GBP/USD: general analysis

02 April 2018, 10:02

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.4065 |

| Take Profit | 1.4165 |

| Stop Loss | 1.4000 |

| Key Levels | 1.3970, 1.4000, 1.4040, 1.4060, 1.4100, 1.4150, 1.4165 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3970 |

| Take Profit | 1.3910 |

| Stop Loss | 1.4000 |

| Key Levels | 1.3970, 1.4000, 1.4040, 1.4060, 1.4100, 1.4150, 1.4165 |

Current trend

Last week USD grew against GBP.

Most of the financial enterprises are closed, and the economic activity is low because of the weekend in the UK on the occasion of Easter celebration. Revival may come only at the end of the day, after the publication of March data on the index of business activity in the US manufacturing sector.

The pair is trading around the support level 1.4000, which will be the key one in the struggle of “bears” and “bulls” in the short term.

Support and resistance

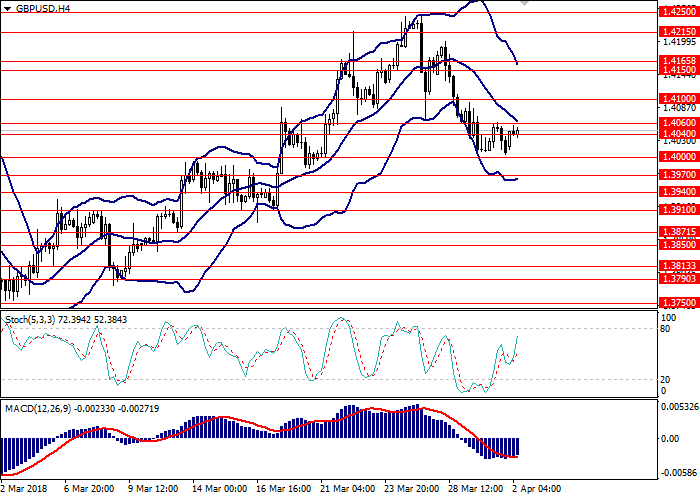

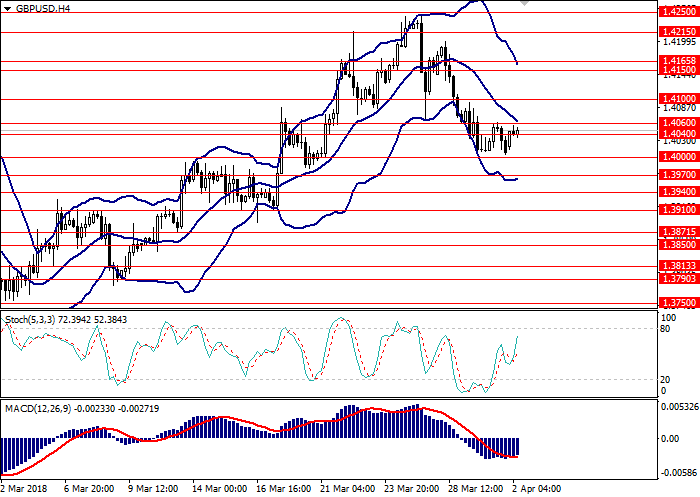

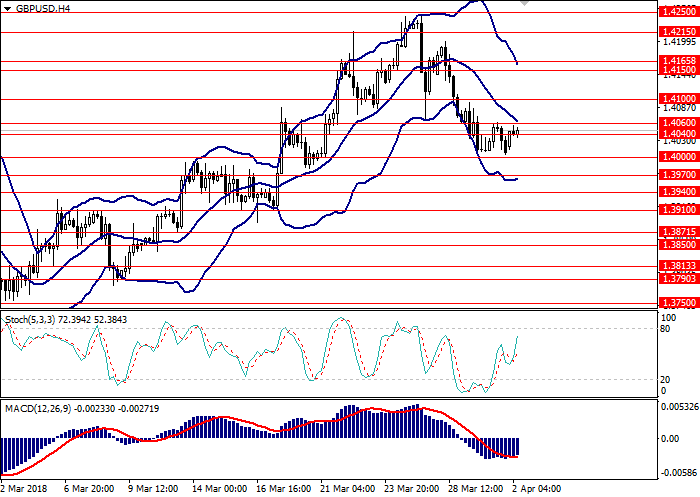

On the 4-hour chart, the pair was corrected to the middle line of Bollinger Bands. MACD histogram is in the negative zone, keeping a signal to open short positions.

Resistance levels: 1.4060, 1.4100, 1.4150, 1.4165.

Support levels: 1.4040, 1.4000, 1.3970.

Trading tips

Long positions can be opened at the level of 1.4065 with the target at 1.4165 and stop loss 1.4000.

Short positions can be opened at the level of 1.3970 with the target at 1.3910 and stop loss 1.4000.

Implementation period: 3–5 days.

Last week USD grew against GBP.

Most of the financial enterprises are closed, and the economic activity is low because of the weekend in the UK on the occasion of Easter celebration. Revival may come only at the end of the day, after the publication of March data on the index of business activity in the US manufacturing sector.

The pair is trading around the support level 1.4000, which will be the key one in the struggle of “bears” and “bulls” in the short term.

Support and resistance

On the 4-hour chart, the pair was corrected to the middle line of Bollinger Bands. MACD histogram is in the negative zone, keeping a signal to open short positions.

Resistance levels: 1.4060, 1.4100, 1.4150, 1.4165.

Support levels: 1.4040, 1.4000, 1.3970.

Trading tips

Long positions can be opened at the level of 1.4065 with the target at 1.4165 and stop loss 1.4000.

Short positions can be opened at the level of 1.3970 with the target at 1.3910 and stop loss 1.4000.

Implementation period: 3–5 days.

No comments:

Write comments