AUD/USD: the pair continues stable growth

08 September 2017, 10:55

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 0.8080 |

| Take Profit | 0.8040, 0.8000 |

| Stop Loss | 0.8120 |

| Key Levels | 0.7994, 0.8012, 0.8041, 0.8064, 0.8080, 0.8115, 0.8161, 0.8200 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.8115 |

| Take Profit | 0.8200 |

| Stop Loss | 0.8060 |

| Key Levels | 0.7994, 0.8012, 0.8041, 0.8064, 0.8080, 0.8115, 0.8161, 0.8200 |

Current trend

Australian dollar grew as a result of trading on Thursday, September 7, and continues active "bullish" dynamics during the morning session on September 8, updating record-setting maximums since May 2015.

The reason for the strengthening of the Australian currency was the weakness of USD, while macroeconomic statistics from Australia often was uncertain. On Friday, September 8, the value of mortgage crediting in July grew by 2.9% against the forecast of +1.0% and +1.2% in the previous month. In turn, investment loans for new houses construction dropped by 3.9% in July after growth by 1.6% in June. Investors were also slightly disappointed by Chinese statistics.

At 10:30 (GMT+2) traders are waiting for the statement by the head of RBA Philip Lowe who may hint at the regulator's plans for the near future.

Support and resistance

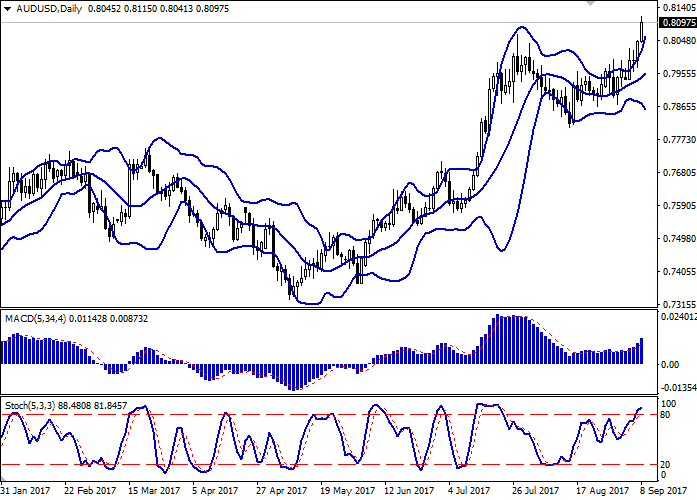

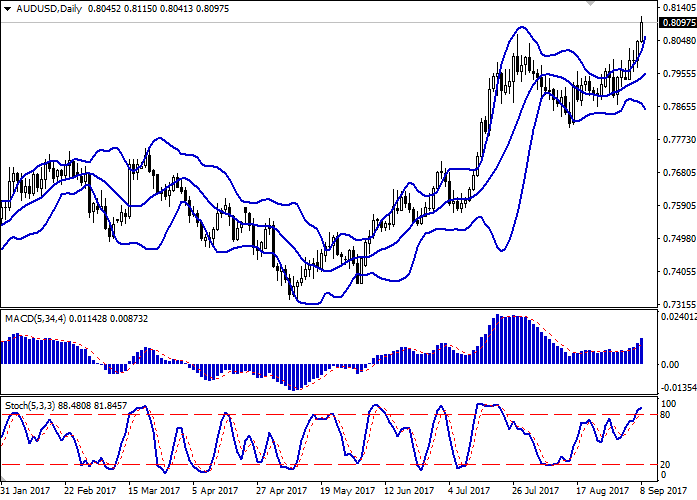

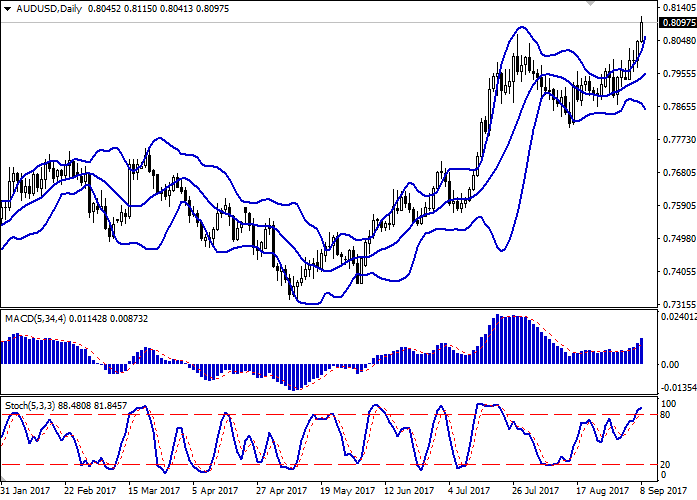

Bollinger Bands in D1 chart demonstrate stable increase. The price range is actively widening. MACD indicator is growing preserving a stable buy signal (the histogram is above the signal line). Stochastic keeps the upward direction but is located in the overbought area.

