USD/CHF: the pair is showing mixed dynamics

20 September 2017, 08:55

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9655 |

| Take Profit | 0.9700, 0.9725 |

| Stop Loss | 0.9610 |

| Key Levels | 0.9541, 0.9562, 0.9584, 0.9615, 0.9650, 0.9677, 0.9702, 0.9724 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9580 |

| Take Profit | 0.9520, 0.9500 |

| Stop Loss | 0.9630 |

| Key Levels | 0.9541, 0.9562, 0.9584, 0.9615, 0.9650, 0.9677, 0.9702, 0.9724 |

Current trend

US dollar showed unstable growth against Swiss franc during trading on Tuesday, September 19, having lost the majority of advantages by the closing of the daily session. The reason was the release of uncertain data in the dynamics of housing construction in the USA in August. In turn, franc positively reacted to the strengthening of the business sentiment index and current economic conditions assessment in Germany.

During the morning session on September 20 the pair is showing cautious dynamics connected with the release of final minutes of the Fed's meeting at 20:00 (GMT+2) and the beginning of a follow-up conference at 20:30 (GMT+2). Moreover, a quarterly report by the National Bank of Switzerland is to be released at 15:00 (GMT+2).

Support and resistance

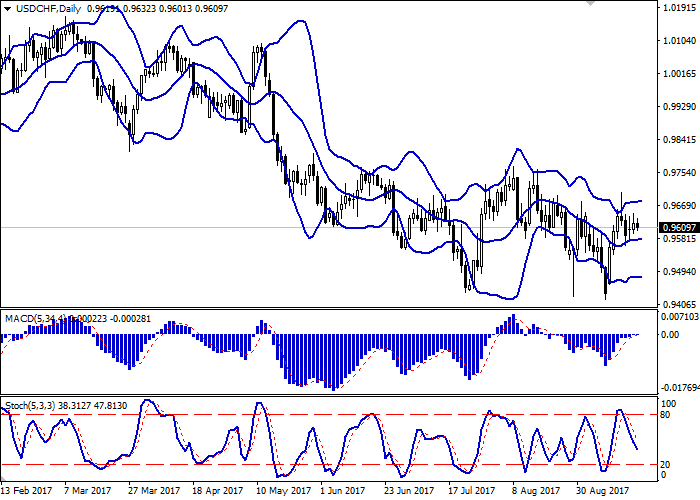

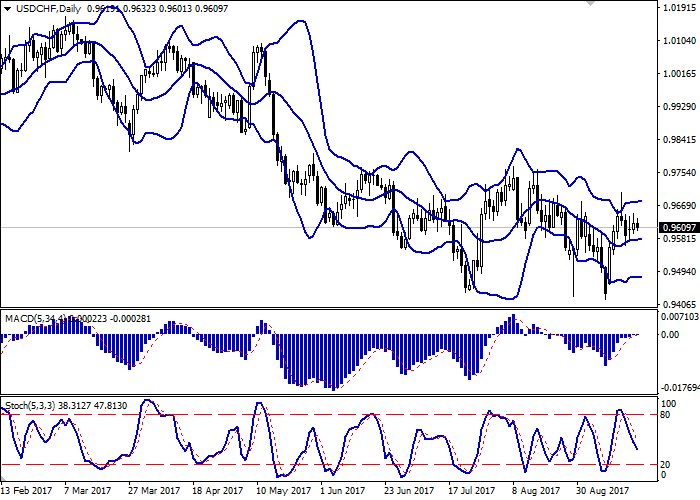

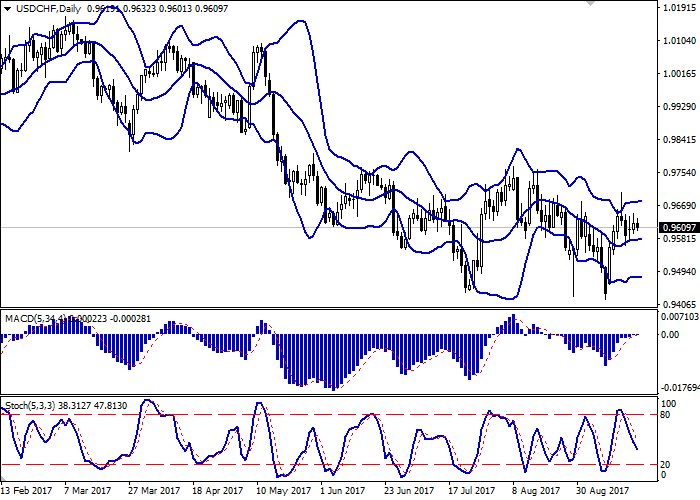

Bollinger Bands on D1 chart demonstrate flat dynamics. The price range remains practically unchanged. MACD indicator is growing but is unable to consolidate above zero.

