Bitcoin: technical analysis

28 March 2018, 11:29

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 7450.00 |

| Take Profit | 7187.50 |

| Stop Loss | 7600.00 |

| Key Levels | 7187.50, 7500.00, 7812.50, 8125.00, 8437.50, 8750.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 8150.00 |

| Take Profit | 8437.50, 8750.00 |

| Stop Loss | 8000.00 |

| Key Levels | 7187.50, 7500.00, 7812.50, 8125.00, 8437.50, 8750.00 |

Current trend

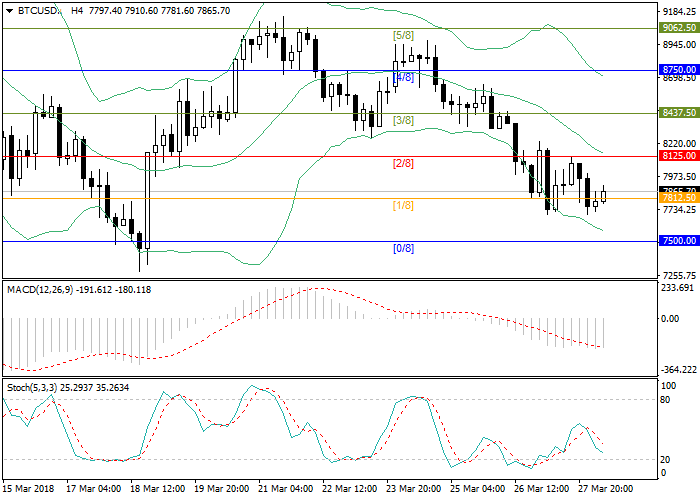

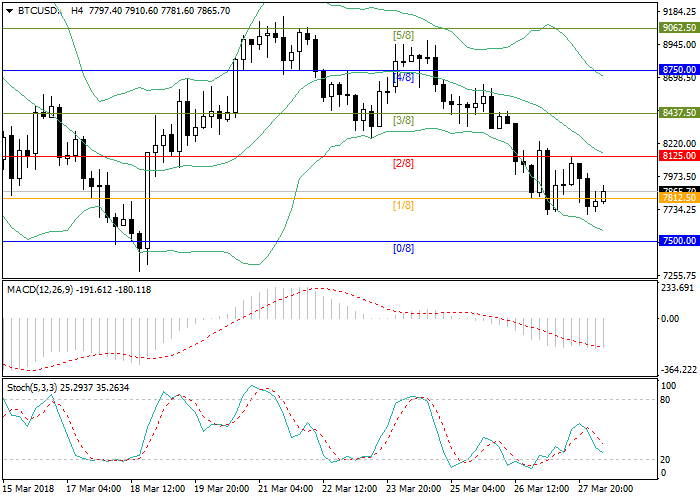

Quotes of Bitcoin continue to move within the descending channel and are trying to consolidate below the level of 7812.50 (Murray [1/8]). While maintaining the current trend, the decline may continue in the area of 7500.00 (Murray [0/8]), where there is a high probability of rate reversal and formation of ascending correction.

Technical indicators maintain a sell signal. Bollinger Bands are pointing downwards. MACD volumes increase in the negative zone. Stochatic lines are directed downwards. One may speak about downward movement continuation after the price consolidates below 7500.00. In this case, the next target of sellers will be the 7187.50 mark (Murray [-1/8]). If attempts to consolidate below 7500.00 remain unsuccessful, then the development of correction to the area of the mark 8125.00 (Murray [2/8]) corresponding to the midline of Bollinger Bands is possible. Such a scenario will be possible if the rate is fixed above the level of 7900.00. Breakout and consolidation of the rate above the level of 8125.00 will signal a resumption of the upward trend and will open the Bitcoin way to the area of 8437.50 (Murray [3/8])–8750.00 (Murray [4/8]).

Support and resistance

Support levels: 7812.50, 7500.00, 7187.50.

Resistance levels: 8125.00, 8437.50, 8750.00.

Trading tips

Sell positions should be opened below the level of 7500.00 with target at 7187.50 and stop-loss at 7600.00.

Buy positions may be opened above the level of 8125.00 with targets at 8437.50–8750.00 and stop-loss at 8000.00.

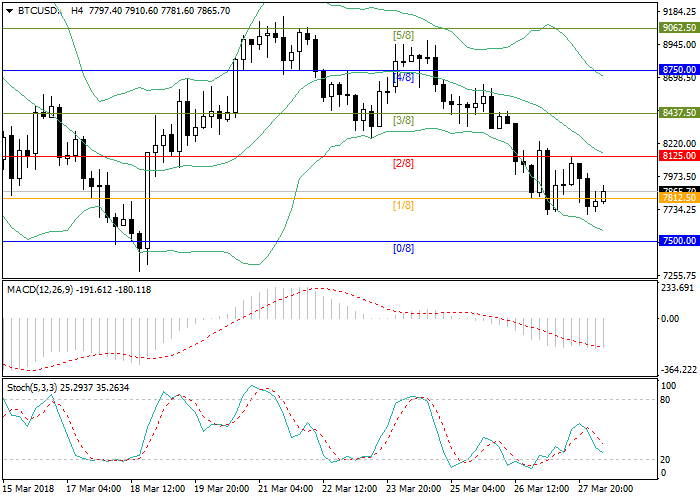

Quotes of Bitcoin continue to move within the descending channel and are trying to consolidate below the level of 7812.50 (Murray [1/8]). While maintaining the current trend, the decline may continue in the area of 7500.00 (Murray [0/8]), where there is a high probability of rate reversal and formation of ascending correction.

Technical indicators maintain a sell signal. Bollinger Bands are pointing downwards. MACD volumes increase in the negative zone. Stochatic lines are directed downwards. One may speak about downward movement continuation after the price consolidates below 7500.00. In this case, the next target of sellers will be the 7187.50 mark (Murray [-1/8]). If attempts to consolidate below 7500.00 remain unsuccessful, then the development of correction to the area of the mark 8125.00 (Murray [2/8]) corresponding to the midline of Bollinger Bands is possible. Such a scenario will be possible if the rate is fixed above the level of 7900.00. Breakout and consolidation of the rate above the level of 8125.00 will signal a resumption of the upward trend and will open the Bitcoin way to the area of 8437.50 (Murray [3/8])–8750.00 (Murray [4/8]).

Support and resistance

Support levels: 7812.50, 7500.00, 7187.50.

Resistance levels: 8125.00, 8437.50, 8750.00.

Trading tips

Sell positions should be opened below the level of 7500.00 with target at 7187.50 and stop-loss at 7600.00.

Buy positions may be opened above the level of 8125.00 with targets at 8437.50–8750.00 and stop-loss at 8000.00.

No comments:

Write comments