NZD/USD: general analysis

14 September 2017, 11:43

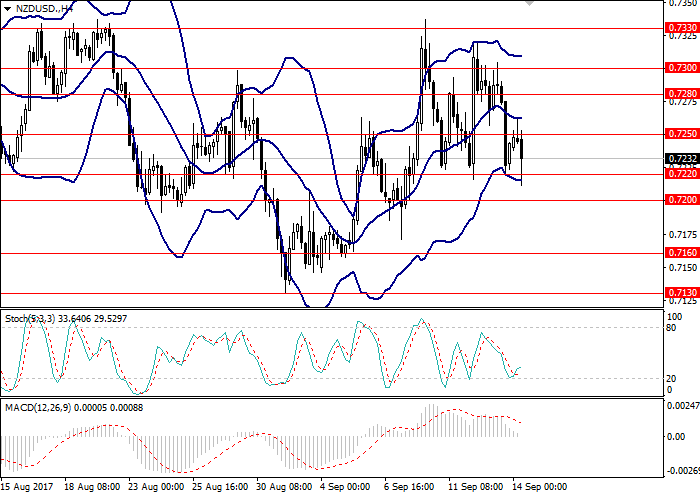

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 0.7233 |

| Take Profit | 0.7160 |

| Stop Loss | 0.7260 |

| Key Levels | 0.7130, 0.7160, 0.7200, 0.7220, 0.7250, 0.7280, 0.7300, 0.7330, 0.7415 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.7270 |

| Take Profit | 0.7320 |

| Stop Loss | 0.7240 |

| Key Levels | 0.7130, 0.7160, 0.7200, 0.7220, 0.7250, 0.7280, 0.7300, 0.7330, 0.7415 |

Current trend

During the trading session on Tuesday the NZD/USD pair was falling. Despite the fact that the US Producer Price index data were poorer than expected, the US dollar grew against most of the currencies and continues to strengthen. USD is also supported by the growth of the US Government bonds yield and President Trump’s promises to cut corporate taxes.

On Thursday the key issue for the NZD/USD pair will be the US inflation report, which is expected to be mixed. The pressure on USD can be strengthened by the hurricane consequences, as experts suggest the slowing of the GDP growth in the third quarter, decrease of retail sales and production.

Support and resistance

Resistance levels: 0.7250, 0.7280, 0.7300, 0.7330, 0.7415.

Support levels: 0.7220, 0.7200, 0.7160, 0.7130.

Trading tips

Short positions can be opened at the current price with the target at 0.7160 and stop loss at 0.7260.

Long positions can be opened at the level of 0.7270 with the target at 0.7320 and stop loss at 0.7240.

Implementation period: 1-3 days.

During the trading session on Tuesday the NZD/USD pair was falling. Despite the fact that the US Producer Price index data were poorer than expected, the US dollar grew against most of the currencies and continues to strengthen. USD is also supported by the growth of the US Government bonds yield and President Trump’s promises to cut corporate taxes.

On Thursday the key issue for the NZD/USD pair will be the US inflation report, which is expected to be mixed. The pressure on USD can be strengthened by the hurricane consequences, as experts suggest the slowing of the GDP growth in the third quarter, decrease of retail sales and production.

Support and resistance

Resistance levels: 0.7250, 0.7280, 0.7300, 0.7330, 0.7415.

Support levels: 0.7220, 0.7200, 0.7160, 0.7130.

Trading tips

Short positions can be opened at the current price with the target at 0.7160 and stop loss at 0.7260.

Long positions can be opened at the level of 0.7270 with the target at 0.7320 and stop loss at 0.7240.

Implementation period: 1-3 days.

No comments:

Write comments