USD/CHF: dollar is weakening in the end of the week

15 September 2017, 09:37

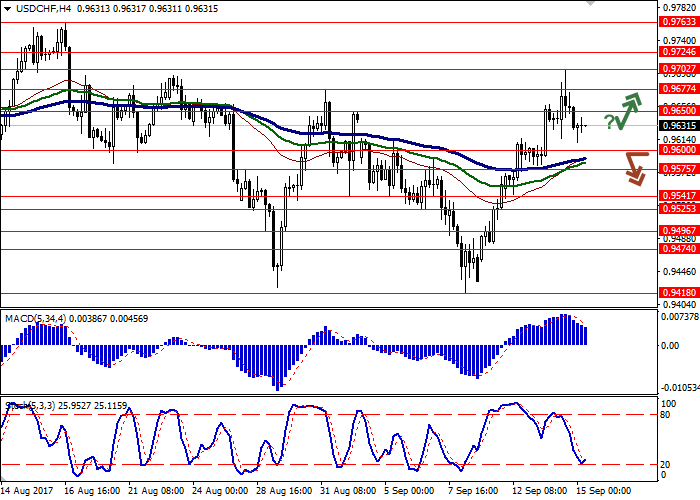

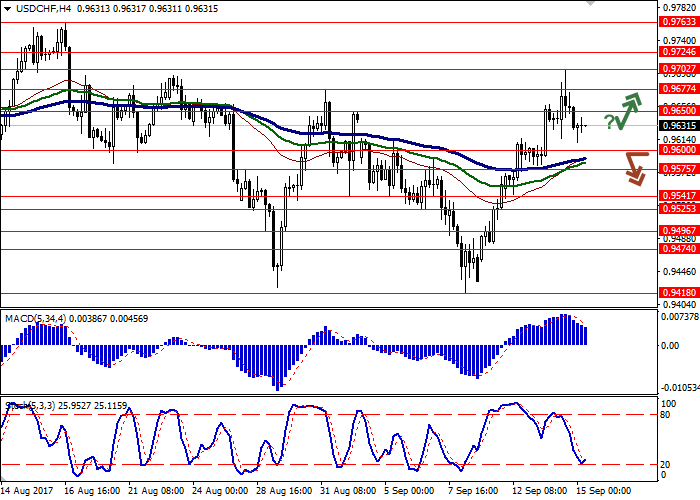

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9660 |

| Take Profit | 0.9720 |

| Stop Loss | 0.9600 |

| Key Levels | 0.9525, 0.9541, 0.9575, 0.9600, 0.9650, 0.9677, 0.9702, 0.9724 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9590, 0.9570 |

| Take Profit | 0.9500 |

| Stop Loss | 0.9650 |

| Key Levels | 0.9525, 0.9541, 0.9575, 0.9600, 0.9650, 0.9677, 0.9702, 0.9724 |

Current trend

During the trading session on Thursday, September, 14, the US dollar was actively growing against Swiss franc and renewed maximum since August, 16, due to positive inflation data, which increased the possibility of the Fed’s interest rate rise in 2017. However, it couldn’t consolidate at the gained positions and by the end of the trading session entered a red zone, which has broken the series of 3 “bullish” days.

Swiss franc moderately reacted to the SNB’s rate decisions. As expected, Swiss National Bank has left the deposit rate on the same level of –0.75%. The following statement implies that the current monetary policy well be kept for some time, while the situation of the market is unstable.

