Ethereum: general analysis

22 May 2018, 12:41

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 675.00 |

| Take Profit | 625.00, 562.50 |

| Stop Loss | 720.00 |

| Key Levels | 562.50, 625.00, 687.50, 750.00, 812.50, 875.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 820.00 |

| Take Profit | 875.00, 950.00 |

| Stop Loss | 780.00 |

| Key Levels | 562.50, 625.00, 687.50, 750.00, 812.50, 875.00 |

Current trend

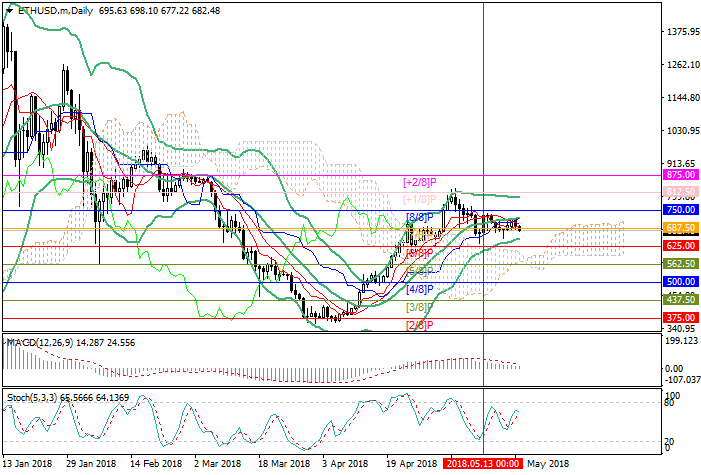

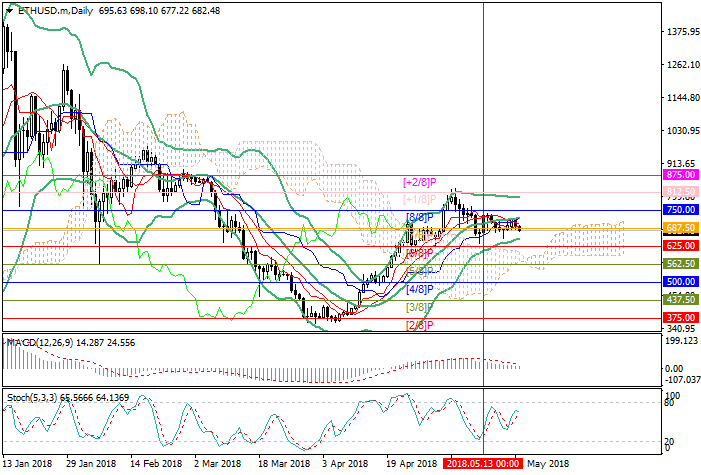

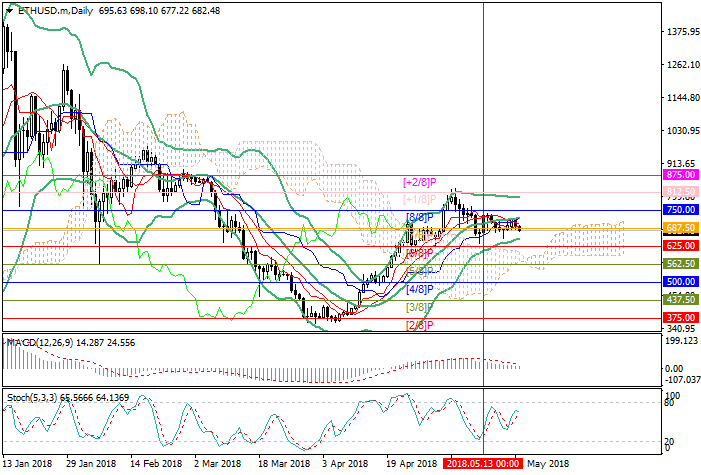

For the second week Ether is trading within the lower band of Bollinger around 687.50 (Murray [2/8]) and cannot get away due to a lack of drivers.

Ethereum has new problems with transactions processing. It increased due to the launch of a new game “Ether Shrimp Farm”, where the client grows shrimps and exchanges them for Ether. Only in the first day the transactions number increased by 26 thousand, and the amount of compensation for processing doubled. Investors are concerned if a popular game application can create problems network, how can it work with large customers.

American regional regulators actively join the anti-fraud fight in the sector. On Monday, it became known that the North American Association of Securities Administrators (NASAA), which includes 40 regional regulators of the United States and Canada, implements the “Operation Cryptosweep” project: about 70 fraud investigations were initiated and measures were taken against 35 unscrupulous companies.

Support and resistance

After the price is set below the level 687.50 (Murray [7/8]), it can reach the levels of 625.00 (Murray [6/8]) and 562.50 (Murray [5/8]). The growth to the levels of 875.00 (Murray [+2/8]) and 950.00 is possible after the price is set above its May highs around 812.50 (Murray [+1/8], the upper border of the Bollinger bands). Technical indicators reflect a fall, MACD decreases in the negative zone, Stochastic reversed downwards.

Resistance levels: 750.00, 812.50, 875.00.

Support levels: 687.50, 625.00, 562.50.

Trading tips

Short positions can be opened after the price is set below the level of 687.50 with the targets at 625.00, 562.50 and stop loss around 720.00.

Long positions can be opened above the level of 812.50 with the targets at 875.00, 950.00 and stop loss 780.00.

Implementation period: 3–5 days.

For the second week Ether is trading within the lower band of Bollinger around 687.50 (Murray [2/8]) and cannot get away due to a lack of drivers.

Ethereum has new problems with transactions processing. It increased due to the launch of a new game “Ether Shrimp Farm”, where the client grows shrimps and exchanges them for Ether. Only in the first day the transactions number increased by 26 thousand, and the amount of compensation for processing doubled. Investors are concerned if a popular game application can create problems network, how can it work with large customers.

American regional regulators actively join the anti-fraud fight in the sector. On Monday, it became known that the North American Association of Securities Administrators (NASAA), which includes 40 regional regulators of the United States and Canada, implements the “Operation Cryptosweep” project: about 70 fraud investigations were initiated and measures were taken against 35 unscrupulous companies.

Support and resistance

After the price is set below the level 687.50 (Murray [7/8]), it can reach the levels of 625.00 (Murray [6/8]) and 562.50 (Murray [5/8]). The growth to the levels of 875.00 (Murray [+2/8]) and 950.00 is possible after the price is set above its May highs around 812.50 (Murray [+1/8], the upper border of the Bollinger bands). Technical indicators reflect a fall, MACD decreases in the negative zone, Stochastic reversed downwards.

Resistance levels: 750.00, 812.50, 875.00.

Support levels: 687.50, 625.00, 562.50.

Trading tips

Short positions can be opened after the price is set below the level of 687.50 with the targets at 625.00, 562.50 and stop loss around 720.00.

Long positions can be opened above the level of 812.50 with the targets at 875.00, 950.00 and stop loss 780.00.

Implementation period: 3–5 days.

No comments:

Write comments