GBP/USD: what will the Bank of England say?

14 September 2017, 11:48

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3240 |

| Take Profit | 1.3300, 1.3360 |

| Stop Loss | 1.3200 |

| Key Levels | 1.3000, 1.3050, 1.3115, 1.3200, 1.3230, 1.3300, 1.3360 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3175 |

| Take Profit | 1.3115, 1.3050 |

| Stop Loss | 1.3230 |

| Key Levels | 1.3000, 1.3050, 1.3115, 1.3200, 1.3230, 1.3300, 1.3360 |

Current trend

On Tuesday investors were enthusiastic about the release of August data on inflation in the UK that demonstrated considerable growth (CPI made up 2.9%, and basic - 2.7%). Market players hoped these data will put pressure on the Bank of England, and its officials will have to think about the increase of the interest rate once again. However, on Wednesday enthusiasm was replaced by disappointment after the release of the data from the British labor market. Instead of expected growth, the values of average salary remained on the previous level of 2.1% (with and without bonuses). Therefore, inflation in the UK still outperforms the growth of salaries which may have negative impact on the purchasing power and the volumes of GDP. In these conditions the Bank of England can postpone the increase of the interest rate for a long time and is unlikely to carry it out at today's meeting.

Today the attention of investors will be focused on follow-up comments of the Bank of England and the distribution of votes of the Fiscal Policy Committee. One should also pay attention to the release of the inflation data in the USA that may give the price additional dynamics.

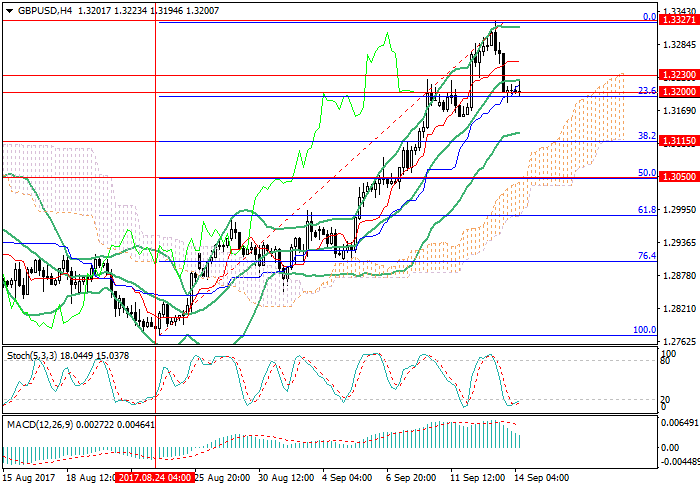

Support and resistance

After the growth of the price in the beginning of the week to maximum levels since last September at 1.3325 it corrected to the level of 1.3200 (Fibo correction 23.6%, Murrey level [4/8]). In case of its breakdown the fall may continue to 1.3115 (Fibo correction 38.2%) and 1.3050 (Fibo correction 50.0%). In case the price consolidates above the middle line of Bollinger Bands (1.3230), growth may continue to 1.3300, which is confirmed by Stochastic leaving the oversold zone.

Support levels: 1.3200, 1.3115, 1.3050, 1.3000.

Resistance levels: 1.3230, 1.3300, 1.3360.

Trading tips

In the current situation long positions should be opened above the level of 1.3230 with targets at 1.3300, 1.3360 and stop-loss at 1.3200.

Short positions can be opened if the price consolidates below 1.3200 with targets at 1.3115, 1.3050 and stop-loss at 1.3230.

On Tuesday investors were enthusiastic about the release of August data on inflation in the UK that demonstrated considerable growth (CPI made up 2.9%, and basic - 2.7%). Market players hoped these data will put pressure on the Bank of England, and its officials will have to think about the increase of the interest rate once again. However, on Wednesday enthusiasm was replaced by disappointment after the release of the data from the British labor market. Instead of expected growth, the values of average salary remained on the previous level of 2.1% (with and without bonuses). Therefore, inflation in the UK still outperforms the growth of salaries which may have negative impact on the purchasing power and the volumes of GDP. In these conditions the Bank of England can postpone the increase of the interest rate for a long time and is unlikely to carry it out at today's meeting.

Today the attention of investors will be focused on follow-up comments of the Bank of England and the distribution of votes of the Fiscal Policy Committee. One should also pay attention to the release of the inflation data in the USA that may give the price additional dynamics.

Support and resistance

After the growth of the price in the beginning of the week to maximum levels since last September at 1.3325 it corrected to the level of 1.3200 (Fibo correction 23.6%, Murrey level [4/8]). In case of its breakdown the fall may continue to 1.3115 (Fibo correction 38.2%) and 1.3050 (Fibo correction 50.0%). In case the price consolidates above the middle line of Bollinger Bands (1.3230), growth may continue to 1.3300, which is confirmed by Stochastic leaving the oversold zone.

Support levels: 1.3200, 1.3115, 1.3050, 1.3000.

Resistance levels: 1.3230, 1.3300, 1.3360.

Trading tips

In the current situation long positions should be opened above the level of 1.3230 with targets at 1.3300, 1.3360 and stop-loss at 1.3200.

Short positions can be opened if the price consolidates below 1.3200 with targets at 1.3115, 1.3050 and stop-loss at 1.3230.

No comments:

Write comments