SX5E: technical analysis

30 March 2018, 12:00

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL LIMIT |

| Entry Point | 3388.0 |

| Take Profit | 3330.0, 3295.0, 3255.0 |

| Stop Loss | 3420.0 |

| Key Levels | 3330.0, 3295.0, 3255.0, 3388.0, 3420.0, 3445.0 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 3445.0 |

| Take Profit | 3516.0 |

| Stop Loss | 3415.0. |

| Key Levels | 3330.0, 3295.0, 3255.0, 3388.0, 3420.0, 3445.0 |

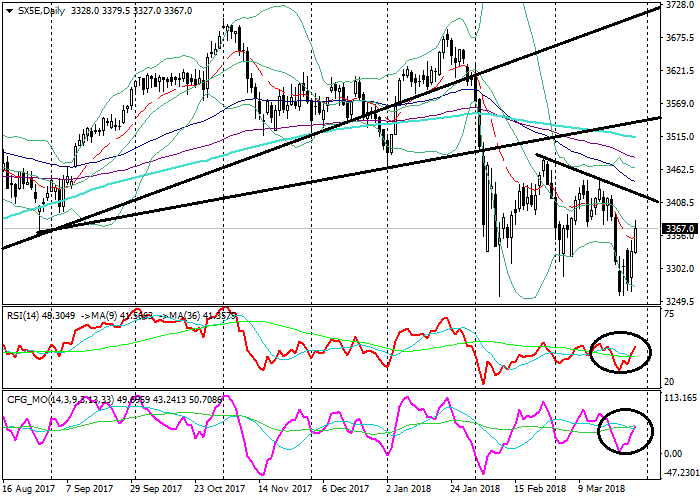

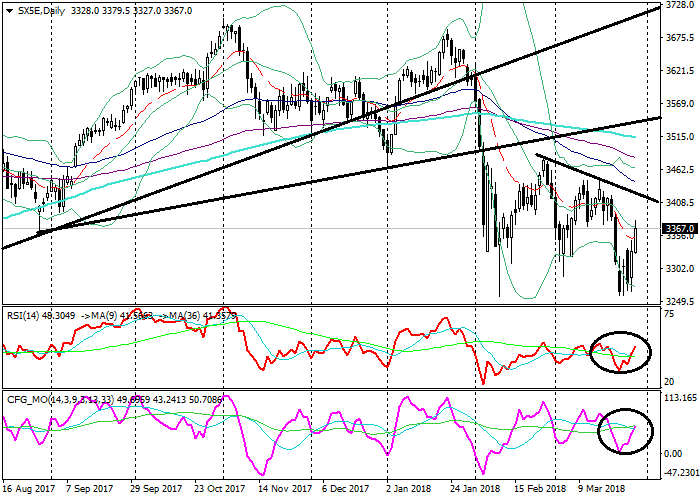

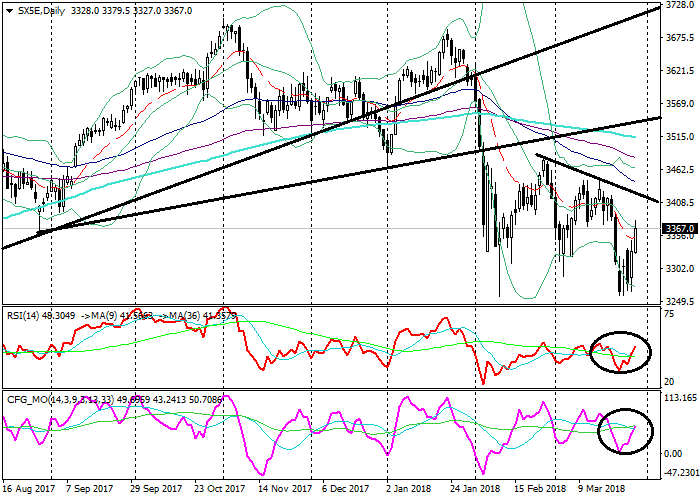

SX5E, D1

On the daily chart, the instrument is trading on the middle MA of the Bollinger Bands. The price remains below the EMA65, EMA130 and SMA200 that are directed down. The RSI is growing, having broken down its longer MA. The Composite is testing from below its longer MA as well.

