NZD/USD: New Zealand dollar under pressure

15 September 2017, 09:16

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7265 |

| Take Profit | 0.7300, 0.7320 |

| Stop Loss | 0.7222 |

| Key Levels | 0.7130, 0.7160, 0.7181,0.7200, 0.7222, 0.7261, 0.7297, 0.7319, 0.7336 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL LIMIT |

| Entry Point | 0.7250 |

| Take Profit | 0.7200, 0.7160 |

| Stop Loss | 0.7300 |

| Key Levels | 0.7130, 0.7160, 0.7181,0.7200, 0.7222, 0.7261, 0.7297, 0.7319, 0.7336 |

Current trend

New Zealand dollar showed a stable fall against USD during trading on Thursday, September 14, updating its weekly minimum. The reason for the development of "bearish" dynaics was the strengthening of USD after the release of optimistic data on consumer inflation in the USA that increased the chances for the tightening of the Fed's monetary policy in the end of 2017. Moreover, US currency is supported by expectations of the tax reform announced by Trump administration. The information about the reform may be presented next week.

During the morning session of September 15 the pair is showing growth in view of the release of strong business activity data from New Zealand. In August industrial PMI grew from 55.4 to 57.9 points which exceeded average outlooks of analysts.

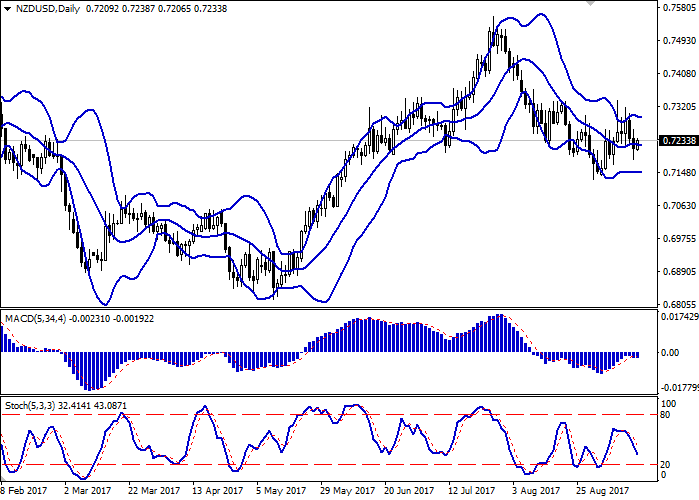

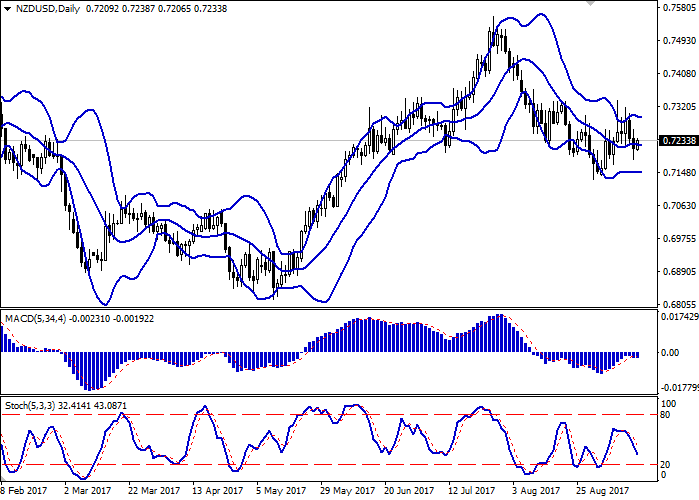

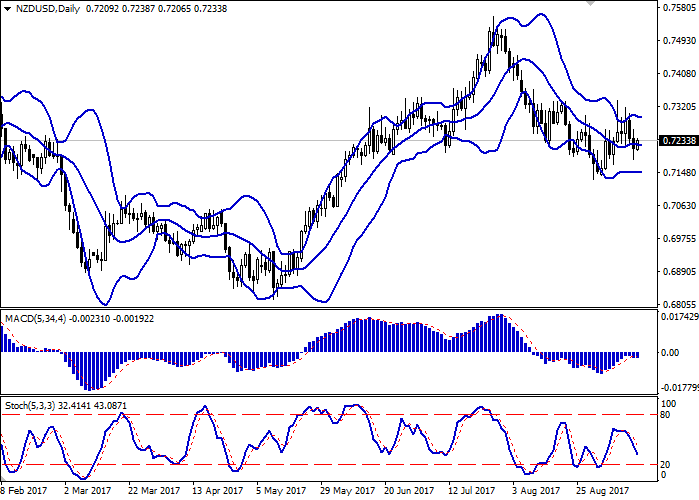

Support and resistance

Bollinger Bands on D1 chart demonstrate flat dynamics. Price range is not changing. MACD indicator tries to reverse downwards and to form a buy signal (the histogram has to consolidate below the signal line). Stochastic is reducing approaching the border with the ovesold area.

