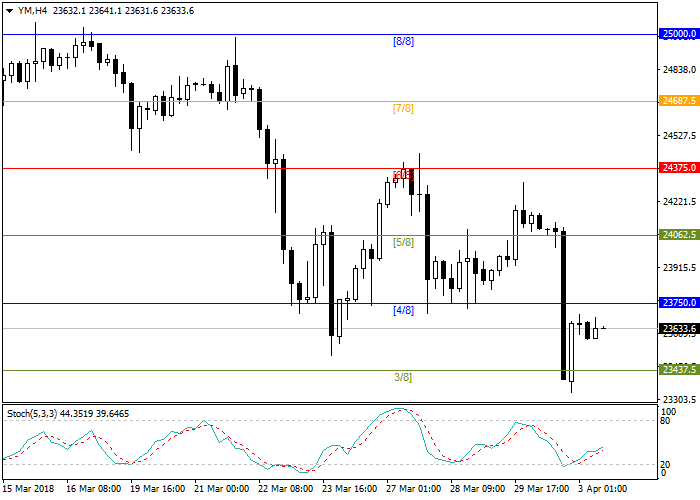

YM: general review

03 April 2018, 13:29

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL LIMIT |

| Entry Point | 23750.0 |

| Take Profit | 23437.5 |

| Stop Loss | 24062.5 |

| Key Levels | 23350.8, 23437.5, 23750.0, 24062.5 |

Current trend

Dow Jones index slightly recovered last week's losses and is now trading at 23632.8, still under pressure.

The main news that makes traders look for opportunities for sale remains the US-China trade war. Since Monday, the Celestial Empire has increased customs duties by 25% on 128 goods imported from the United States. If events continue to go on this way, it will affect the world economy and trade, and losses will be incurred by both sides.

The economic statistics could not support stock markets as well: in particular, the index of business activity fell slightly, reaching 59.3 points in March against the forecast of 60.0. The shares of the technology sector, which usually leads the market in terms of profitability, have also fallen: Intel's capitalization fell by 5% because of news that Apple will cease using the company's processors and will begin to implement its own. Given all of the above facts, the external background is still negative for the stock market, and the fall may continue.

Today, the data on the total volume of sales of cars will be published.

Support and resistance

Stochastic is at 38 points and does not provide a signal for the opening of positions.

Resistance levels: 23750.0, 24062.5.

Support levels: 23437.5, 23350.8.

Trading tips

Short positions may be opened from the level of 4/8 Murray or 23750.0 with take-profit at 23437.5 mark and stop-loss at 24062.5.

Dow Jones index slightly recovered last week's losses and is now trading at 23632.8, still under pressure.

The main news that makes traders look for opportunities for sale remains the US-China trade war. Since Monday, the Celestial Empire has increased customs duties by 25% on 128 goods imported from the United States. If events continue to go on this way, it will affect the world economy and trade, and losses will be incurred by both sides.

The economic statistics could not support stock markets as well: in particular, the index of business activity fell slightly, reaching 59.3 points in March against the forecast of 60.0. The shares of the technology sector, which usually leads the market in terms of profitability, have also fallen: Intel's capitalization fell by 5% because of news that Apple will cease using the company's processors and will begin to implement its own. Given all of the above facts, the external background is still negative for the stock market, and the fall may continue.

Today, the data on the total volume of sales of cars will be published.

Support and resistance

Stochastic is at 38 points and does not provide a signal for the opening of positions.

Resistance levels: 23750.0, 24062.5.

Support levels: 23437.5, 23350.8.

Trading tips

Short positions may be opened from the level of 4/8 Murray or 23750.0 with take-profit at 23437.5 mark and stop-loss at 24062.5.

No comments:

Write comments