XAU/USD: gold is updating record-setting maximums

08 September 2017, 09:49

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1355.48 |

| Take Profit | 1374.93 |

| Stop Loss | 1340.00 |

| Key Levels | 1325.65, 1330.60, 1343.98, 1350.00, 1355.48, 1366.99, 1374.93 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1350.00, 1343.98 |

| Take Profit | 1316.03 |

| Stop Loss | 1365.00 |

| Key Levels | 1325.65, 1330.60, 1343.98, 1350.00, 1355.48, 1366.99, 1374.93 |

Current trend

Gold prices have updated 1-year record-setting maximums after the release of disappointing data on the dynamics of jobless claims in the USA and after ECB kept the interest rate on the previous level.

A report published yesterday showed the growth of initial jobless claims from 235K to 298K, while the analysts expected them to grow only to 241K. The number of repeated claims reduced more than expected: from 1.945 mln to 1.940 mln against the outlook of growth to 1.950 mln.

ECB press conference was neutral. The head of the regulator Mario Draghi pointed out that economic growth forecasts in the region remained unchanged and inflation expectations had not changed as well.

Support and resistance

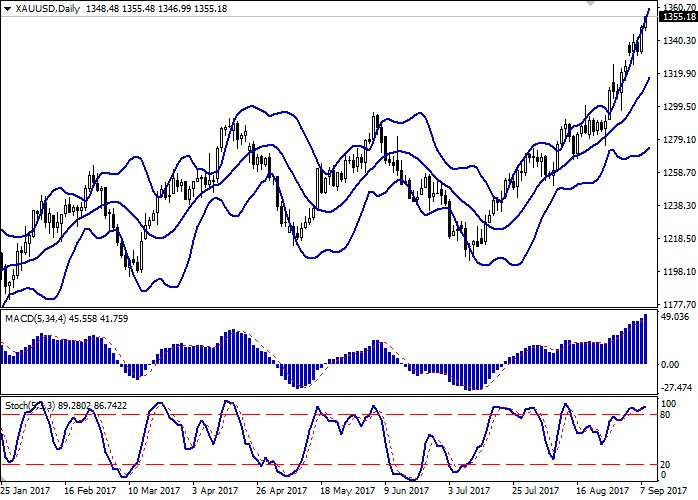

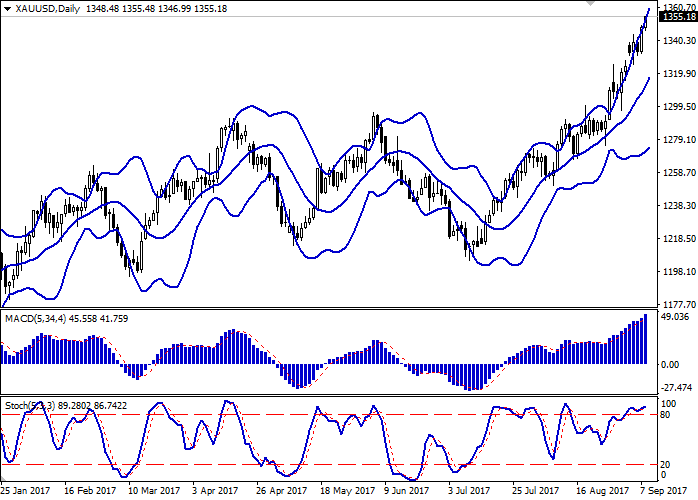

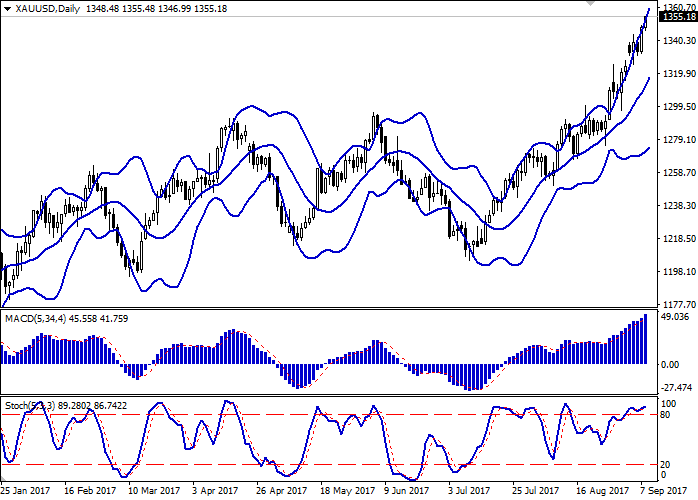

Bollinger Bands in D1 chart demonstrate stable increase. The price range is actively widening. MACD indicator is growing preserving a stable buy signal (the histogram is above the signal line). Stochastic has reached maximum values and reversed horizontally.

