EUR/USD: the euro is declining

21 May 2018, 09:45

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1810 |

| Take Profit | 1.1900, 1.1945 |

| Stop Loss | 1.1750, 1.1740 |

| Key Levels | 1.1688, 1.1711, 1.1741, 1.1800, 1.1860, 1.1900, 1.1945 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL |

| Entry Point | 1.1733 |

| Take Profit | 1.1688, 1.1650 |

| Stop Loss | 1.1800 |

| Key Levels | 1.1688, 1.1711, 1.1741, 1.1800, 1.1860, 1.1900, 1.1945 |

Current trend

EUR continues to decline against USD, updating local lows of December 18, 2017.

The data on the EU trade balance released on Friday turned out to be positive: its surplus rose from 21.0 to 21.2 billion euros. However, much more pressure on the single currency was provided by news from Italy. Representatives of "Five Star" and "League" political movements, which yesterday announced the formation of a coalition government, published its program. It runs counter to the current EU policy and calls for a revision of the budget rules and canceling of sanctions against Russia. Also, the new government proposes to abandon the pension reform, which was supposed to raise the retirement age, and demand that the EU countries write off part of the national debt.

Today, the pair is trading downwards but the activity is moderate as most European markets are closed due to national holidays. Investors will focus on EU financial stability review which is due at 10:00 (GMT+2).

Support and resistance

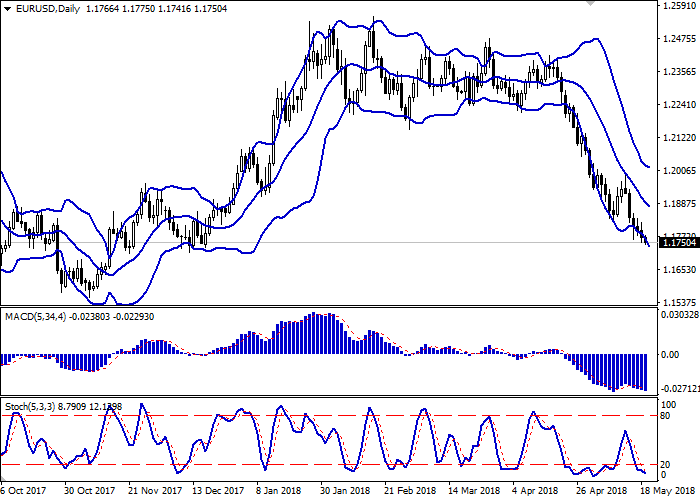

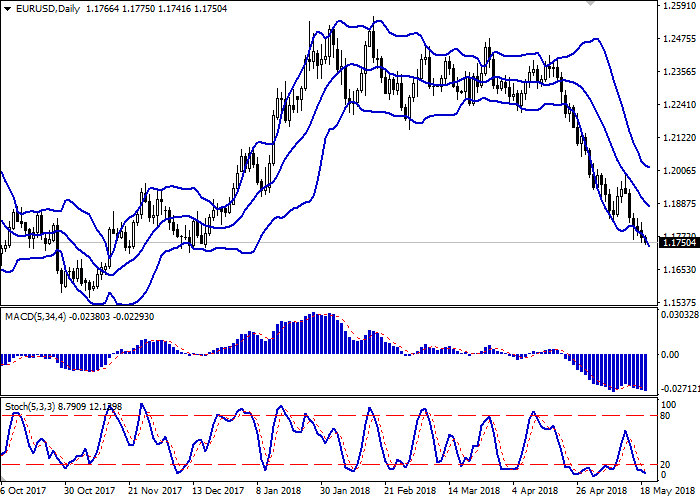

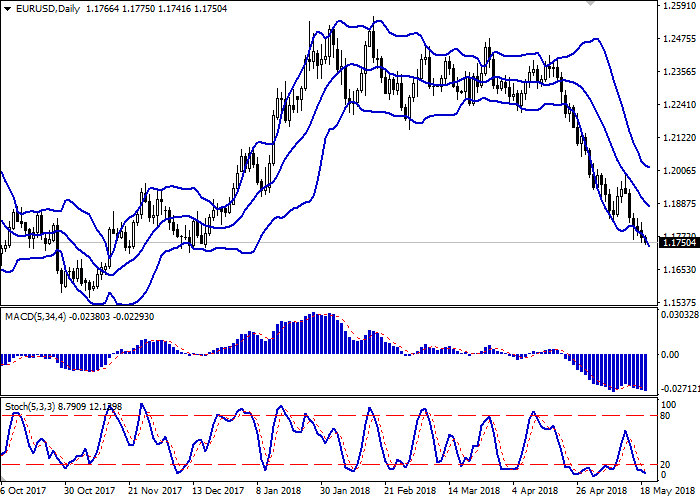

Bollinger Bands in D1 chart are directed downwards. The price range is expanding but it’s not wide enough for "bearish" trend.

