EUR/USD: the decision of the US Federal Reserve disappointed investors

28 July 2022, 11:42

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.0259 |

| Take Profit | 1.0494 |

| Stop Loss | 1.0200 |

| Key Levels | 0.9952, 1.0112, 1.0259, 1.0494 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.0112 |

| Take Profit | 0.9952 |

| Stop Loss | 1.0220 |

| Key Levels | 0.9952, 1.0112, 1.0259, 1.0494 |

Current trend

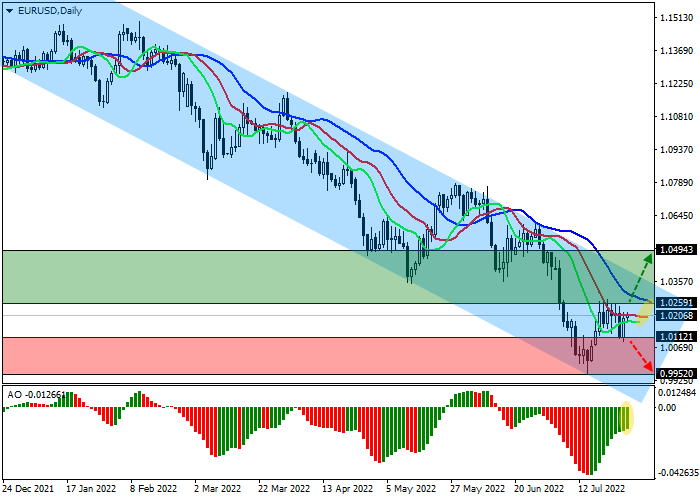

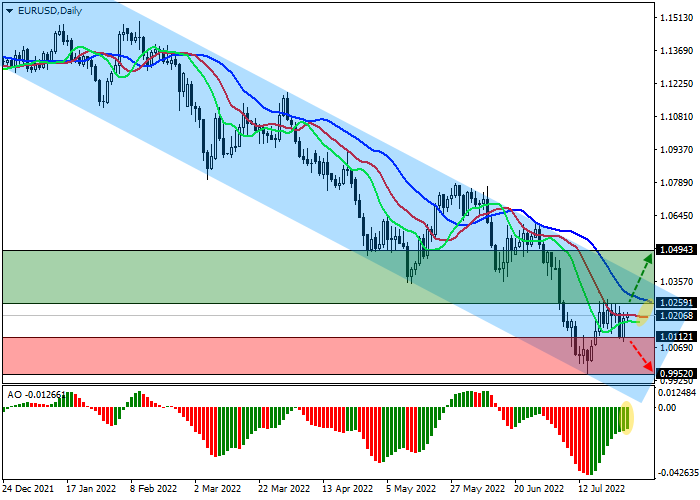

The EUR/USD pair is in a corrective trend, trading around 1.0205.

This week, within the framework of an extraordinary meeting, the energy ministers of the EU countries reached a compromise on the issue of reducing the consumption of "blue fuel" by 15% from the average level over the past five years. The emergency plan, developed in the event of a complete cessation of energy supplies from Russia, assumes a decrease in the volume of gas used in the upcoming winter heating season, starting from August this year to the end of March 2023. The driver for the decision was the reduction in the volume of fuel transported through the Nord Stream gas pipeline to 1/5 of the throughput capacity due to technical work carried out on the gas turbine engine. The market took this as a signal of an escalation of political tension between Russia and the European Union. Nevertheless, despite the decrease in the volume of supplies, the filling of gas storage facilities continues and, according to experts, may reach 80% by November 1. As for the state of the economies of the EU countries, the situation continues to deteriorate, and, as shown by the German consumer climate index for August, the decline in the indicator increased to –30.6 points, which is the absolute minimum in the history of observations.

The quotes of the American dollar came close to 106.000 in the USD Index. Investors are disappointed by the decision of the US Federal Reserve to raise interest rates by only 75 basis points, bringing them to 2.50%. As experts predicted yesterday, this level of adjustment is not enough to compensate for high inflation rates, and, against this background, the consumer price index may exceed 10% by the end of the year. The relatively "dovish" rhetoric of the regulator has further aggravated the situation in the economy since now the risks of the national economy going into recession are significantly increasing.

Support and resistance

The trading instrument moves within the global downward channel, rising towards the resistance line. Technical indicators hold a sell signal, which is weakening: fast EMAs on the Alligator indicator is approaching the signal line, and the AO oscillator histogram continues to form upward bars.

Support levels: 1.0112, 0.9952.

Resistance levels: 1.0259, 1.0494.

Trading tips

Long positions may be opened after the continuation of the corrective growth of the asset or consolidation above the local resistance level of 1.0259 with the target at 1.0494. Stop loss – 1.0200. Implementation period: 7 days or more.

Short positions may be opened after a reversal and continuation of the global decline in the asset and consolidation below the local support level of 1.0112 with the target at 0.9952. Stop loss – 1.0220.

No comments:

Write comments