NZD/USD: the instrument is in the correction

21 May 2018, 09:43

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6940 |

| Take Profit | 0.7000, 0.7050 |

| Stop Loss | 0.6890, 0.6880 |

| Key Levels | 0.6800, 0.6820, 0.6850, 0.6880, 0.6913, 0.6935, 0.6982, 0.7000 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6840 |

| Take Profit | 0.6800, 0.6780, 0.6770 |

| Stop Loss | 0.6890, 0.6900 |

| Key Levels | 0.6800, 0.6820, 0.6850, 0.6880, 0.6913, 0.6935, 0.6982, 0.7000 |

Current trend

On Friday, NZD moderately grew against USD, developing the “bullish” momentum, formed in the idle of the last week and replaced the steady downward trend.

Investors continue to follow the progress of the US-China trade talks in Washington. On Thursday, it was reported that Chinese representatives suggested reducing the trade deficit by USD 200 billion, thereby fulfilling one of the key requirements of the American delegation. To do this, it is planned to increase the purchase of American goods and to cancel some of the duties on goods (pork, nuts, and beans) exported from the US to China. However, a number of Chinese officials denied this information on Friday.

On Monday, investors are waiting for the statements of FRS members Patrick Harker and Rafael Bostic, who can comment on the prospects of the US economy and the further actions of the regulator.

On Monday, NZD is under pressure from poor Retail Sales data and April Credit Card Spending.

Support and resistance

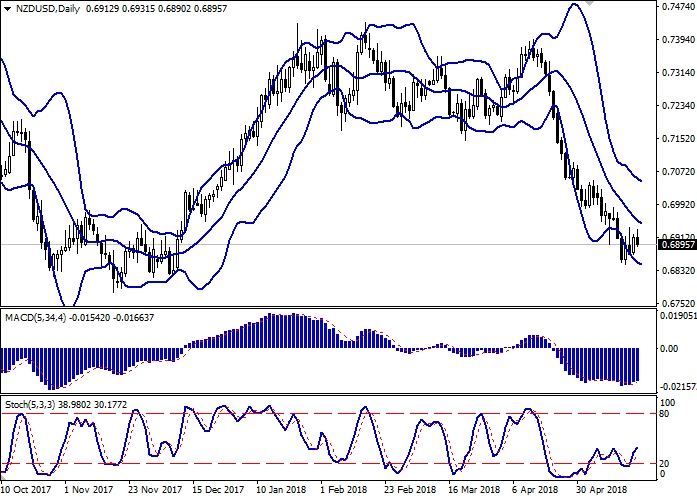

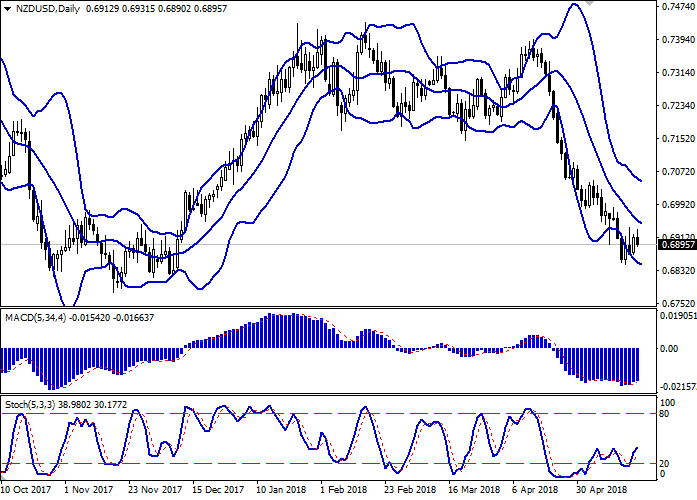

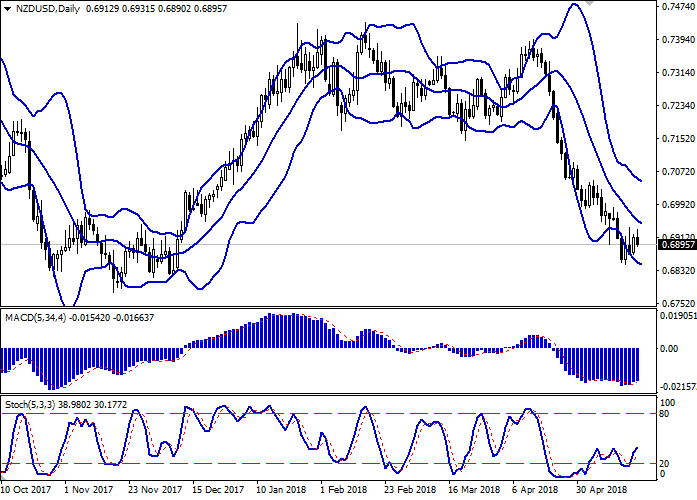

On the daily chart, Bollinger Bands are steadily falling. The price range is slightly narrowing form below, reflecting that the instrument is tending to reverse upwards. MACD is growing, keeping a weak buy signal (the histogram is above the signal line). Stochastic’s dynamic is the same; it is around the middle of its working area.

