NZD/USD: the pair is in correction

30 March 2018, 10:18

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7250 |

| Take Profit | 0.7300 |

| Stop Loss | 0.7220 |

| Key Levels | 0.7150, 0.7165, 0.7186, 0.7200, 0.7243, 0.7261, 0.7278, 0.7300 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7195 |

| Take Profit | 0.7165, 0.7150 |

| Stop Loss | 0.7225 |

| Key Levels | 0.7150, 0.7165, 0.7186, 0.7200, 0.7243, 0.7261, 0.7278, 0.7300 |

Current trend

NZD is moderately growing against USD, stepped off the lows since March 21 due to the technical factors and the general tendency of the investors to close profitable positions before Easter holidays. Macroeconomic US data have supported the dollar additionally.

Published on Thursday, February data on personal spending remained the same, as expected. On YoY basis, the indicator made up 0.2%, and on a monthly basis 0.4%. Data from the labor market turned out to be more positive for investors: the Initial Jobless Claims amounted 215K, continuing the declining trend (which has started early in March).

Support and resistance

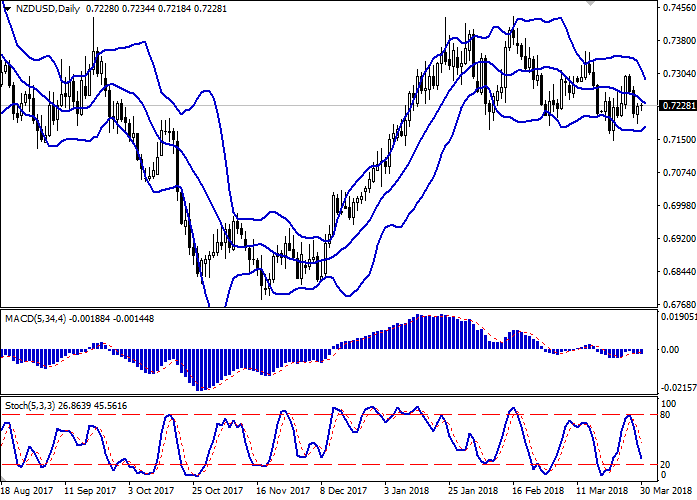

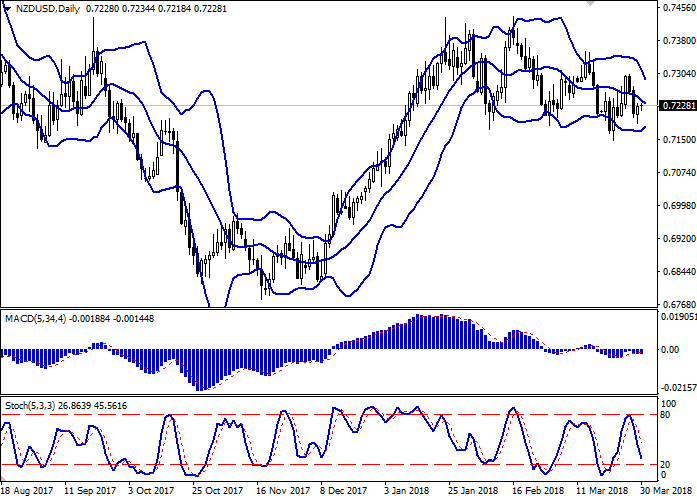

On the daily chart, Bollinger Bands are moderately decreasing. The price range is narrowing, reflecting the mixed trading dynamics.

MACD is trying to reverse upwards and form a “bearish” signal (the histogram should be above the signal line).

Stochastic does almost not react to the attempt of a correctional growth at the end of the current trading week and is actively going down.

The technical indicators’ readings are controversial, so it is better to wait until the situation is clear. However, the upward correction is possible.

Resistance levels: 0.7243, 0.7261, 0.7278, 0.7300.

Support levels: 0.7200, 0.7186, 0.7165, 0.7150.

