EUR/USD: wave analysis

20 September 2017, 09:09

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 1.2001 |

| Take Profit | 1.1800, 1.1700 |

| Stop Loss | 1.2067 |

| Key Levels | 1.1700, 1.1800, 1.2090, 1.2200, 1.2400 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2095 |

| Take Profit | 1.2200, 1.2400 |

| Stop Loss | 1.2035 |

| Key Levels | 1.1700, 1.1800, 1.2090, 1.2200, 1.2400 |

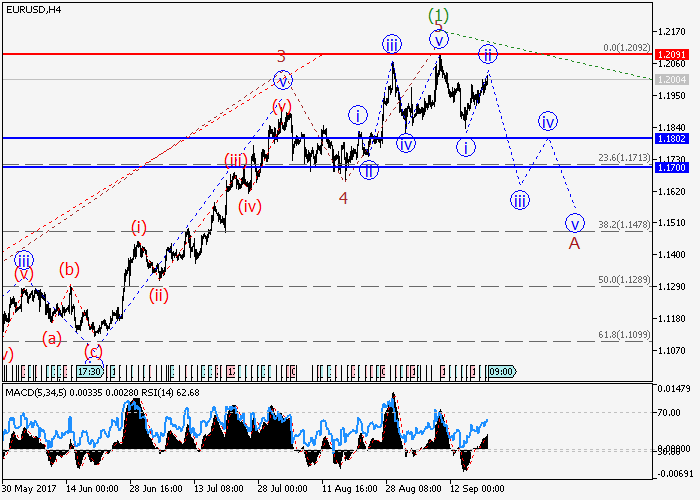

The pair is in correction. The probability of a fall remains.

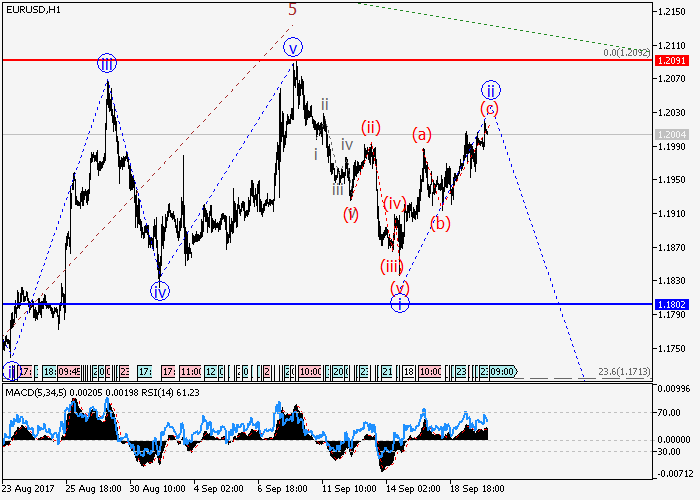

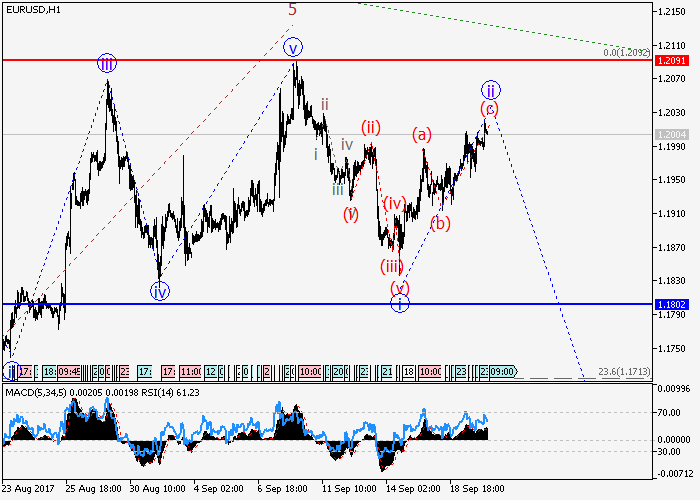

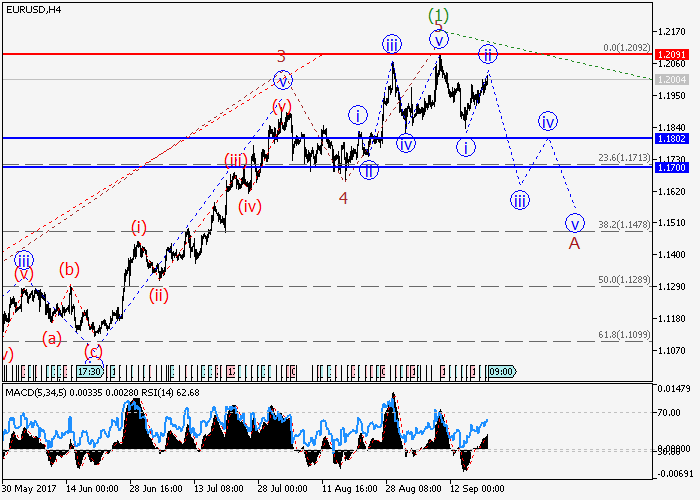

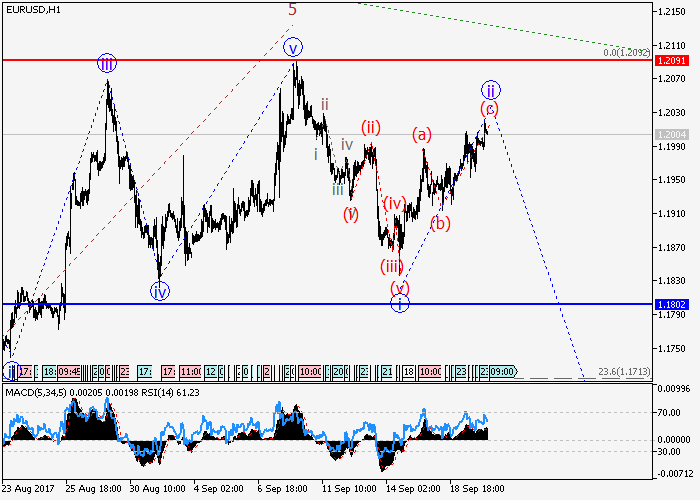

On the four-hour chart, development of the upward pulse as the first wave (1) of the higher level was completed, and the formation of the downward correction (2) began. At the moment, apparently, a low-level input impulse was formed as the wave i of A of (2), and local correction ii of A is completed. If the assumption is true, then the pair decline will continue to the levels of 1.1800-1.1700. The level of 1.2090 is critical for this scenario.

Main scenario

Sell during corrections, below the level of 1.2090 with a target in a range of 1.1800-1.1700.

Alternative scenario

Breakout of the level of 1.2090 will allow the pair to continue its growth to the levels of 1.2200-1.2400.

On the four-hour chart, development of the upward pulse as the first wave (1) of the higher level was completed, and the formation of the downward correction (2) began. At the moment, apparently, a low-level input impulse was formed as the wave i of A of (2), and local correction ii of A is completed. If the assumption is true, then the pair decline will continue to the levels of 1.1800-1.1700. The level of 1.2090 is critical for this scenario.

Main scenario

Sell during corrections, below the level of 1.2090 with a target in a range of 1.1800-1.1700.

Alternative scenario

Breakout of the level of 1.2090 will allow the pair to continue its growth to the levels of 1.2200-1.2400.

No comments:

Write comments