Resistance levels: 0.7261, 0.7297, 0.7319, 0.7336.

Support levels: 0.7222, 0.7200, 0.7181, 0.7160, 0.7130.

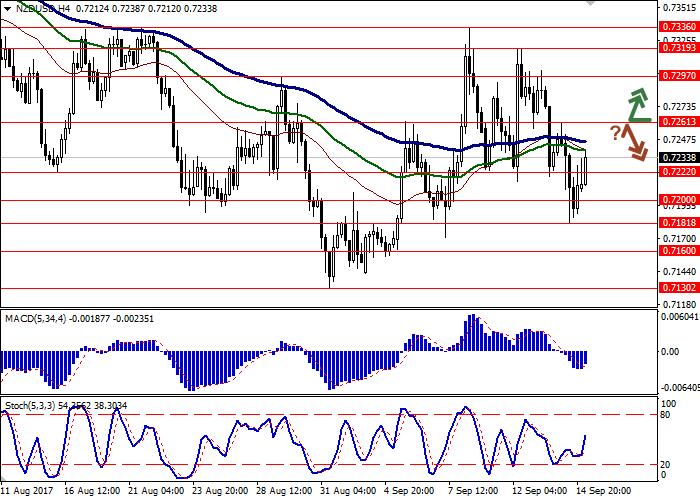

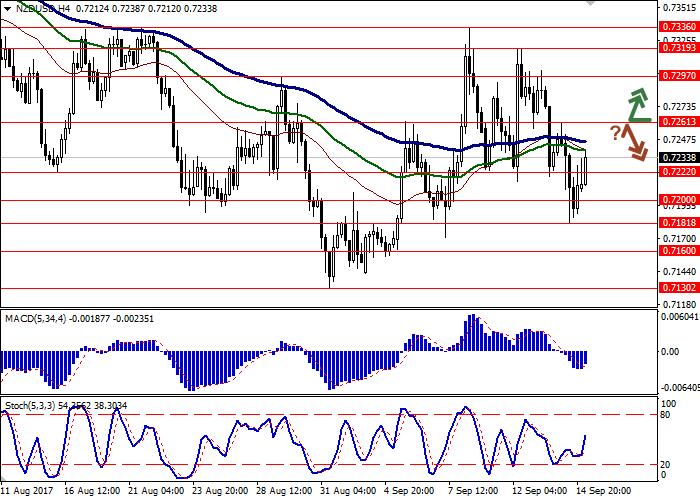

Trading tips

Long positions may be opened after the breakthrough of the level of 0.7261 with targets at 0.7300, 0.7320 and stop-loss at 0.7222. The period of implementation is 2 days.

The reversal of the price near 0.7261 may be a signal to corrective sales with targets at 0.7200 or 0.7160 and stop-loss at 0.7300. The period of implementation is 2-3 days.

New Zealand dollar showed a stable fall against USD during trading on Thursday, September 14, updating its weekly minimum. The reason for the development of "bearish" dynaics was the strengthening of USD after the release of optimistic data on consumer inflation in the USA that increased the chances for the tightening of the Fed's monetary policy in the end of 2017. Moreover, US currency is supported by expectations of the tax reform announced by Trump administration. The information about the reform may be presented next week.

During the morning session of September 15 the pair is showing growth in view of the release of strong business activity data from New Zealand. In August industrial PMI grew from 55.4 to 57.9 points which exceeded average outlooks of analysts.

Support and resistance

Bollinger Bands on D1 chart demonstrate flat dynamics. Price range is not changing. MACD indicator tries to reverse downwards and to form a buy signal (the histogram has to consolidate below the signal line). Stochastic is reducing approaching the border with the ovesold area.

Resistance levels: 0.7261, 0.7297, 0.7319, 0.7336.

Support levels: 0.7222, 0.7200, 0.7181, 0.7160, 0.7130.

Trading tips

Long positions may be opened after the breakthrough of the level of 0.7261 with targets at 0.7300, 0.7320 and stop-loss at 0.7222. The period of implementation is 2 days.

The reversal of the price near 0.7261 may be a signal to corrective sales with targets at 0.7200 or 0.7160 and stop-loss at 0.7300. The period of implementation is 2-3 days.

No comments:

Write comments