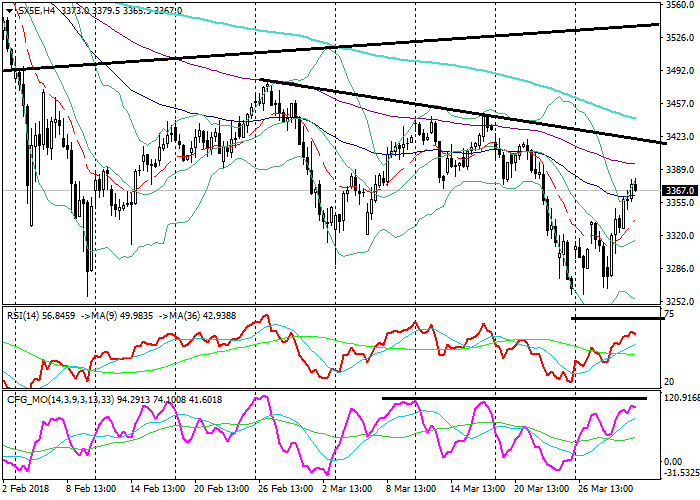

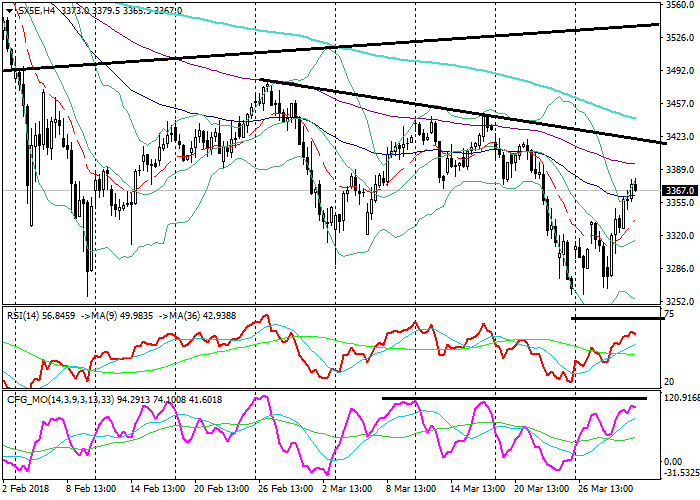

SX5E, H4

On the 4-hour chart, the instrument is trading on the upper line of the Bollinger Bands. The price remains above the EMA14, EMA65 that start turning up and below the EMA130, SMA200 which are directed down. The RSI is approaching the border of the overbought zone. The Composite is about to test its strong resistance region.

Key levels

Support levels: 3330.0 (local lows), 3295.0 (local lows), 3255.0 (February lows).

Resistance levels: 3388.0 (local highs), 3420.0 (local highs), 3445.0 (local highs).

Trading tips

The price is approaching its short-term descending trendline. There is a high chance of a downward reverse.

Short positions can be opened from the level of 3388.0 with targets at 3330.0, 3295.0, 3255.0 and stop-loss at 3420.0.

Long positions can be opened from the level of 3445.0 with the target at 3516.0 and stop-loss at 3415.0.

On the daily chart, the instrument is trading on the middle MA of the Bollinger Bands. The price remains below the EMA65, EMA130 and SMA200 that are directed down. The RSI is growing, having broken down its longer MA. The Composite is testing from below its longer MA as well.

SX5E, H4

On the 4-hour chart, the instrument is trading on the upper line of the Bollinger Bands. The price remains above the EMA14, EMA65 that start turning up and below the EMA130, SMA200 which are directed down. The RSI is approaching the border of the overbought zone. The Composite is about to test its strong resistance region.

Key levels

Support levels: 3330.0 (local lows), 3295.0 (local lows), 3255.0 (February lows).

Resistance levels: 3388.0 (local highs), 3420.0 (local highs), 3445.0 (local highs).

Trading tips

The price is approaching its short-term descending trendline. There is a high chance of a downward reverse.

Short positions can be opened from the level of 3388.0 with targets at 3330.0, 3295.0, 3255.0 and stop-loss at 3420.0.

Long positions can be opened from the level of 3445.0 with the target at 3516.0 and stop-loss at 3415.0.

No comments:

Write comments