Brent Crude Oil: general review

11 September 2017, 10:14| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 53.60 |

| Take Profit | 54.80, 55.30 |

| Stop Loss | 53.20 |

| Key Levels | 50.65, 51.65, 52.50, 53.40, 54.40, 55.35, 56.30 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 53.35 |

| Take Profit | 52.45 |

| Stop Loss | 53.60 |

| Key Levels | 50.65, 51.65, 52.50, 53.40, 54.40, 55.35, 56.30 |

Current trend

Last Friday the price of Brent oil reduced after the announcement of intermediary results of assessment of the damage caused by Harvey storm. The launch of operation of refineries in the Gulf of Mexico reduced the investors' concerns about a serious crisis in the US oil industry. The market reacted to this news by fixing profits in long positions which put additional pressure on the trading instrument. Moreover, according to EAI information, weekly reserves of crude oil in the USA increased by 4.6 mln barrels. At the same time gas prices have dropped, as the majority of the Americans decided to limit the use of personal cars due to Irma storm.

No important macroeconomic data able to have considerably impact on the dynamics of the trading instrument are due today. Tomorrow attention should be paid to the release of the API report on oil stocks in the USA.

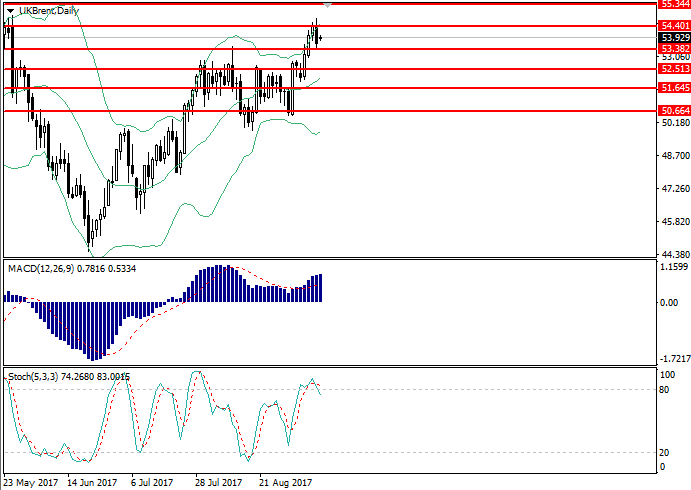

Support and resistance

On D1 chart the pair is trading in the upper part of Bollinger Bands. The indicator is directed to the side, and the price range is widening, indicating the continuation of the current trend. MACD histogram is in positive zone, keeping the signal for the opening of long positions. Stochastic has left the overbought zone and formed a strong sell signal.

Support levels: 50.65, 51.65, 52.50, 53.40.

Resistance levels: 54.40, 55.35, 56.30.

Trading tips

Long positions may be opened at the current price with targets at 54.80, 55.30 and stop-loss at 53.20. The period of implementation is 1-3 days.

Short positions may be opened from the level of 53.35 with targets at 52.45 and stop-loss at 53.60. The period of implementation is 1-3 days.

Last Friday the price of Brent oil reduced after the announcement of intermediary results of assessment of the damage caused by Harvey storm. The launch of operation of refineries in the Gulf of Mexico reduced the investors' concerns about a serious crisis in the US oil industry. The market reacted to this news by fixing profits in long positions which put additional pressure on the trading instrument. Moreover, according to EAI information, weekly reserves of crude oil in the USA increased by 4.6 mln barrels. At the same time gas prices have dropped, as the majority of the Americans decided to limit the use of personal cars due to Irma storm.

No important macroeconomic data able to have considerably impact on the dynamics of the trading instrument are due today. Tomorrow attention should be paid to the release of the API report on oil stocks in the USA.

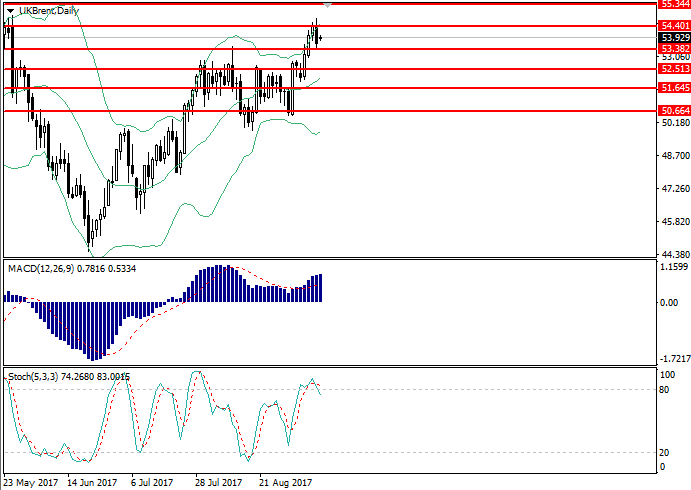

Support and resistance

On D1 chart the pair is trading in the upper part of Bollinger Bands. The indicator is directed to the side, and the price range is widening, indicating the continuation of the current trend. MACD histogram is in positive zone, keeping the signal for the opening of long positions. Stochastic has left the overbought zone and formed a strong sell signal.

Support levels: 50.65, 51.65, 52.50, 53.40.

Resistance levels: 54.40, 55.35, 56.30.

Trading tips

Long positions may be opened at the current price with targets at 54.80, 55.30 and stop-loss at 53.20. The period of implementation is 1-3 days.

Short positions may be opened from the level of 53.35 with targets at 52.45 and stop-loss at 53.60. The period of implementation is 1-3 days.

No comments:

Write comments