United Technologies Corp. (UTX/NYSE) general review

28 March 2018, 12:04

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 124.90 |

| Take Profit | 123.00, 121.00, 120.00 |

| Stop Loss | 127.00 |

| Key Levels | 120.00, 123.00, 125.00, 129.00, 132.50, 135.50 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 129.10 |

| Take Profit | 132.50, 135.00 |

| Stop Loss | 127.00 |

| Key Levels | 120.00, 123.00, 125.00, 129.00, 132.50, 135.50 |

Current trend

United Technologies Corp., along with large contractors of the Pentagon Boeing, Lockheed Martin, and Northrop, will be one of the beneficiaries of the US budget increase for 2018 with armament spending up to USD 1.3 trillion. In addition, the US government approved an additional USD 2.9 billion to increase the order for another 20 F-35 fighters with engines from Pratt & Whitney, the United Technologies business unit.

In the previous week, the stock of United Technologies Corp. dropped by 1.48%. S&P500 dropped by 3.66% within the same period.

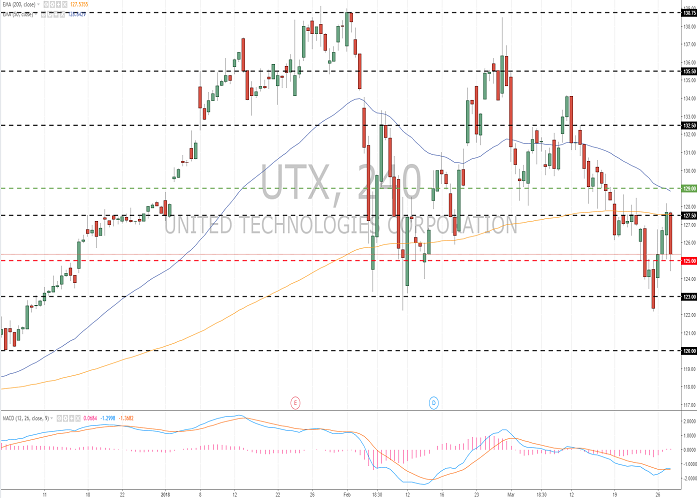

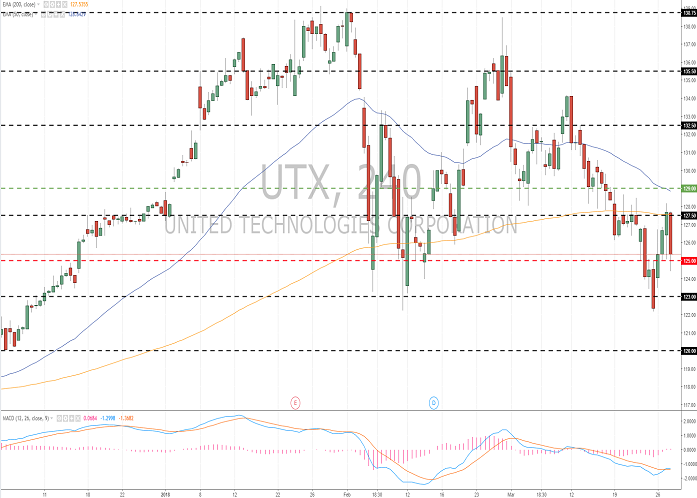

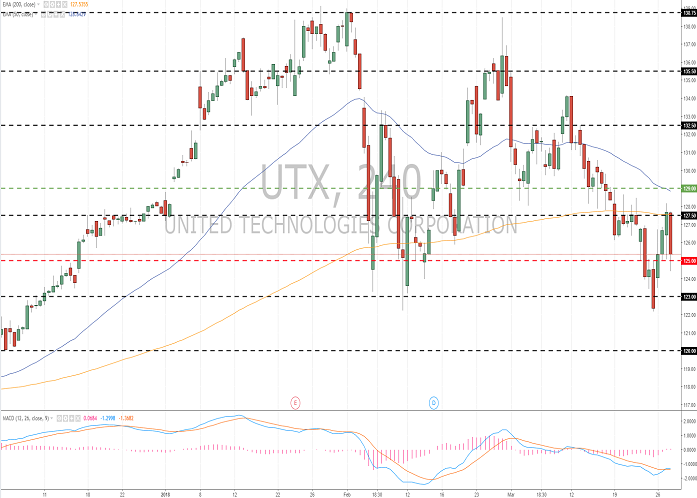

Support and resistance

Yesterday, #UTX kept the local supply zone of 127.50–129.00 which caused "bearish" tendencies. Currently, the quotes of #UTX are testing the local support level of 125.00. The emitter has the potential to further correction. Indicators don't give a clear signal: the price consolidated above 50(MA) and 200(MA), and MACD histogram is close to zero zone. Positions are to be opened from key levels.

Comparing company's multiplier with its competitors in the industry, we can say that #UTX shares are neutral.

Support levels: 125.00, 123.00, 120.00.

Resistance levels: 129.00, 132.50, 135.50.

Trading tips

If the price consolidates below the support level of 125.00, #UTX quotes are expected to decline. Potential profits should be locked in by orders at 123.00, 121.00 and 120.00. Stop-loss will be placed at 127.00 mark.

If the price consolidates above 129.00, one should consider buying the company's shares. The moving potential is aimed at the area of 132.50-135.00. Stop-loss should be placed at 127.00. Implementation time: 3 days.

United Technologies Corp., along with large contractors of the Pentagon Boeing, Lockheed Martin, and Northrop, will be one of the beneficiaries of the US budget increase for 2018 with armament spending up to USD 1.3 trillion. In addition, the US government approved an additional USD 2.9 billion to increase the order for another 20 F-35 fighters with engines from Pratt & Whitney, the United Technologies business unit.

In the previous week, the stock of United Technologies Corp. dropped by 1.48%. S&P500 dropped by 3.66% within the same period.

Support and resistance

Yesterday, #UTX kept the local supply zone of 127.50–129.00 which caused "bearish" tendencies. Currently, the quotes of #UTX are testing the local support level of 125.00. The emitter has the potential to further correction. Indicators don't give a clear signal: the price consolidated above 50(MA) and 200(MA), and MACD histogram is close to zero zone. Positions are to be opened from key levels.

Comparing company's multiplier with its competitors in the industry, we can say that #UTX shares are neutral.

Support levels: 125.00, 123.00, 120.00.

Resistance levels: 129.00, 132.50, 135.50.

Trading tips

If the price consolidates below the support level of 125.00, #UTX quotes are expected to decline. Potential profits should be locked in by orders at 123.00, 121.00 and 120.00. Stop-loss will be placed at 127.00 mark.

If the price consolidates above 129.00, one should consider buying the company's shares. The moving potential is aimed at the area of 132.50-135.00. Stop-loss should be placed at 127.00. Implementation time: 3 days.

No comments:

Write comments