Brent Crude Oil: general review

05 April 2018, 14:01

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY LIMIT |

| Entry Point | 66.55 |

| Take Profit | 67.80 |

| Stop Loss | 66.25 |

| Key Levels | 66.00, 66.55, 69.00, 69.50 |

Current trend

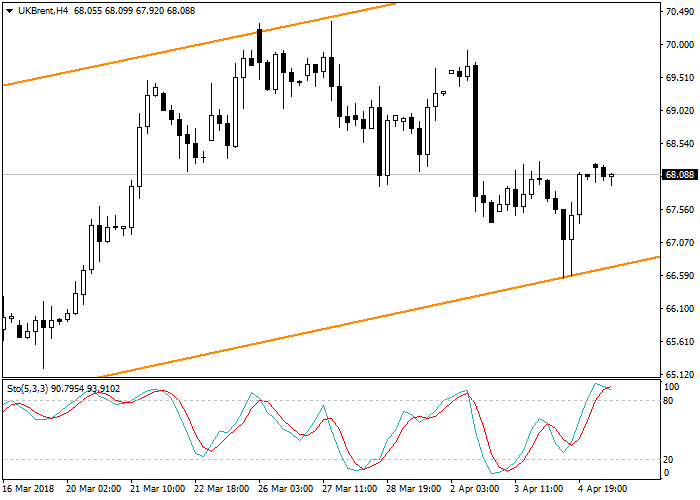

Brent Crude oil slightly decreases and is currently traded at around 68.02. An important support level is at the lower border of the upward channel (66.55), if it is passed, the next target will be the level of 63.00.

The demand for "black gold" was largely due to statistics from the US, where, according to the Ministry of Energy, hydrocarbon reserves fell by 4.6 million barrels with a forecast for growth by 1.4 million. In terms of total production, there is a tendency for growth, so this indicator increased by 27K barrels per day and reached 10.46 million. To make a decision on new drilling, the average price of a barrel should be about USD 45-48. Now it is much higher, and the increase in volumes is economically expedient. Speaking of exports, the US continues showing records: The volume of oil sold abroad reached 2.175 million barrels per day. Thus, while maintaining the current trend, America can become one of the key players in the crudes market.

The second factor, which is also positively evaluated by the market, is the possible settlement of trade issues between the US and China affecting protective measures. Trump's advisor Larry Kudlow admitted that protectionism policies may not be used if the parties can agree on a number of key issues.

Support and resistance

Stochastic is at the level of 98 points and indicates the possible correction.

Resistance levels: 69.00, 69.50.

Support levels: 66.55, 66.00.

Trading tips

Long positions may be opened from the level of 66.55 with take-profit at 67.80 and stop-loss at 66.25.

Brent Crude oil slightly decreases and is currently traded at around 68.02. An important support level is at the lower border of the upward channel (66.55), if it is passed, the next target will be the level of 63.00.

The demand for "black gold" was largely due to statistics from the US, where, according to the Ministry of Energy, hydrocarbon reserves fell by 4.6 million barrels with a forecast for growth by 1.4 million. In terms of total production, there is a tendency for growth, so this indicator increased by 27K barrels per day and reached 10.46 million. To make a decision on new drilling, the average price of a barrel should be about USD 45-48. Now it is much higher, and the increase in volumes is economically expedient. Speaking of exports, the US continues showing records: The volume of oil sold abroad reached 2.175 million barrels per day. Thus, while maintaining the current trend, America can become one of the key players in the crudes market.

The second factor, which is also positively evaluated by the market, is the possible settlement of trade issues between the US and China affecting protective measures. Trump's advisor Larry Kudlow admitted that protectionism policies may not be used if the parties can agree on a number of key issues.

Support and resistance

Stochastic is at the level of 98 points and indicates the possible correction.

Resistance levels: 69.00, 69.50.

Support levels: 66.55, 66.00.

Trading tips

Long positions may be opened from the level of 66.55 with take-profit at 67.80 and stop-loss at 66.25.

No comments:

Write comments