USD/JPY: dollar is moderately growing

05 April 2018, 09:56

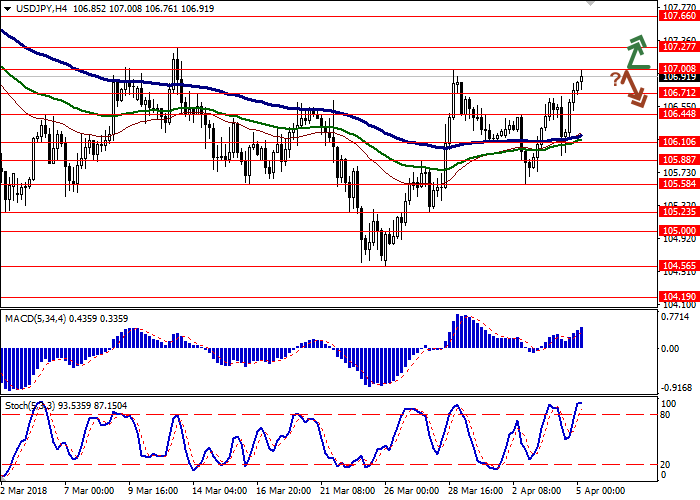

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 107.08 |

| Take Profit | 107.50, 107.66 |

| Stop Loss | 106.71 |

| Key Levels | 105.88, 106.10, 106.44, 106.71, 107.00, 107.27, 107.66 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 106.65 |

| Take Profit | 106.10, 106.00 |

| Stop Loss | 107.00 |

| Key Levels | 105.88, 106.10, 106.44, 106.71, 107.00, 107.27, 107.66 |

Current trend

Yesterday USD grew against JPY, despite the whole day it has been trading downwards. Markit Services PMI release, which decreased from 51.7 to 50.9 points in March, while the decrease to 51.6 points was expected, has affected JPY negatively a bit. However, US PMI was worse than the market expected, too.

Investors are focused on the development of the trade crisis between China and the United States. On Tuesday, it became known that China's retaliatory measures will not be limited to imposing a 25% duty on 128 US goods worth USD 3 billion. The same duties will be imposed on another 106 types of products from the US worth a total of USD 50 billion.

Today the weekly Initial Jobless Claims publication is expected in the USA. These releases are used as a leading indicator of the number of non-farm jobs. A slight increase in applications is expected from 215K to 225K.

Support and resistance

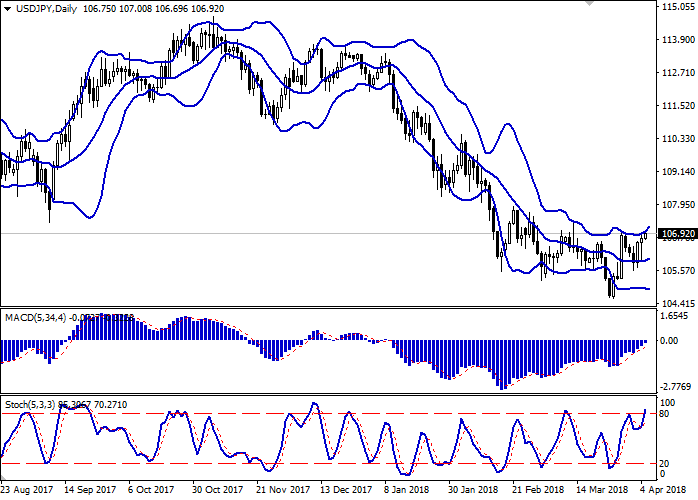

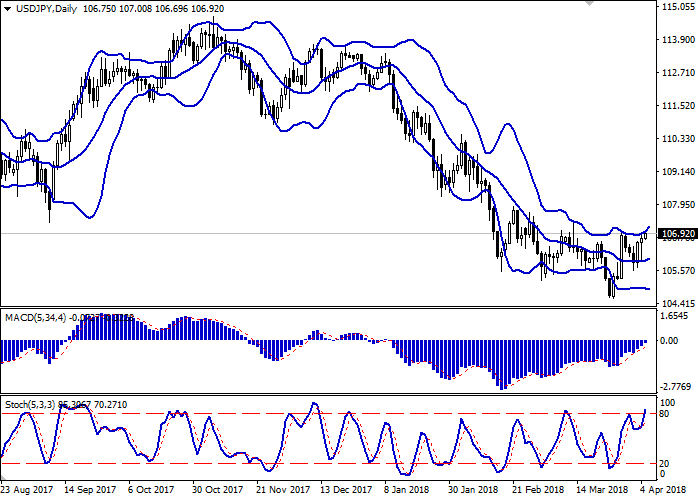

On the daily chart, Bollinger Bands are moderately growing. The price range is widening form above, letting “bears” renew local highs. MACD is growing, keeping a steady buy signal (the histogram is above the signal line). Stochastic is directed upwards, too, but is reaching its highs, reflecting that the instrument is overbought.