Stochastic preserves stable downward direction.

Resistance levels: 0.9650, 0.9677, 0.9702, 0.9724.

Support levels: 0.9615, 0.9584, 0.9562, 0.9541.

Trading tips

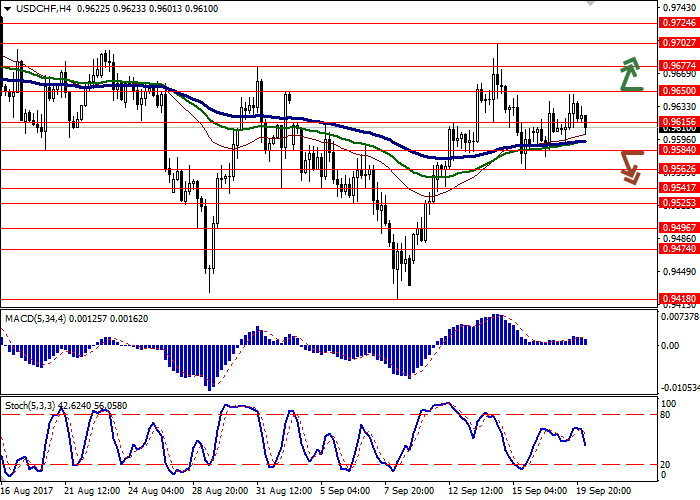

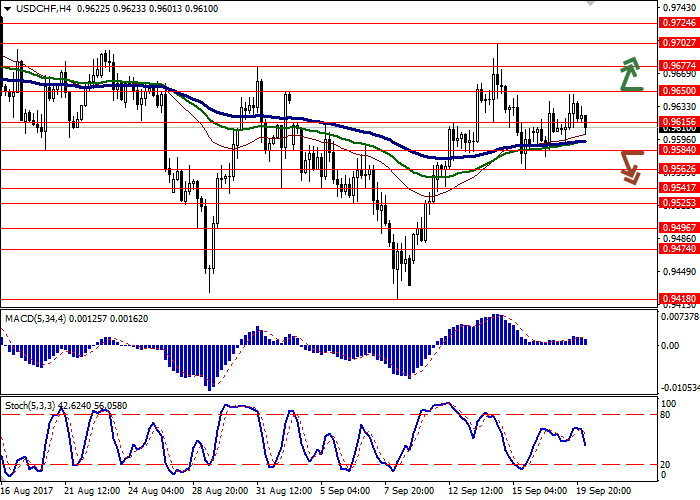

Long positions may be opened after breaking through the level of 0.9650 with targets at 0.9700, 0.9725 and stop-loss at 0.9610. The period of implementation is 2 days.

Short positions may be opened after breaking through the level of 0.9584 with targets at 0.9520, 0.9500 and stop-loss at 0.9630. The period of implementation is 2-3 days.

US dollar showed unstable growth against Swiss franc during trading on Tuesday, September 19, having lost the majority of advantages by the closing of the daily session. The reason was the release of uncertain data in the dynamics of housing construction in the USA in August. In turn, franc positively reacted to the strengthening of the business sentiment index and current economic conditions assessment in Germany.

During the morning session on September 20 the pair is showing cautious dynamics connected with the release of final minutes of the Fed's meeting at 20:00 (GMT+2) and the beginning of a follow-up conference at 20:30 (GMT+2). Moreover, a quarterly report by the National Bank of Switzerland is to be released at 15:00 (GMT+2).

Support and resistance

Bollinger Bands on D1 chart demonstrate flat dynamics. The price range remains practically unchanged. MACD indicator is growing but is unable to consolidate above zero.

Stochastic preserves stable downward direction.

Resistance levels: 0.9650, 0.9677, 0.9702, 0.9724.

Support levels: 0.9615, 0.9584, 0.9562, 0.9541.

Trading tips

Long positions may be opened after breaking through the level of 0.9650 with targets at 0.9700, 0.9725 and stop-loss at 0.9610. The period of implementation is 2 days.

Short positions may be opened after breaking through the level of 0.9584 with targets at 0.9520, 0.9500 and stop-loss at 0.9630. The period of implementation is 2-3 days.

No comments:

Write comments