Trading tips

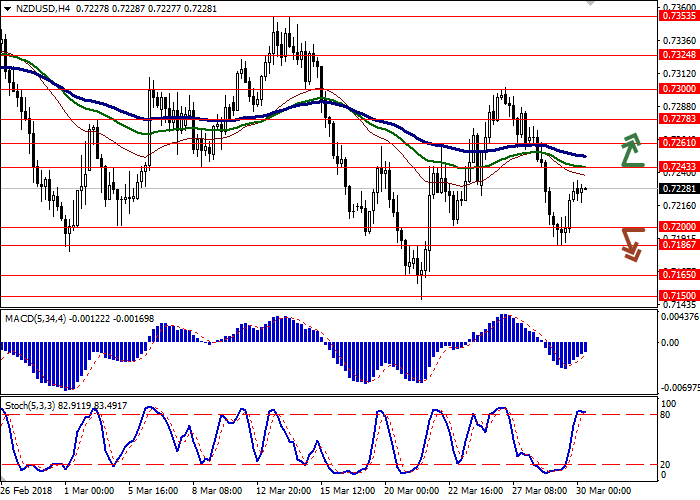

Long positions can be opened after the breakout of the level 0.7243 with the target at 0.7300 and stop loss 0.7220.

Short positions can be opened after the breakdown of the level 0.7200 with the targets at 0.7165–0.7150 and stop loss 0.7225.

Implementation period: 2–3 days.

NZD is moderately growing against USD, stepped off the lows since March 21 due to the technical factors and the general tendency of the investors to close profitable positions before Easter holidays. Macroeconomic US data have supported the dollar additionally.

Published on Thursday, February data on personal spending remained the same, as expected. On YoY basis, the indicator made up 0.2%, and on a monthly basis 0.4%. Data from the labor market turned out to be more positive for investors: the Initial Jobless Claims amounted 215K, continuing the declining trend (which has started early in March).

Support and resistance

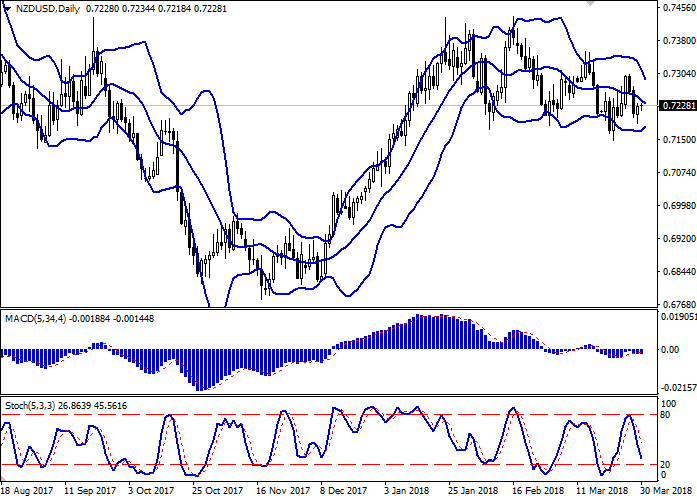

On the daily chart, Bollinger Bands are moderately decreasing. The price range is narrowing, reflecting the mixed trading dynamics.

MACD is trying to reverse upwards and form a “bearish” signal (the histogram should be above the signal line).

Stochastic does almost not react to the attempt of a correctional growth at the end of the current trading week and is actively going down.

The technical indicators’ readings are controversial, so it is better to wait until the situation is clear. However, the upward correction is possible.

Resistance levels: 0.7243, 0.7261, 0.7278, 0.7300.

Support levels: 0.7200, 0.7186, 0.7165, 0.7150.

Trading tips

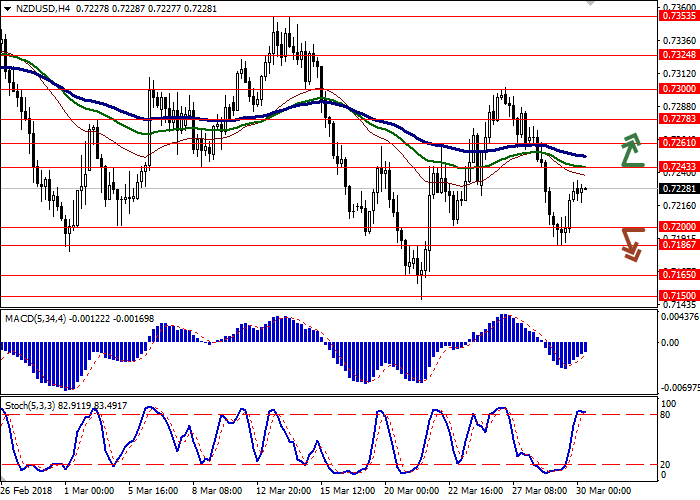

Long positions can be opened after the breakout of the level 0.7243 with the target at 0.7300 and stop loss 0.7220.

Short positions can be opened after the breakdown of the level 0.7200 with the targets at 0.7165–0.7150 and stop loss 0.7225.

Implementation period: 2–3 days.

No comments:

Write comments