Brent Crude Oil: to the new highs

30 March 2018, 14:27

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 69.33 |

| Take Profit | 73.00, 75.30 |

| Stop Loss | 66.10 |

| Key Levels | 59.00, 60.00, 62.70, 64.50, 65.75, 67.00, 68.00, 69.60, 70.70, 71.50, 73.00, 75.30 |

Current trend

Since the middle of March, the oil price is growing due to the increase in the investment attraction of the instrumentа and the weakening of USD.

At the beginning of the month, “black gold” has tested the lower border of the long-term upward trend unsuccessfully, but this week it got some support and returned to the level of 70 USD per barrel. Later the price decreased insignificantly, but on Thursday grew again. Despite the increase in resources and production of oil, according to EIA, the price is strengthening, which reflects that the oil production limitation Agreement is effective, and the market is balancing.

The next OPEC+ meeting was postponed to the second half of April. According to Iraq Oil Minister, some of the key exporter countries support the suggestion to prolong the Agreement for 6 months more. Saudi Arabian Energy Minister supported the statement. The positive decision can strengthen the price significantly. The members of the Agreement will meet in Vienna at the end of June.

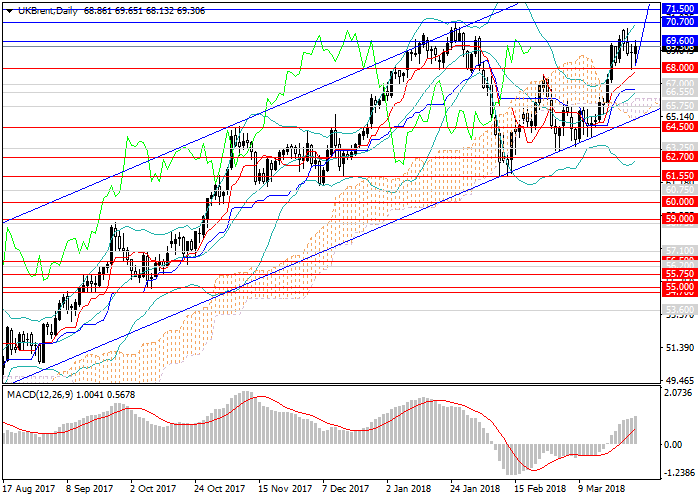

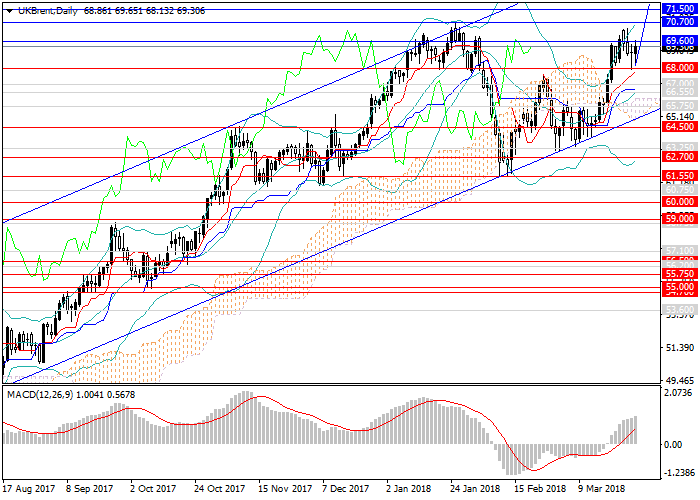

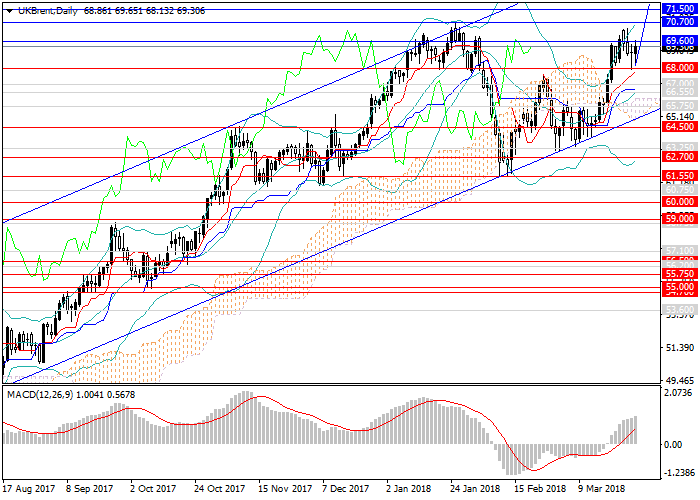

Support and resistance

The further growth of the instrumentа to the area of 73–75 USD per barrel is expected, where it will consolidate in the sideways range. Technical indicators confirm the growth within the long-term upward trend, MACD long positions’ volumes are growing, on the weekly chart, Bollinger Bands are pointed upwards.

Resistance levels: 69.60, 70.70, 71.50, 73.00, 75.30.

Support levels: 68.00, 67.00, 65.75, 64.50, 62.70, 60.00, 59.00.

Trading tips

It is relevant to increase the volume of long positions at the current level with the targets at 73.00, 75.30 and stop loss 66.10.

Since the middle of March, the oil price is growing due to the increase in the investment attraction of the instrumentа and the weakening of USD.

At the beginning of the month, “black gold” has tested the lower border of the long-term upward trend unsuccessfully, but this week it got some support and returned to the level of 70 USD per barrel. Later the price decreased insignificantly, but on Thursday grew again. Despite the increase in resources and production of oil, according to EIA, the price is strengthening, which reflects that the oil production limitation Agreement is effective, and the market is balancing.

The next OPEC+ meeting was postponed to the second half of April. According to Iraq Oil Minister, some of the key exporter countries support the suggestion to prolong the Agreement for 6 months more. Saudi Arabian Energy Minister supported the statement. The positive decision can strengthen the price significantly. The members of the Agreement will meet in Vienna at the end of June.

Support and resistance

The further growth of the instrumentа to the area of 73–75 USD per barrel is expected, where it will consolidate in the sideways range. Technical indicators confirm the growth within the long-term upward trend, MACD long positions’ volumes are growing, on the weekly chart, Bollinger Bands are pointed upwards.

Resistance levels: 69.60, 70.70, 71.50, 73.00, 75.30.

Support levels: 68.00, 67.00, 65.75, 64.50, 62.70, 60.00, 59.00.

Trading tips

It is relevant to increase the volume of long positions at the current level with the targets at 73.00, 75.30 and stop loss 66.10.

No comments:

Write comments