The indicators’ readings do not contradict with the “bullish” trend development until the end of the trading week.

Resistance levels: 107.00, 107.27, 107.66.

Support levels: 106.71, 106.44, 106.10, 105.88.

Trading tips

Long positions can be opened after the breakout of the level 107.00 with the targets at 107.50–107.66 and stop loss 106.71.

Short positions can be opened after the rebound at the level of 107.00 and the breakdown of the level 106.71 with the targets at 106.10–106.00 and stop loss 107.00.

Implementation period: 2–3 days.

Yesterday USD grew against JPY, despite the whole day it has been trading downwards. Markit Services PMI release, which decreased from 51.7 to 50.9 points in March, while the decrease to 51.6 points was expected, has affected JPY negatively a bit. However, US PMI was worse than the market expected, too.

Investors are focused on the development of the trade crisis between China and the United States. On Tuesday, it became known that China's retaliatory measures will not be limited to imposing a 25% duty on 128 US goods worth USD 3 billion. The same duties will be imposed on another 106 types of products from the US worth a total of USD 50 billion.

Today the weekly Initial Jobless Claims publication is expected in the USA. These releases are used as a leading indicator of the number of non-farm jobs. A slight increase in applications is expected from 215K to 225K.

Support and resistance

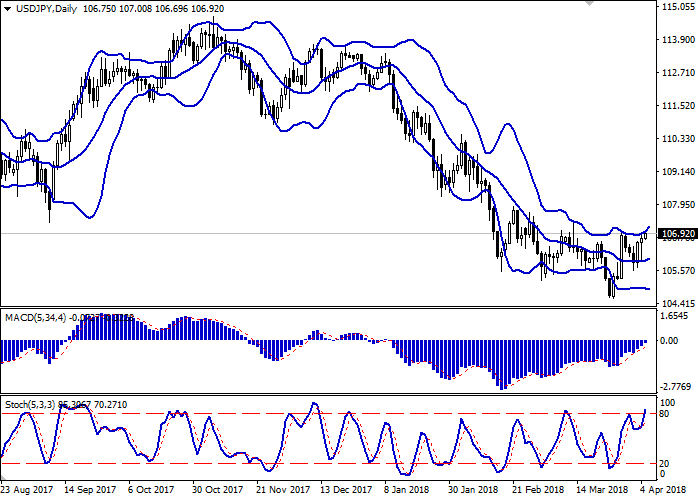

On the daily chart, Bollinger Bands are moderately growing. The price range is widening form above, letting “bears” renew local highs. MACD is growing, keeping a steady buy signal (the histogram is above the signal line). Stochastic is directed upwards, too, but is reaching its highs, reflecting that the instrument is overbought.

The indicators’ readings do not contradict with the “bullish” trend development until the end of the trading week.

Resistance levels: 107.00, 107.27, 107.66.

Support levels: 106.71, 106.44, 106.10, 105.88.

Trading tips

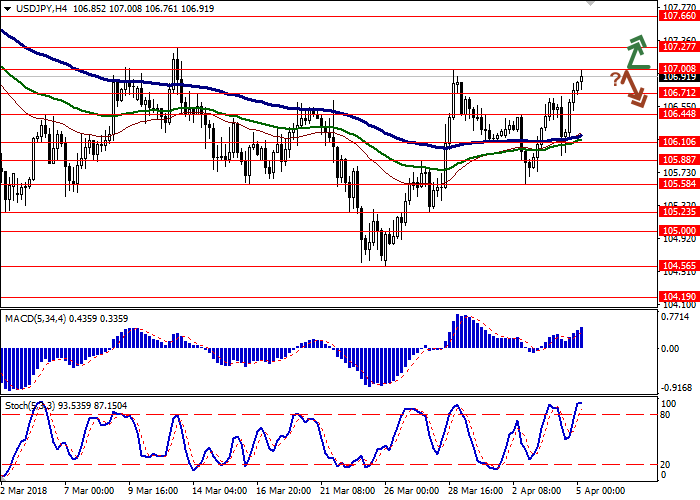

Long positions can be opened after the breakout of the level 107.00 with the targets at 107.50–107.66 and stop loss 106.71.

Short positions can be opened after the rebound at the level of 107.00 and the breakdown of the level 106.71 with the targets at 106.10–106.00 and stop loss 107.00.

Implementation period: 2–3 days.

No comments:

Write comments