USD/CAD: general analysis

03 April 2018, 13:11

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.2850 |

| Take Profit | 1.2800 |

| Stop Loss | 1.2880 |

| Key Levels | 1.2800, 1.2820, 1.2860, 1.2880, 1.2900, 1.2930, 1.2950, 1.3000 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2900 |

| Take Profit | 1.2950 |

| Stop Loss | 1.2870 |

| Key Levels | 1.2800, 1.2820, 1.2860, 1.2880, 1.2900, 1.2930, 1.2950, 1.3000 |

Current trend

On Monday, USD insignificantly strengthened against CAD, despite the decrease of ISM Manufacturing PMI to 59.3 points, which was below the expectations of 60.0 points. The growth of ISM Prices Paid, which reflects the condition of US manufacturing sector, supported USD. It reached the level of в 78.1 points, which is above the forecast of 74.5 points. Canadian Markit Manufacturing PMI grew by 0.1 points to the level of 55.7 points.

The traders return to schedule after the holidays, when the liquidity and volatility in the market were low. Today the traders are focused on FOMC Member Kashkari Speech at 15:30 (GMT+2) and FOMC Member Brainard Speech at 22:30 (GMT+2), a moderate level of volatility is expected.

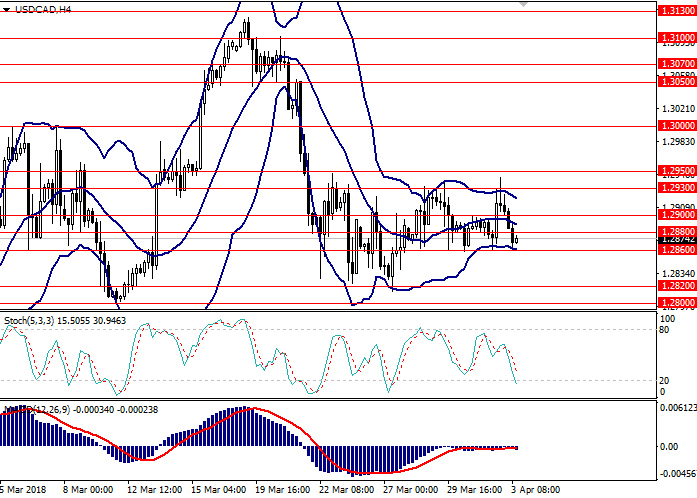

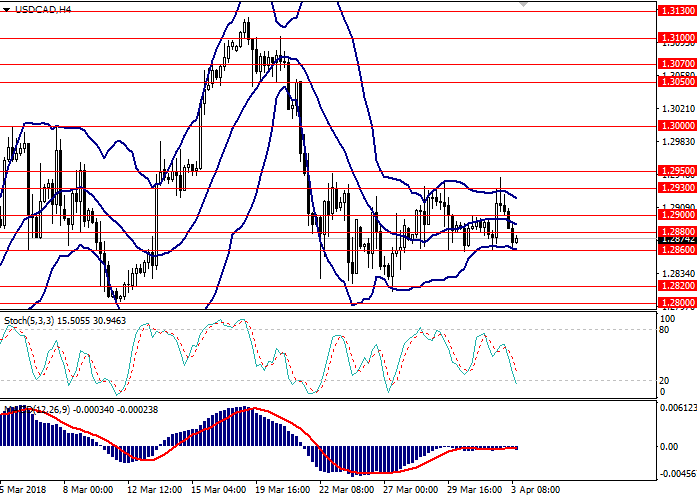

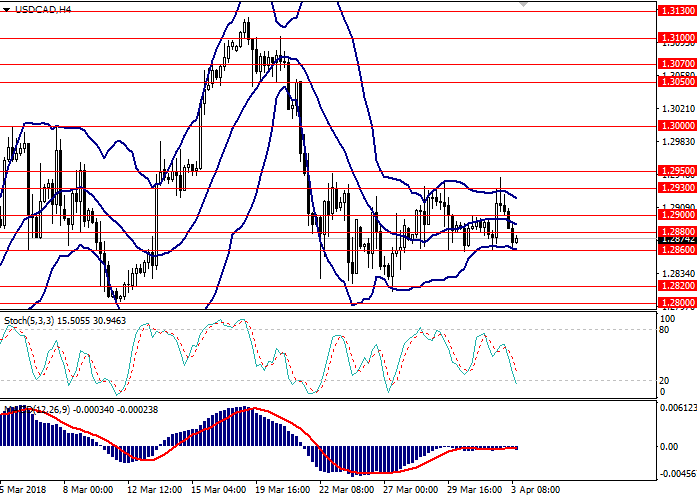

Support and resistance

On the 4-hour chart, the instrument is trading within the narrow range, formed by the borders of Bollinger Bands, the price range is narrowing. MACD histogram is around the zero line, its volumes are minimal, and the signal line is moving horizontally.

Resistance levels: 1.2880, 1.2900, 1.2930, 1.2950, 1.3000.

Support levels: 1.2860, 1.2820, 1.2800.

Trading tips

Short positions can be opened at the level of 1.2850 with the target at 1.2800 and stop loss 1.2880.

Long positions can be opened at the level of 1.2900 with the target at 1.2950 and stop loss 1.2870.

Implementation period: 1–3 days.

On Monday, USD insignificantly strengthened against CAD, despite the decrease of ISM Manufacturing PMI to 59.3 points, which was below the expectations of 60.0 points. The growth of ISM Prices Paid, which reflects the condition of US manufacturing sector, supported USD. It reached the level of в 78.1 points, which is above the forecast of 74.5 points. Canadian Markit Manufacturing PMI grew by 0.1 points to the level of 55.7 points.

The traders return to schedule after the holidays, when the liquidity and volatility in the market were low. Today the traders are focused on FOMC Member Kashkari Speech at 15:30 (GMT+2) and FOMC Member Brainard Speech at 22:30 (GMT+2), a moderate level of volatility is expected.

Support and resistance

On the 4-hour chart, the instrument is trading within the narrow range, formed by the borders of Bollinger Bands, the price range is narrowing. MACD histogram is around the zero line, its volumes are minimal, and the signal line is moving horizontally.

Resistance levels: 1.2880, 1.2900, 1.2930, 1.2950, 1.3000.

Support levels: 1.2860, 1.2820, 1.2800.

Trading tips

Short positions can be opened at the level of 1.2850 with the target at 1.2800 and stop loss 1.2880.

Long positions can be opened at the level of 1.2900 with the target at 1.2950 and stop loss 1.2870.

Implementation period: 1–3 days.

No comments:

Write comments