Ethereum: general analysis

03 April 2018, 13:56

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 415.00 |

| Take Profit | 500.00, 625.00 |

| Stop Loss | 380.00 |

| Key Levels | 250.00, 312.50, 375.00, 500.00, 625.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 355.00 |

| Take Profit | 312.50, 250.00 |

| Stop Loss | 400.00 |

| Key Levels | 250.00, 312.50, 375.00, 500.00, 625.00 |

Current trend

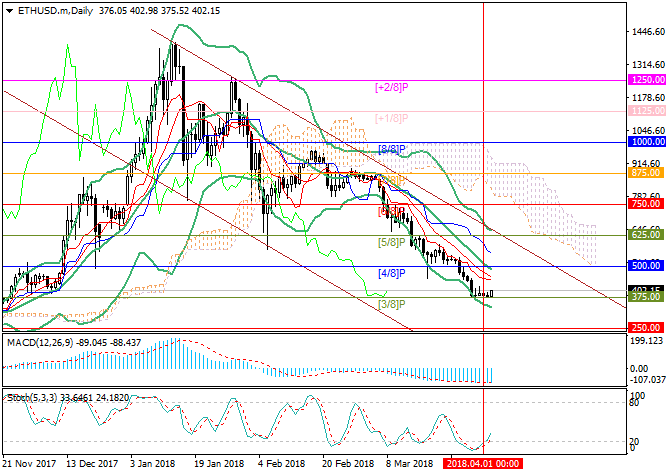

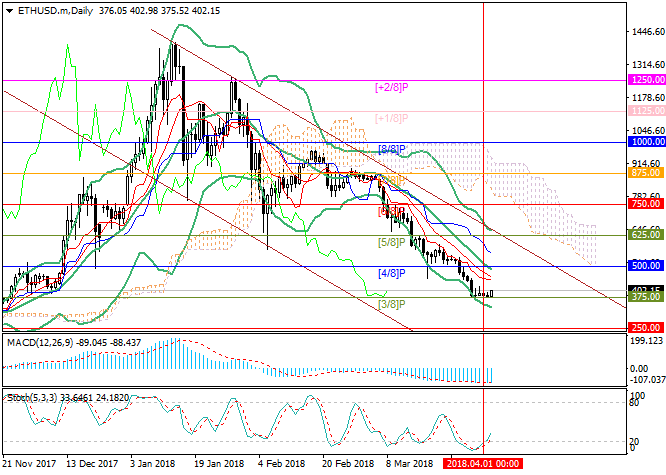

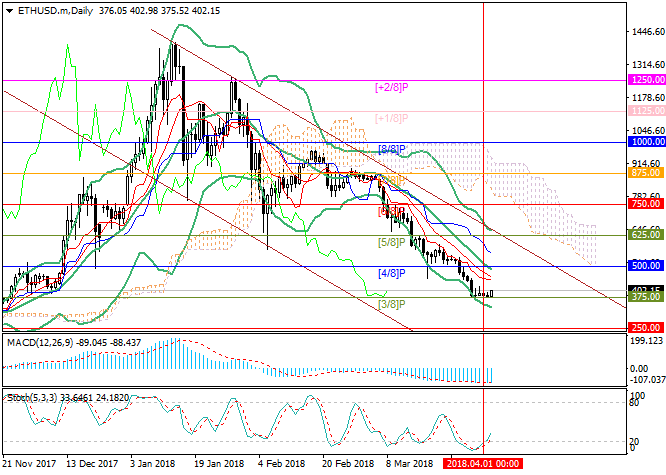

At the end of the last week, Ether prices reached the level of 375.00 (Murray [3/4]), where are now trading.

The news background stays negative for the cryptocurrency market. Google Company, after the prohibition of digital assets commercials, began to block all the mining applications in Chrome Web Store. Montreal Bank, which is one of the five largest Canadian banks, began to block its customers’ cryptocurrency transactions on debit and credit cards. Earlier, the US largest banks JP Morgan Chase, Bank of America and Citigroup, and the second largest UK Lloyds Banking Group, implied similar measures.

Vitalik Buterin’s statement upon the possibility to set the final number of ETH produces coins of 120204432 units, is worth mentioning. Later Ethereum head claimed it to be an April’s fool joke but noted that the idea of the restriction is worth wide consideration and discussion, as it may provide the currency with economic stability.

Support and resistance

Despite the negative news background, the technical picture reflects the possibility of a correctional growth to the area of 500.00 (Murray [4/8], the middle line of Bollinger Bands) and 625.00 (Murray [5/8]). Stochastic is leaving the oversold area and forms a sell signal. The key “bearish” level is 375.00 (Murray [3/4]), the breakdown of it can decrease the price to the levels of 312.50 (Murray [2/8], H4) 250.00 (Murray [2/8]).

Resistance levels: 500.00, 625.00.

Support levels: 375.00, 312.50, 250.00.

Trading tips

Long positions can be opened at the level of 415.00 with the targets at 500.00, 625.00 and stop loss around 380.00.

Short positions can be opened after the price is set below the level of 375.00 with the targets at 312.50, 250.00 and stop loss around 400.00.

At the end of the last week, Ether prices reached the level of 375.00 (Murray [3/4]), where are now trading.

The news background stays negative for the cryptocurrency market. Google Company, after the prohibition of digital assets commercials, began to block all the mining applications in Chrome Web Store. Montreal Bank, which is one of the five largest Canadian banks, began to block its customers’ cryptocurrency transactions on debit and credit cards. Earlier, the US largest banks JP Morgan Chase, Bank of America and Citigroup, and the second largest UK Lloyds Banking Group, implied similar measures.

Vitalik Buterin’s statement upon the possibility to set the final number of ETH produces coins of 120204432 units, is worth mentioning. Later Ethereum head claimed it to be an April’s fool joke but noted that the idea of the restriction is worth wide consideration and discussion, as it may provide the currency with economic stability.

Support and resistance

Despite the negative news background, the technical picture reflects the possibility of a correctional growth to the area of 500.00 (Murray [4/8], the middle line of Bollinger Bands) and 625.00 (Murray [5/8]). Stochastic is leaving the oversold area and forms a sell signal. The key “bearish” level is 375.00 (Murray [3/4]), the breakdown of it can decrease the price to the levels of 312.50 (Murray [2/8], H4) 250.00 (Murray [2/8]).

Resistance levels: 500.00, 625.00.

Support levels: 375.00, 312.50, 250.00.

Trading tips

Long positions can be opened at the level of 415.00 with the targets at 500.00, 625.00 and stop loss around 380.00.

Short positions can be opened after the price is set below the level of 375.00 with the targets at 312.50, 250.00 and stop loss around 400.00.

No comments:

Write comments