Resistance levels: 1355.48, 1366.99, 1374.93.

Support levels: 1350.00, 1343.98, 1330.60, 1325.65.

Trading tips

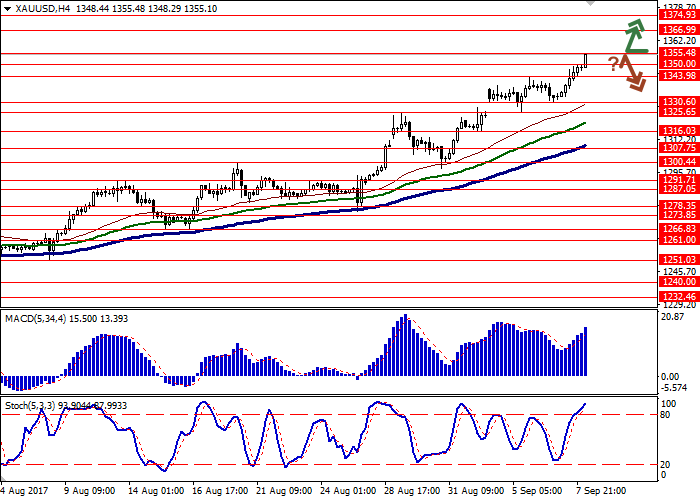

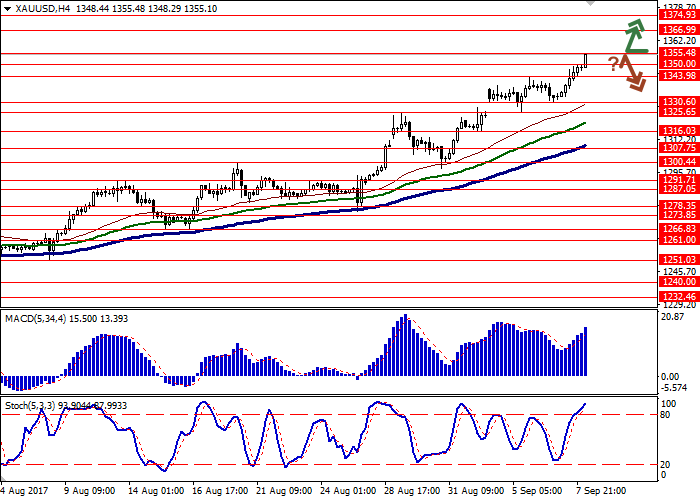

Long positions may be opened from the level of 1355.48 with target at 1374.93 and stop-loss at 1340.00. The period of implementation is 1-2 days.

Short positions may be opened from the levels of 1350.00, 1343.98 with targets at 1316.03 and stop-loss at 1365.00. The period of implementation is 2-3 days.

Gold prices have updated 1-year record-setting maximums after the release of disappointing data on the dynamics of jobless claims in the USA and after ECB kept the interest rate on the previous level.

A report published yesterday showed the growth of initial jobless claims from 235K to 298K, while the analysts expected them to grow only to 241K. The number of repeated claims reduced more than expected: from 1.945 mln to 1.940 mln against the outlook of growth to 1.950 mln.

ECB press conference was neutral. The head of the regulator Mario Draghi pointed out that economic growth forecasts in the region remained unchanged and inflation expectations had not changed as well.

Support and resistance

Bollinger Bands in D1 chart demonstrate stable increase. The price range is actively widening. MACD indicator is growing preserving a stable buy signal (the histogram is above the signal line). Stochastic has reached maximum values and reversed horizontally.

Resistance levels: 1355.48, 1366.99, 1374.93.

Support levels: 1350.00, 1343.98, 1330.60, 1325.65.

Trading tips

Long positions may be opened from the level of 1355.48 with target at 1374.93 and stop-loss at 1340.00. The period of implementation is 1-2 days.

Short positions may be opened from the levels of 1350.00, 1343.98 with targets at 1316.03 and stop-loss at 1365.00. The period of implementation is 2-3 days.

No comments:

Write comments