USD/JPY: Murrey analysis

07 September 2017, 13:37

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 109.40 |

| Take Profit | 110.15, 110.98, 111.71 |

| Stop Loss | 109.00 |

| Key Levels | 106.25, 107.81, 108.59, 109.37, 110.15, 110.93, 111.71 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 108.50 |

| Take Profit | 107.81, 106.25 |

| Stop Loss | 109.00 |

| Key Levels | 106.25, 107.81, 108.59, 109.37, 110.15, 110.93, 111.71 |

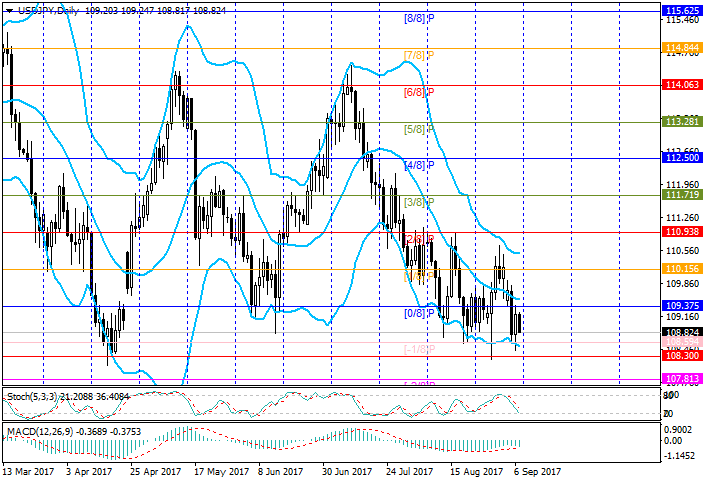

On the D1 chart the price is around the level of 109.37 [0/8] (main support)

— 108.59 [-1/8] (extreme support). The zone seems quite strong as the pair has

been testing it in vain since April. Currently the price is approaching the

cyclical line near which it may reverse upwards. In this case the growth of the

price may continue through a number of levels (110.15 [1/8] and 110.93 [2/8]) to

the lower border of horizontal channel 111.71 [3/8] (bottom of the channel). The

continuation of the fall is possible if the price consolidates below 108.59

[-1/8]. In this case the pair may decrease to 107.81 [-2/8] (final resistance)

and 106.25 [2/8] (for W1 chart). Technical indicators show the possibility of

the fall but in limited scope. Stochastic is directed downwards but has

approached the oversold area. MACD histogram shows indicators of bearish

divergence, the occurrence of which will open the way to purchases.

Support and resistance

Support levels: 108.59 [-1/8] (extreme support), 107.81 [-2/8] (final support), 106.25 [2/8] (rotation and reversal in W1).

Resistance levels: 109.37 [0/8] (main support), 110.15 [1/8] (stop, reversal), 110.93 [2/8] (rotation, reversal), 111.71 [3/8] (bottom of the channel).

Trading tips

In the current situation buy positions may be opened at the level above109.37 or in case of a turn around 108.59 with targets at 110.15, 110.98, 111.71 and stop-losses at 109.00 and 108.30. Short positions can be opened if the price consolidates below 108.59 with targets at 107.81, 106.25 and stop-loss at 109.00.

Support and resistance

Support levels: 108.59 [-1/8] (extreme support), 107.81 [-2/8] (final support), 106.25 [2/8] (rotation and reversal in W1).

Resistance levels: 109.37 [0/8] (main support), 110.15 [1/8] (stop, reversal), 110.93 [2/8] (rotation, reversal), 111.71 [3/8] (bottom of the channel).

Trading tips

In the current situation buy positions may be opened at the level above109.37 or in case of a turn around 108.59 with targets at 110.15, 110.98, 111.71 and stop-losses at 109.00 and 108.30. Short positions can be opened if the price consolidates below 108.59 with targets at 107.81, 106.25 and stop-loss at 109.00.

No comments:

Write comments