XAG/USD: silver prices are consolidating

21 May 2018, 10:27

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 16.35, 16.45 |

| Take Profit | 16.55, 16.60 |

| Stop Loss | 16.30, 16.24 |

| Key Levels | 16.00, 16.09, 16.20, 16.33, 16.44, 16.51, 16.66 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 16.17 |

| Take Profit | 16.00 |

| Stop Loss | 16.33 |

| Key Levels | 16.00, 16.09, 16.20, 16.33, 16.44, 16.51, 16.66 |

Current trend

On Monday, silver prices are falling within the correction after a moderate growth since the middle of the last week. The investors are waiting for the new drivers to appear.

The further growth of the instrument is prevented by quite steady positions of the US currency, which is strongly growing against its main competitors. On the other hand, silver is supported by the development of the political and business crisis in Italy, which, according to experts, can affect the market more than the Greece crisis did.

Today the traders are focused on Chicago Fed National Activity Index release at 14:30 (GMT+2), FOMC Member Bostic speech, and FOMC Member Bostic speech.

Support and resistance

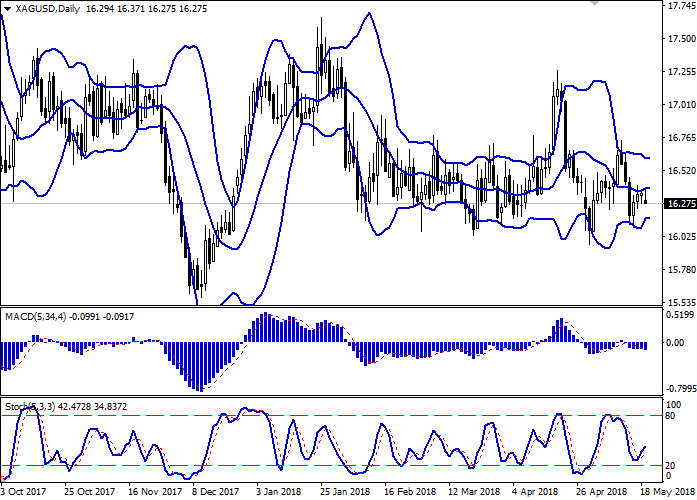

On the daily chart, Bollinger Bands are moving flat. The price range is narrowing, reflecting the mixed trade character of the recent days. MACD is slightly going down; keeping a weak sell signal (the histogram is below the signal line). Stochastic is still reversing upwards and does not almost react to today’s downward dynamic appearance.

It is better to wait until stronger signals of the further upward dynamic development in the short or very short term.

Resistance levels: 16.33, 16.44, 16.51, 16.66.

Support levels: 16.20, 16.09, 16.00.

Trading tips

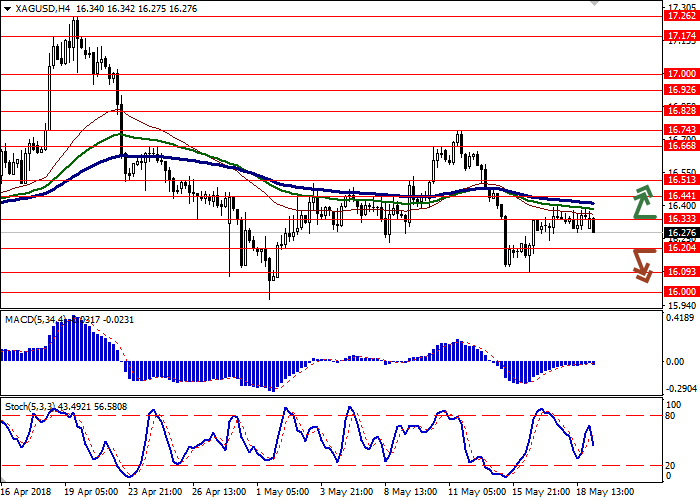

Long positions can be opened after the breakout of the levels 16.33–16.40 with the target at 16.55 or 16.60 and stop loss 16.30–16.24.

Short positions can be opened after the breakout of the level 16.20 downwards with the target at 16.00 and stop loss 16.33.

Implementation period: 2–3 days.

On Monday, silver prices are falling within the correction after a moderate growth since the middle of the last week. The investors are waiting for the new drivers to appear.

The further growth of the instrument is prevented by quite steady positions of the US currency, which is strongly growing against its main competitors. On the other hand, silver is supported by the development of the political and business crisis in Italy, which, according to experts, can affect the market more than the Greece crisis did.

Today the traders are focused on Chicago Fed National Activity Index release at 14:30 (GMT+2), FOMC Member Bostic speech, and FOMC Member Bostic speech.

Support and resistance

On the daily chart, Bollinger Bands are moving flat. The price range is narrowing, reflecting the mixed trade character of the recent days. MACD is slightly going down; keeping a weak sell signal (the histogram is below the signal line). Stochastic is still reversing upwards and does not almost react to today’s downward dynamic appearance.

It is better to wait until stronger signals of the further upward dynamic development in the short or very short term.

Resistance levels: 16.33, 16.44, 16.51, 16.66.

Support levels: 16.20, 16.09, 16.00.

Trading tips

Long positions can be opened after the breakout of the levels 16.33–16.40 with the target at 16.55 or 16.60 and stop loss 16.30–16.24.

Short positions can be opened after the breakout of the level 16.20 downwards with the target at 16.00 and stop loss 16.33.

Implementation period: 2–3 days.

No comments:

Write comments