USD/JPY: market gets used to DPRK missiles tests

15 September 2017, 12:08

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 111.22 |

| Take Profit | 111.70 |

| Stop Loss | 110.70 |

| Key Levels | 109.00, 109.40, 110.00, 111.00, 111.35, 111.70 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 110.50 |

| Take Profit | 110.00, 109.40 |

| Stop Loss | 110.90 |

| Key Levels | 109.00, 109.40, 110.00, 111.00, 111.35, 111.70 |

Current trend

Today the pair was trading actively. In the night it weakened to the area of 109.55. The investors have rapidly left the USD for yen after the next DPRK launch of missile, which has flown over Hokkaido and fallen into Pacific Ocean. However, the fear of the market was not long, as everybody is getting used to Pyongyang’s provocations, and the world community only answered with strong statement, so at the moment the pair has restores most of the loss and is trading around 110.70. The geopolitical tense upon the North Korea can last quite long, as it cannot be solved by military action, as the US Army cannot provide the safety of Seoul, while the sanctions didn’t help either. The possible full oil embargo can make a doubtful impact, as the proven oil resources in the DPRK can cover the inner requirements.

The investors are focused on the US statistics now. Today August Retail Sales and Industrial Production data will be published. The data are expected to be poor; the Retail Sales Index can fall again from 0.6% to 0.1%. The Industrial Production indicator can fall for the second month in a row and reach the level of 0.1%. In this case the USD will be under the pressure, and the pair will be significantly corrected.

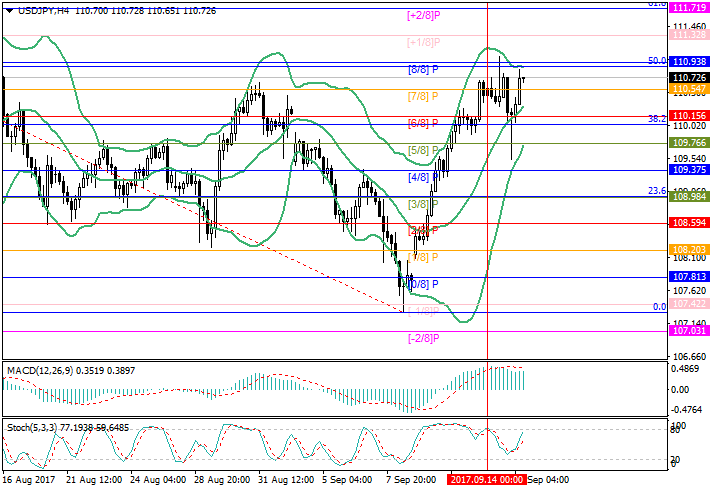

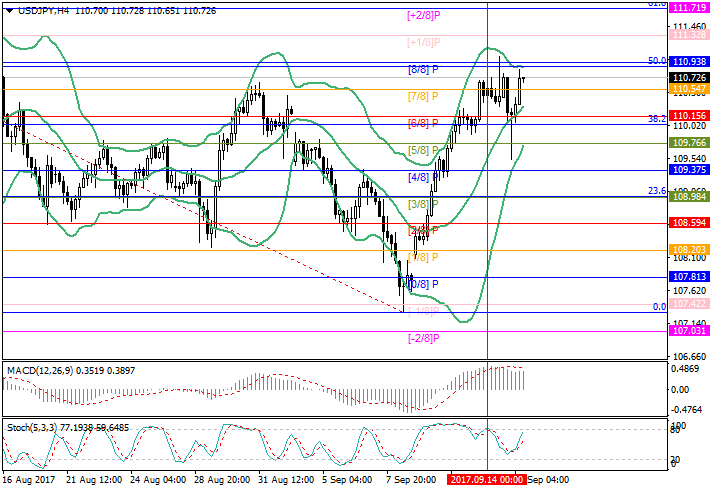

Support and resistance

Technically the price is tending to the area of 111.00 (Fibonacci correction 50.0%, Murray [8/8]). In case of breakout the “bulls” targets will be the level of 111.35 (Murray [+1/8]) and 111.70 (Murray [+2/8], Fibonacci correction 61.8%). However, taking into consideration the possible effect of the negative US releases, the correction to the area of 110.00 (Fibonacci correction 38.2%, Murray [6/8]) and 109.40 (Murray [4/8]) is possible.

Resistance levels: 111.00, 111.35, 111.70.

Support levels: 110.00, 109.40, 109.00.

Trading tips

Long positions can be opened above the level of 111.00 with the target at 111.70 and stop loss at 110.70.

Short positions can be opened below the level of 110.54 with the targets at 110.00, 109.40 and stop loss at 110.90.

Today the pair was trading actively. In the night it weakened to the area of 109.55. The investors have rapidly left the USD for yen after the next DPRK launch of missile, which has flown over Hokkaido and fallen into Pacific Ocean. However, the fear of the market was not long, as everybody is getting used to Pyongyang’s provocations, and the world community only answered with strong statement, so at the moment the pair has restores most of the loss and is trading around 110.70. The geopolitical tense upon the North Korea can last quite long, as it cannot be solved by military action, as the US Army cannot provide the safety of Seoul, while the sanctions didn’t help either. The possible full oil embargo can make a doubtful impact, as the proven oil resources in the DPRK can cover the inner requirements.

The investors are focused on the US statistics now. Today August Retail Sales and Industrial Production data will be published. The data are expected to be poor; the Retail Sales Index can fall again from 0.6% to 0.1%. The Industrial Production indicator can fall for the second month in a row and reach the level of 0.1%. In this case the USD will be under the pressure, and the pair will be significantly corrected.

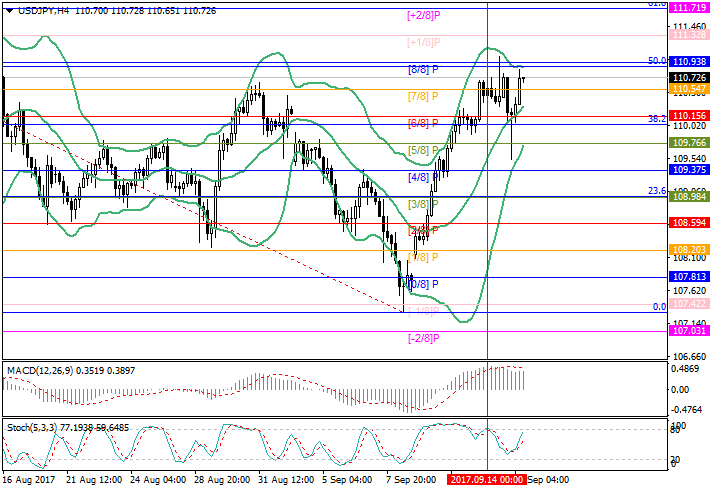

Support and resistance

Technically the price is tending to the area of 111.00 (Fibonacci correction 50.0%, Murray [8/8]). In case of breakout the “bulls” targets will be the level of 111.35 (Murray [+1/8]) and 111.70 (Murray [+2/8], Fibonacci correction 61.8%). However, taking into consideration the possible effect of the negative US releases, the correction to the area of 110.00 (Fibonacci correction 38.2%, Murray [6/8]) and 109.40 (Murray [4/8]) is possible.

Resistance levels: 111.00, 111.35, 111.70.

Support levels: 110.00, 109.40, 109.00.

Trading tips

Long positions can be opened above the level of 111.00 with the target at 111.70 and stop loss at 110.70.

Short positions can be opened below the level of 110.54 with the targets at 110.00, 109.40 and stop loss at 110.90.

No comments:

Write comments