USD/CAD: the instrument is consolidating

02 April 2018, 09:57

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.2930, 1.2950 |

| Take Profit | 1.3000, 1.3025, 1.3045 |

| Stop Loss | 1.2900 |

| Key Levels | 1.2710, 1.2752, 1.2800, 1.2855, 1.2900, 1.2947, 1.3000, 1.3045 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2850 |

| Take Profit | 1.2800, 1.2750 |

| Stop Loss | 1.2900 |

| Key Levels | 1.2710, 1.2752, 1.2800, 1.2855, 1.2900, 1.2947, 1.3000, 1.3045 |

Current trend

USD is trading in different directions against CAD, waiting for the appearance of new drivers. The beginning of the new week is characterized by low trading activity, since not all traders have returned from the long Easter weekend.

Investors continue discussing the statistics of the end of last week and are focusing on reports on the US and Canadian labor market, which will appear later this week.

Pressure on CAD is provided by data on Canada's GDP, released last Thursday. In January 2018 Canada's GDP declined by 0.1% MoM with a forecast of +0.1% MoM. In December 2017, the Canadian economy grew at a faster pace (+0.2% MoM). Raw material price index is also disappointing, having collapsed in February at 0.3% MoM with a forecast of growth of 2.8% MoM.

Support and resistance

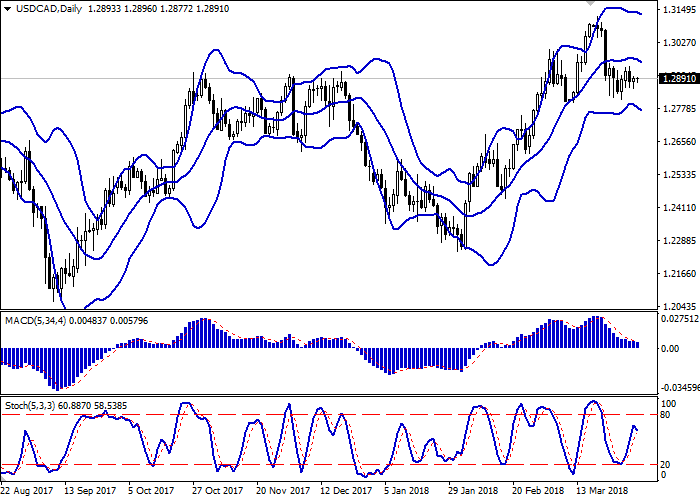

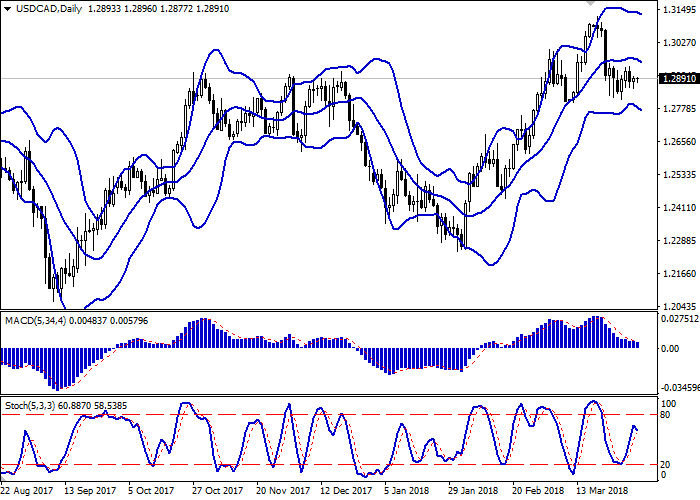

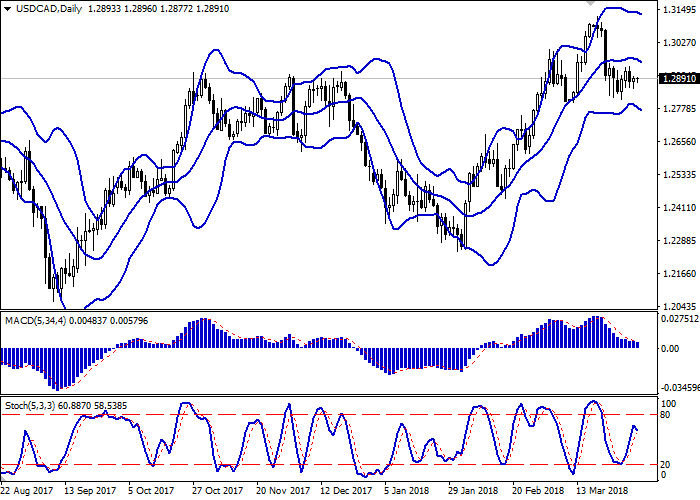

Bollinger Bands in D1 chart demonstrate an unsteady decrease. The price range expands, making way for new local lows for the "bears".

