Verizon Communications Inc. (VZ/NYSE/S&P500)

15 September 2017, 12:13

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 47.55 |

| Take Profit | 47.90, 47.30, 47.50 |

| Stop Loss | 47.10 |

| Key Levels | 45.80, 46.40, 47.00, 47.50, 47.90, 48.40 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 46.90 |

| Take Profit | 46.25, 46.00 |

| Stop Loss | 47.40 |

| Key Levels | 45.80, 46.40, 47.00, 47.50, 47.90, 48.40 |

Industry: telecommunication services

Current trend

Verizon announced its plans to reduce expenses by $10 bln by 2022 which will help the telecom giant increase its dividend payments. Last week the company increased its annual dividends for the 11th time in a row. However, the slowdown of return from wireless services raises a question whether Verizon is able to finance its dividends in the long term. Moreover, the company has a considerable loan burden ($120 bln). The management of the company emphasized that in view of expenses reduction it will continue to invest into the 5G wireless technology and optic fiber networks.

Last week, Verizon shares increased by 2.27%. S&P500 index gained 1.23% within the same period.

Comparing company's multiplier with its competitors, we can say that Verizon's shares are neutral.

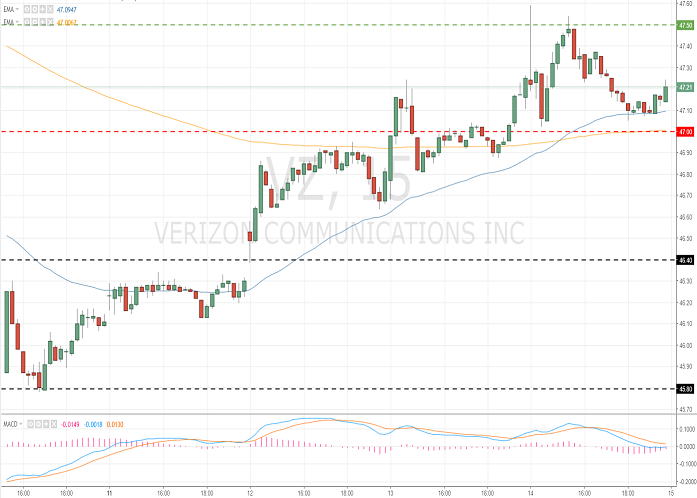

Key levels

The quotes of #VZ have been corrected since the beginning of the week. However, current technical picture is uncertain. Yesterday the emitter formed local support and resistance levels at 47.00 and 47.50 respectively. Indicator signals differ. Positions may be opened from key levels.

Support levels: 47.00, 46.40, 45.80.

Resistance levels: 47.50, 47.90, 48.40.

Trading tips

If the price consolidates above the local resistance level of 47.50, one may consider buying #VZ. Stop-loss will be placed at 47.10. Potential profits can be locked in by orders at 47.90, 47.30, 47.50.

If the price consolidates below 47.00, short positions may be opened. Stop-loss should be placed at 47.40. There is potential of movement to 46.25-46.00.

Trading tips will be relevant for 3 days.

Current trend

Verizon announced its plans to reduce expenses by $10 bln by 2022 which will help the telecom giant increase its dividend payments. Last week the company increased its annual dividends for the 11th time in a row. However, the slowdown of return from wireless services raises a question whether Verizon is able to finance its dividends in the long term. Moreover, the company has a considerable loan burden ($120 bln). The management of the company emphasized that in view of expenses reduction it will continue to invest into the 5G wireless technology and optic fiber networks.

Last week, Verizon shares increased by 2.27%. S&P500 index gained 1.23% within the same period.

Comparing company's multiplier with its competitors, we can say that Verizon's shares are neutral.

Key levels

The quotes of #VZ have been corrected since the beginning of the week. However, current technical picture is uncertain. Yesterday the emitter formed local support and resistance levels at 47.00 and 47.50 respectively. Indicator signals differ. Positions may be opened from key levels.

Support levels: 47.00, 46.40, 45.80.

Resistance levels: 47.50, 47.90, 48.40.

Trading tips

If the price consolidates above the local resistance level of 47.50, one may consider buying #VZ. Stop-loss will be placed at 47.10. Potential profits can be locked in by orders at 47.90, 47.30, 47.50.

If the price consolidates below 47.00, short positions may be opened. Stop-loss should be placed at 47.40. There is potential of movement to 46.25-46.00.

Trading tips will be relevant for 3 days.

No comments:

Write comments