Resistance levels: 0.8115, 0.8161, 0.8200.

Support levels: 0.8080, 0.8064, 0.8041, 0.8012, 0.7994.

Trading tips

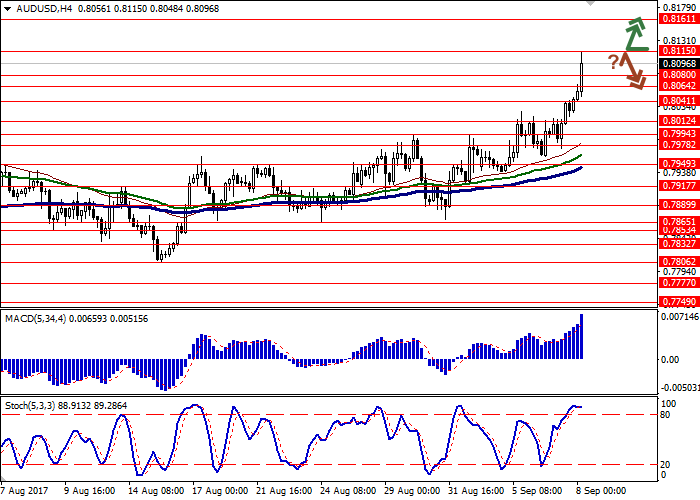

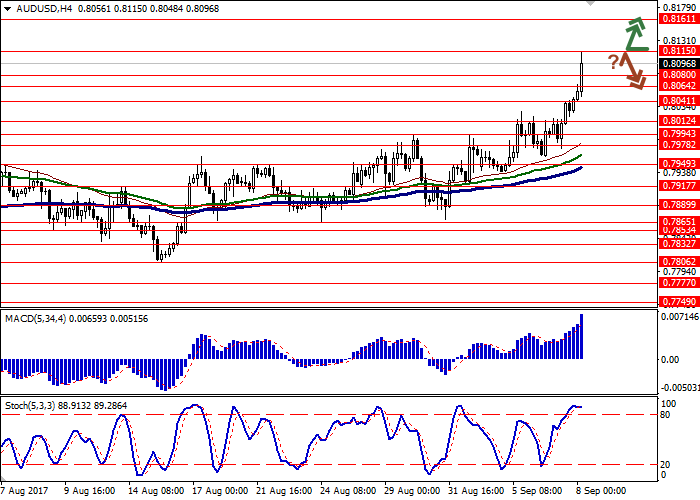

Long positions may be opened from the level of 0.8115 with targets at 0.8200 and stop-loss at 0.8060. The period of implementation is 2-3 days.

The option of corrective dynamics formation in the short terms seems more likely. In this case the nearest targets of the "bears" may be located around 0.8040, 0.8000. Stop-loss will be placed at 0.8120. The period of implementation is 2-3 days.

Australian dollar grew as a result of trading on Thursday, September 7, and continues active "bullish" dynamics during the morning session on September 8, updating record-setting maximums since May 2015.

The reason for the strengthening of the Australian currency was the weakness of USD, while macroeconomic statistics from Australia often was uncertain. On Friday, September 8, the value of mortgage crediting in July grew by 2.9% against the forecast of +1.0% and +1.2% in the previous month. In turn, investment loans for new houses construction dropped by 3.9% in July after growth by 1.6% in June. Investors were also slightly disappointed by Chinese statistics.

At 10:30 (GMT+2) traders are waiting for the statement by the head of RBA Philip Lowe who may hint at the regulator's plans for the near future.

Support and resistance

Bollinger Bands in D1 chart demonstrate stable increase. The price range is actively widening. MACD indicator is growing preserving a stable buy signal (the histogram is above the signal line). Stochastic keeps the upward direction but is located in the overbought area.

Resistance levels: 0.8115, 0.8161, 0.8200.

Support levels: 0.8080, 0.8064, 0.8041, 0.8012, 0.7994.

Trading tips

Long positions may be opened from the level of 0.8115 with targets at 0.8200 and stop-loss at 0.8060. The period of implementation is 2-3 days.

The option of corrective dynamics formation in the short terms seems more likely. In this case the nearest targets of the "bears" may be located around 0.8040, 0.8000. Stop-loss will be placed at 0.8120. The period of implementation is 2-3 days.

No comments:

Write comments