USD/CHF: USD remains under pressure

18 September 2017, 09:25

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.9620 |

| Take Profit | 0.9700 |

| Stop Loss | 0.9562 |

| Key Levels | 0.9496, 0.9525, 0.9541, 0.9562, 0.9615, 0.9650, 0.9677, 0.9702 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9560 |

| Take Profit | 0.9500, 0.9474 |

| Stop Loss | 0.9615 |

| Key Levels | 0.9496, 0.9525, 0.9541, 0.9562, 0.9615, 0.9650, 0.9677, 0.9702 |

Current trend

US dollar showed a stable decrease against Swiss franc during trading on Friday, September 15, having reacted to the release of weak macroeconomic statistics from the USA. Along with this, in the end of Friday trading session USD managed to regain a number of positions and during the morning session on September 18 the instrument is showing flat dynamics.

The volumes of retail sales in the USA dropped by 0.2% MoM in August against growth by 0.3% in the previous month. Analysts expected minimal growth at the rate of 0.1% MoM. In turn, the volume of industrial output within the same period dropped by 0.9% MoM after growth by 0.4% in July due to the damage caused by two hurricanes.

On Thursday, September 18, investors will focus their attention on Eurozone statistics on consumer inflation. On Tuesday investors will pay attention to the USA once again after the release of the data on the state of th housing construction market. One of the key events of the week will be the meetings of ECB and the Fed on Wednesday, September 20.

Support and resistance

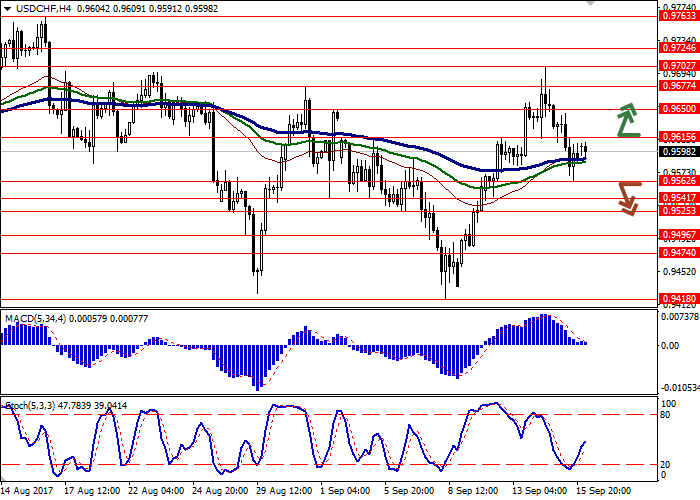

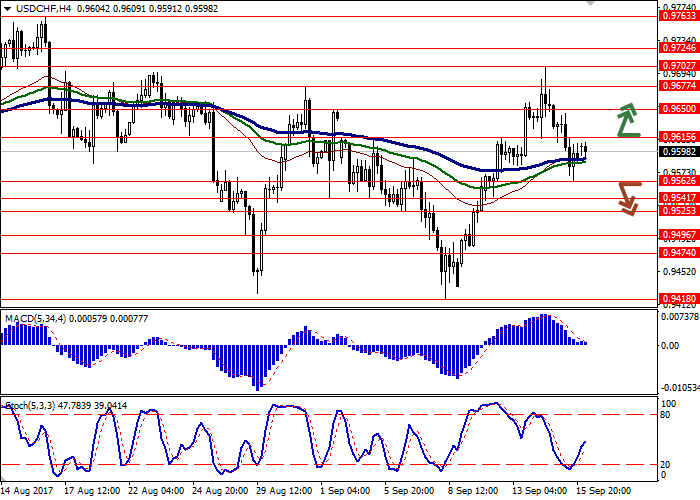

Bollinger Bands on D1 chart demonstrates flat dynamics. The price range remains practically unchanged. The growth of MACD indicator is reversing down preserving the buy signal (the histogram is located above the signal line). Having lost the overbought zone, Stochastic is practically vertically reducing.

Resistance levels: 0.9615, 0.9650, 0.9677, 0.9702.

Support levels: 0.9562, 0.9541, 0.9525, 0.9496.

Trading tips

Long positions may be opened after breaking through the level of 0.9615 with target at 0.9700 and stop-loss at 0.9562. The period of implementation is 2 days.

A breakdown of the level of 0.9562 may be a signal for further sales with targets at 0.9500, 0.9474 and stop-loss at 0.9615. The period of implementation is 2-3 days.

US dollar showed a stable decrease against Swiss franc during trading on Friday, September 15, having reacted to the release of weak macroeconomic statistics from the USA. Along with this, in the end of Friday trading session USD managed to regain a number of positions and during the morning session on September 18 the instrument is showing flat dynamics.

The volumes of retail sales in the USA dropped by 0.2% MoM in August against growth by 0.3% in the previous month. Analysts expected minimal growth at the rate of 0.1% MoM. In turn, the volume of industrial output within the same period dropped by 0.9% MoM after growth by 0.4% in July due to the damage caused by two hurricanes.

On Thursday, September 18, investors will focus their attention on Eurozone statistics on consumer inflation. On Tuesday investors will pay attention to the USA once again after the release of the data on the state of th housing construction market. One of the key events of the week will be the meetings of ECB and the Fed on Wednesday, September 20.

Support and resistance

Bollinger Bands on D1 chart demonstrates flat dynamics. The price range remains practically unchanged. The growth of MACD indicator is reversing down preserving the buy signal (the histogram is located above the signal line). Having lost the overbought zone, Stochastic is practically vertically reducing.

Resistance levels: 0.9615, 0.9650, 0.9677, 0.9702.

Support levels: 0.9562, 0.9541, 0.9525, 0.9496.

Trading tips

Long positions may be opened after breaking through the level of 0.9615 with target at 0.9700 and stop-loss at 0.9562. The period of implementation is 2 days.

A breakdown of the level of 0.9562 may be a signal for further sales with targets at 0.9500, 0.9474 and stop-loss at 0.9615. The period of implementation is 2-3 days.

No comments:

Write comments