.2000.

Support levels: 1.1800, 1.1755, 1.1711.

Trading tips

To open long positions, one can rely on the rebound from the support level of 1.1800, provided that the showings of technical indicators do not contradict the development of the "bullish" trend. Take-profit — 1.1900 or 1.1945, 1.2000. Stop-loss – 1.1750. Implementation period: 2-3 days.

A breakdown of the level of 1.1800 may be a signal to further sales with targets at 1.1755 or 1.1711, 1.1700 marks. Stop-loss – 1.1850. Implementation period: 1-2 days.

No comments:

Write comments