MACD is going down keeping a weak sell signal (located below the signal line).

Stochastic is close to its minimum levels, which indicates overbought EUR in the short term.

A correction can start in the short term at the beginning of this trading week.

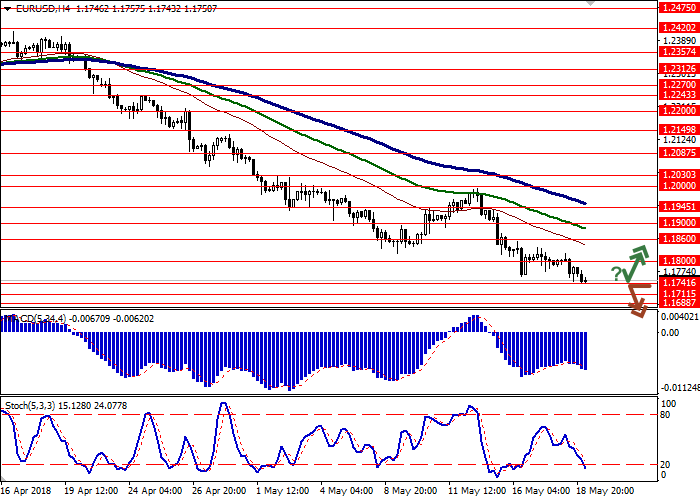

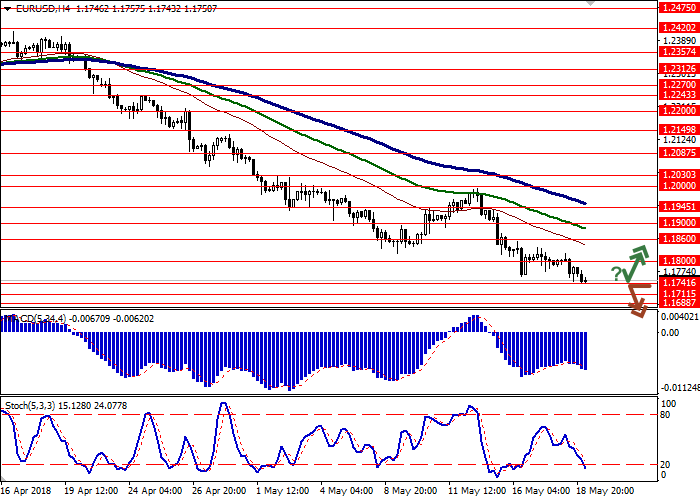

Resistance levels: 1.1800, 1.1860, 1.1900, 1.1945.

Support levels: 1.1741, 1.1711, 1.1688.

Trading tips

Long positions may be opened if the instrument rebounds from the level of 1.1741 followed by the breakout of 1.1800 mark. Take-profit — 1.1900–1.1945. Stop-loss — 1.1750–1.1740.

A breakdown of the level of 1.1741 may be a signal to further sales with targets at 1.1688 or 1.1650 marks. Stop-loss — 1.1800.

Implementation period: 2-3 days.

EUR continues to decline against USD, updating local lows of December 18, 2017.

The data on the EU trade balance released on Friday turned out to be positive: its surplus rose from 21.0 to 21.2 billion euros. However, much more pressure on the single currency was provided by news from Italy. Representatives of "Five Star" and "League" political movements, which yesterday announced the formation of a coalition government, published its program. It runs counter to the current EU policy and calls for a revision of the budget rules and canceling of sanctions against Russia. Also, the new government proposes to abandon the pension reform, which was supposed to raise the retirement age, and demand that the EU countries write off part of the national debt.

Today, the pair is trading downwards but the activity is moderate as most European markets are closed due to national holidays. Investors will focus on EU financial stability review which is due at 10:00 (GMT+2).

Support and resistance

Bollinger Bands in D1 chart are directed downwards. The price range is expanding but it’s not wide enough for "bearish" trend.

MACD is going down keeping a weak sell signal (located below the signal line).

Stochastic is close to its minimum levels, which indicates overbought EUR in the short term.

A correction can start in the short term at the beginning of this trading week.

Resistance levels: 1.1800, 1.1860, 1.1900, 1.1945.

Support levels: 1.1741, 1.1711, 1.1688.

Trading tips

Long positions may be opened if the instrument rebounds from the level of 1.1741 followed by the breakout of 1.1800 mark. Take-profit — 1.1900–1.1945. Stop-loss — 1.1750–1.1740.

A breakdown of the level of 1.1741 may be a signal to further sales with targets at 1.1688 or 1.1650 marks. Stop-loss — 1.1800.

Implementation period: 2-3 days.

No comments:

Write comments