United Technologies Corporation (UTX/NYSE/S&P500)

07 September 2017, 13:02

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 108.90 |

| Take Profit | 107.75, 106.50, 106.00 |

| Stop Loss | 110.25 |

| Key Levels | 109.00, 110.60, 112.00, 115.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 110.70 |

| Take Profit | 112.75, 113.50 |

| Stop Loss | 109.50 |

| Key Levels | 109.00, 110.60, 112.00, 115.00 |

Industry: air, space, and defense products and services

Current trend

On Monday, September 4, United Technologies Corp. announced a plan to purchase Rockwell Collins, a manufacturer of spare parts for aircrafts, for $23 bln, and to unite airspace segments of the two companies into one business unit Collins Aerospace Systems. United Technologies Corp. will pay $140 per share of Rockwell Collins in cash and stocks, which is equal to 18% premium on the price before the announcement of the transaction. The stock of United Technologies Corp. dropped by over 7.5% from the moment of announcement which reflects the dissatisfaction of investors and market analysts. Boeing and Airbus, major purchasers of United Technologies Corp., were skeptical about the deal and pointed out it would have a negative impact on the results of the airspace industry.

Comparing company's multiplier with its competitors, we can say that United Technologies Corp. shares are undervalued.

Key levels

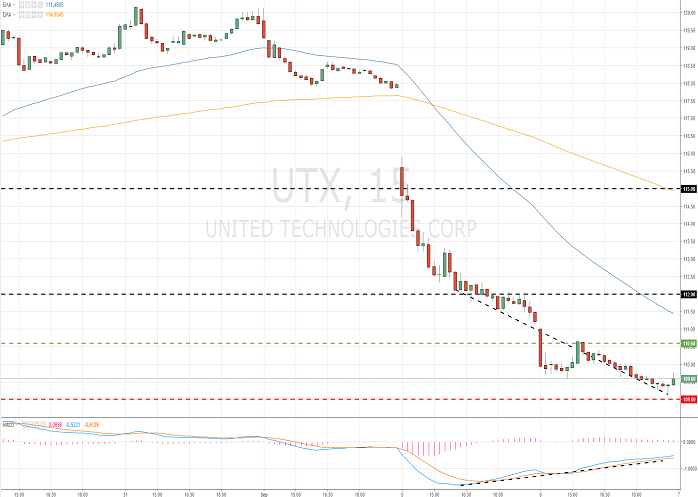

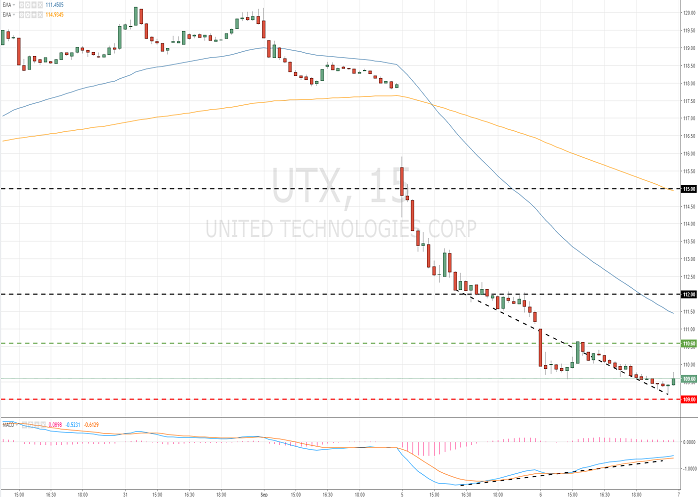

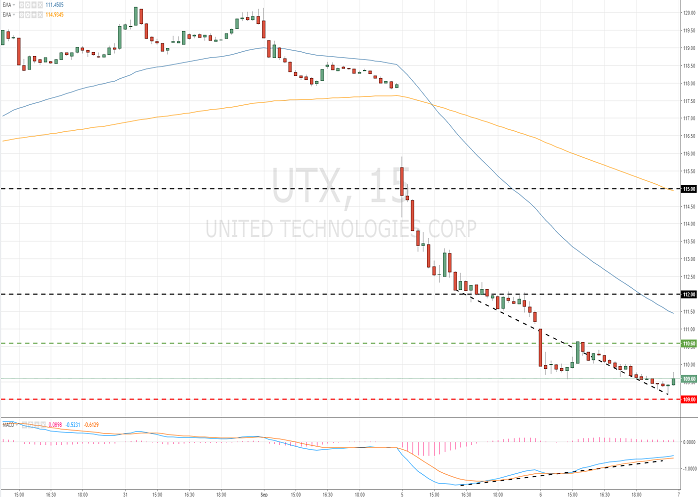

Currently, #UTX is showing aggressive sales. During yesterday's trading the emitter formed local support and resistance levels at 109.00 and 110.60 respectively. Indicators show mixed signals: the price is below MA(50) and MA(200); MACD histogram is in the positive zone. However, positions should be opened in the direction of the current trend.

Support levels: 109.00.

Resistance levels: 110.60, 112.00, 115.00.

Trading tips

If the price consolidates below 109.00, sales of #UTX should be considered. Potential profits can be locked in by installments at 107.75, 106.50, 106.00. Stop-loss will be located at the level of 110.25.

The correction of #UTX quotes is also possible. The emitter shows a strong reverse formation of technical analysis — the divergence of the price and MACD indicator. If the price consolidates over 110.60, one should consider buying the company's shares. There is a potential of movement to 112.75-113.50. Stop-loss should be placed at 109.50.

Trading tips will be relevant for 3 days.

Current trend

On Monday, September 4, United Technologies Corp. announced a plan to purchase Rockwell Collins, a manufacturer of spare parts for aircrafts, for $23 bln, and to unite airspace segments of the two companies into one business unit Collins Aerospace Systems. United Technologies Corp. will pay $140 per share of Rockwell Collins in cash and stocks, which is equal to 18% premium on the price before the announcement of the transaction. The stock of United Technologies Corp. dropped by over 7.5% from the moment of announcement which reflects the dissatisfaction of investors and market analysts. Boeing and Airbus, major purchasers of United Technologies Corp., were skeptical about the deal and pointed out it would have a negative impact on the results of the airspace industry.

Comparing company's multiplier with its competitors, we can say that United Technologies Corp. shares are undervalued.

Key levels

Currently, #UTX is showing aggressive sales. During yesterday's trading the emitter formed local support and resistance levels at 109.00 and 110.60 respectively. Indicators show mixed signals: the price is below MA(50) and MA(200); MACD histogram is in the positive zone. However, positions should be opened in the direction of the current trend.

Support levels: 109.00.

Resistance levels: 110.60, 112.00, 115.00.

Trading tips

If the price consolidates below 109.00, sales of #UTX should be considered. Potential profits can be locked in by installments at 107.75, 106.50, 106.00. Stop-loss will be located at the level of 110.25.

The correction of #UTX quotes is also possible. The emitter shows a strong reverse formation of technical analysis — the divergence of the price and MACD indicator. If the price consolidates over 110.60, one should consider buying the company's shares. There is a potential of movement to 112.75-113.50. Stop-loss should be placed at 109.50.

Trading tips will be relevant for 3 days.

No comments:

Write comments