Support and resistance

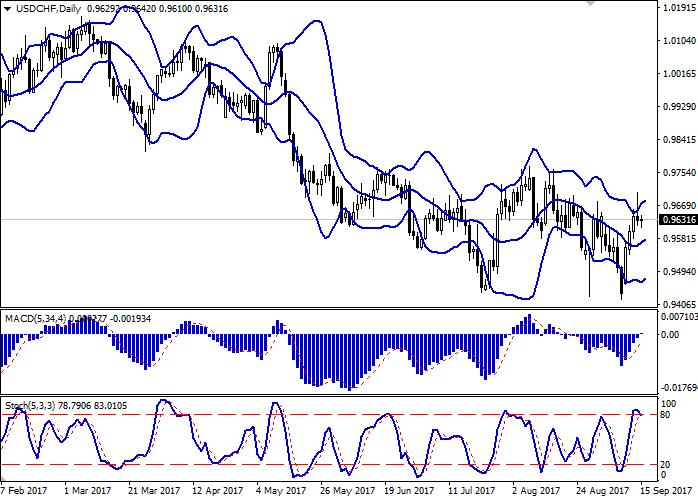

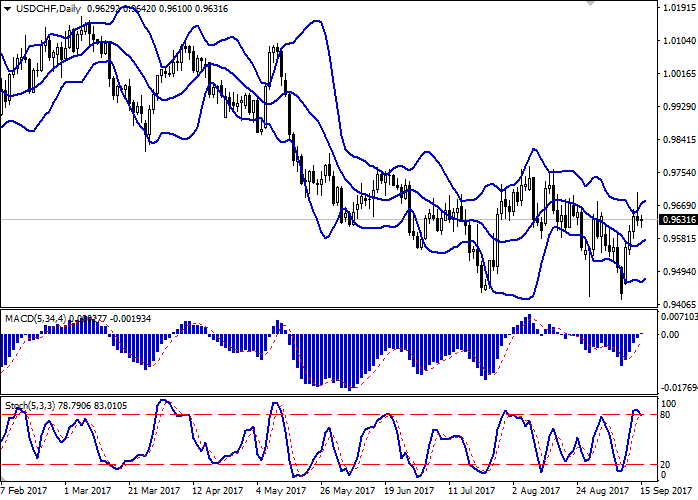

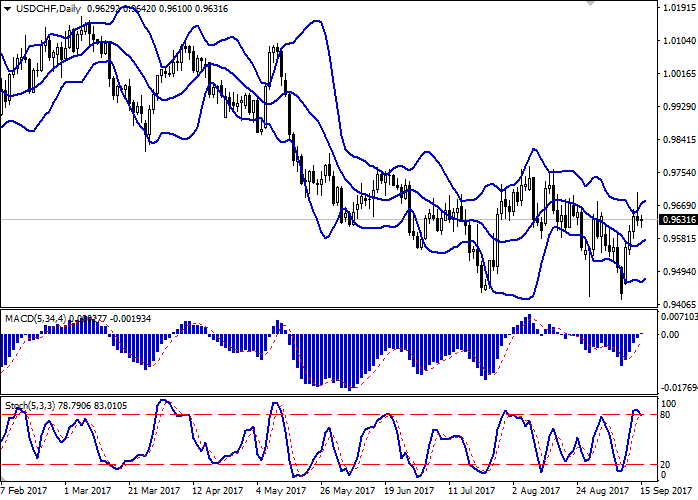

On the daily chart Bollinger Bands are actively growing. The price range is narrowing from below, reacting to the controversial dynamics appearance in the end of the week. It’s better to use the channel trading strategy.

MACD is growing, keeping a strong buy signal (the histogram is above the signal line). At the moment the indicator is trying to consolidate above the zero line. It’s better to keep opened long positions in the short term, but not to open new ones.

Stochastic is reversing downwards in the overbought area. The correction development is possible in the short or very short term.

Resistance levels: 0.9650, 0.9677, 0.9702, 0.9724.

Support levels: 0.9600, 0.9575, 0.9541, 0.9525.

Trading tips

Long positions after can be opened after the upward reversal near the current levels. Take profit is 0.9720. Stop loss is 0.9600–0.9575. Implementation period: 2 days.

The development of the downward correction and the breakdown of the level of 0.9600–0.9575 can be the signal to open short positions to the area of support level of 0.9500. Stop loss is 0.9650. Implementation period: 2-3 days.

During the trading session on Thursday, September, 14, the US dollar was actively growing against Swiss franc and renewed maximum since August, 16, due to positive inflation data, which increased the possibility of the Fed’s interest rate rise in 2017. However, it couldn’t consolidate at the gained positions and by the end of the trading session entered a red zone, which has broken the series of 3 “bullish” days.

Swiss franc moderately reacted to the SNB’s rate decisions. As expected, Swiss National Bank has left the deposit rate on the same level of –0.75%. The following statement implies that the current monetary policy well be kept for some time, while the situation of the market is unstable.

Support and resistance

On the daily chart Bollinger Bands are actively growing. The price range is narrowing from below, reacting to the controversial dynamics appearance in the end of the week. It’s better to use the channel trading strategy.

MACD is growing, keeping a strong buy signal (the histogram is above the signal line). At the moment the indicator is trying to consolidate above the zero line. It’s better to keep opened long positions in the short term, but not to open new ones.

Stochastic is reversing downwards in the overbought area. The correction development is possible in the short or very short term.

Resistance levels: 0.9650, 0.9677, 0.9702, 0.9724.

Support levels: 0.9600, 0.9575, 0.9541, 0.9525.

Trading tips

Long positions after can be opened after the upward reversal near the current levels. Take profit is 0.9720. Stop loss is 0.9600–0.9575. Implementation period: 2 days.

The development of the downward correction and the breakdown of the level of 0.9600–0.9575 can be the signal to open short positions to the area of support level of 0.9500. Stop loss is 0.9650. Implementation period: 2-3 days.

No comments:

Write comments