MACD preserves a weak sell signal (histogram is located below the signal line).

Stochastic interrupted its steady growth and reversed downwards, which does not reflect the real dynamics in the market.

The indicators do not contradict the further development of the "bearish" trend, but it is better to wait for new signals to open new positions.

Resistance levels: 1.2900, 1.2947, 1.3000, 1.3045.

Support levels: 1.2855, 1.2800, 1.2752, 1.2710.

Trading tips

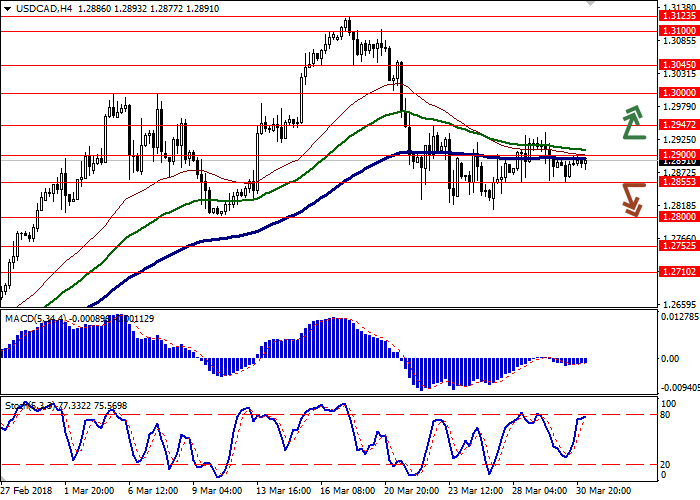

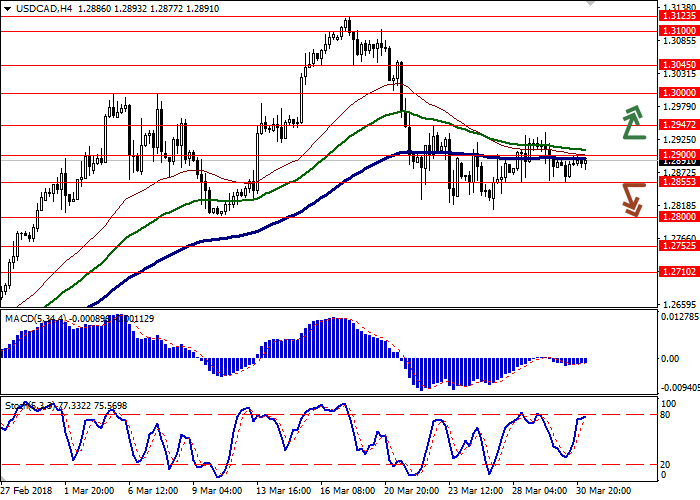

To open long positions, one can rely on the breakout of 1.2925–1.2947 marks. Take-profit — 1.3000 or 1.3025–1.3045. Stop-loss – 1.2900. Implementation period: 2-3 days.

The return of the "bearish" trend to the market with a breakdown of the level of 1.2855 may be an alternative. In this case, the target of the "bears" may be located around 1.2800 or 1.2750 marks. Stop-loss – 1.2900. Implementation period: 2-3 days.

USD is trading in different directions against CAD, waiting for the appearance of new drivers. The beginning of the new week is characterized by low trading activity, since not all traders have returned from the long Easter weekend.

Investors continue discussing the statistics of the end of last week and are focusing on reports on the US and Canadian labor market, which will appear later this week.

Pressure on CAD is provided by data on Canada's GDP, released last Thursday. In January 2018 Canada's GDP declined by 0.1% MoM with a forecast of +0.1% MoM. In December 2017, the Canadian economy grew at a faster pace (+0.2% MoM). Raw material price index is also disappointing, having collapsed in February at 0.3% MoM with a forecast of growth of 2.8% MoM.

Support and resistance

Bollinger Bands in D1 chart demonstrate an unsteady decrease. The price range expands, making way for new local lows for the "bears".

MACD preserves a weak sell signal (histogram is located below the signal line).

Stochastic interrupted its steady growth and reversed downwards, which does not reflect the real dynamics in the market.

The indicators do not contradict the further development of the "bearish" trend, but it is better to wait for new signals to open new positions.

Resistance levels: 1.2900, 1.2947, 1.3000, 1.3045.

Support levels: 1.2855, 1.2800, 1.2752, 1.2710.

Trading tips

To open long positions, one can rely on the breakout of 1.2925–1.2947 marks. Take-profit — 1.3000 or 1.3025–1.3045. Stop-loss – 1.2900. Implementation period: 2-3 days.

The return of the "bearish" trend to the market with a breakdown of the level of 1.2855 may be an alternative. In this case, the target of the "bears" may be located around 1.2800 or 1.2750 marks. Stop-loss – 1.2900. Implementation period: 2-3 days.

No comments:

Write comments