It is better to open long positions in the short or very short term.

Resistance levels: 0.6913, 0.6935, 0.6982, 0.7000.

Support levels: 0.6880, 0.6850, 0.6820, 0.6800.

Trading tips

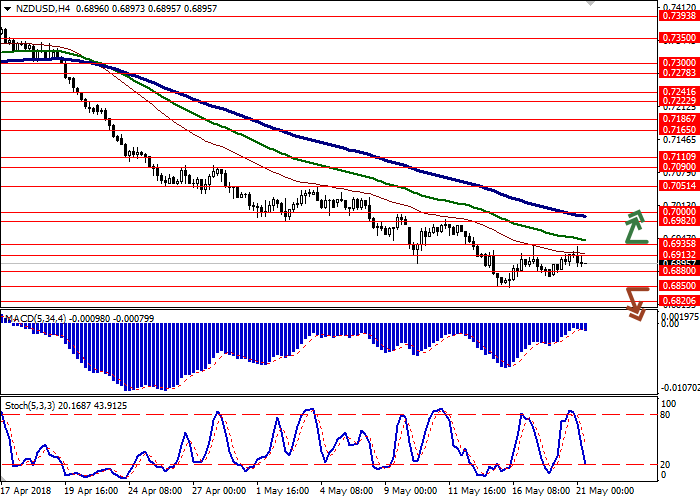

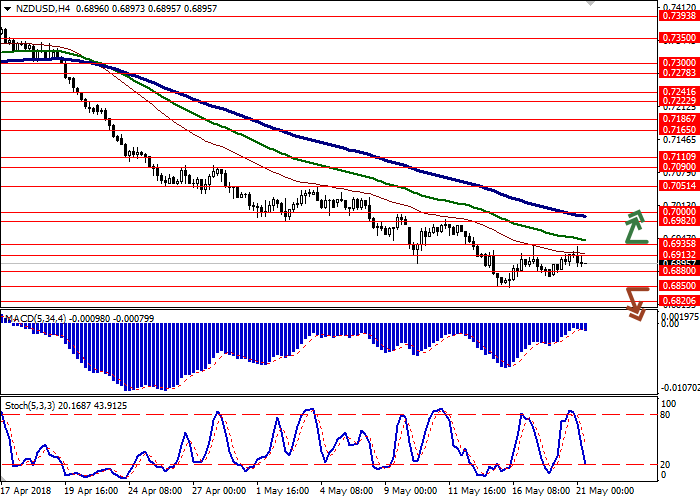

Long positions can be opened after the breakout of the level 0.6935 with the target at 0.7000 or 0.7050 and stop loss 0.6890–0.6880.

Short positions can be opened after the breakdown of the level 0.6850 downwards with the targets at 0.6800 or 0.6780–0.6770 and stop loss 0.6890 or 0.6900.

Implementation period: 2–3 days.

On Friday, NZD moderately grew against USD, developing the “bullish” momentum, formed in the idle of the last week and replaced the steady downward trend.

Investors continue to follow the progress of the US-China trade talks in Washington. On Thursday, it was reported that Chinese representatives suggested reducing the trade deficit by USD 200 billion, thereby fulfilling one of the key requirements of the American delegation. To do this, it is planned to increase the purchase of American goods and to cancel some of the duties on goods (pork, nuts, and beans) exported from the US to China. However, a number of Chinese officials denied this information on Friday.

On Monday, investors are waiting for the statements of FRS members Patrick Harker and Rafael Bostic, who can comment on the prospects of the US economy and the further actions of the regulator.

On Monday, NZD is under pressure from poor Retail Sales data and April Credit Card Spending.

Support and resistance

On the daily chart, Bollinger Bands are steadily falling. The price range is slightly narrowing form below, reflecting that the instrument is tending to reverse upwards. MACD is growing, keeping a weak buy signal (the histogram is above the signal line). Stochastic’s dynamic is the same; it is around the middle of its working area.

It is better to open long positions in the short or very short term.

Resistance levels: 0.6913, 0.6935, 0.6982, 0.7000.

Support levels: 0.6880, 0.6850, 0.6820, 0.6800.

Trading tips

Long positions can be opened after the breakout of the level 0.6935 with the target at 0.7000 or 0.7050 and stop loss 0.6890–0.6880.

Short positions can be opened after the breakdown of the level 0.6850 downwards with the targets at 0.6800 or 0.6780–0.6770 and stop loss 0.6890 or 0.6900.

Implementation period: 2–3 days.

No comments:

Write comments