USD/CAD: US dollar strengthens

09 December 2019, 11:58

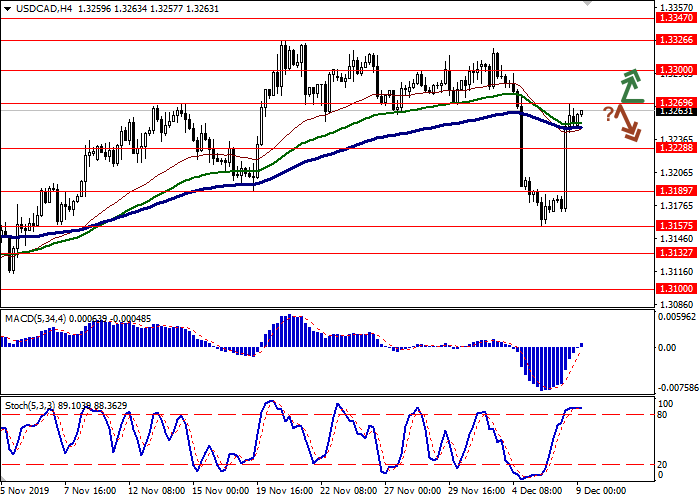

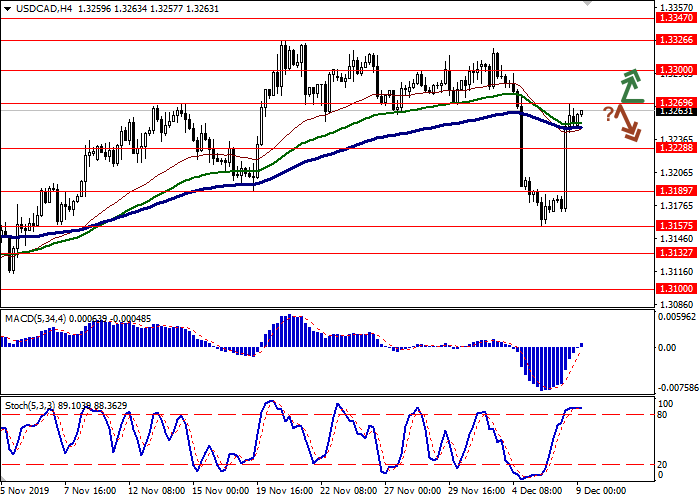

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3275 |

| Take Profit | 1.3326, 1.3347 |

| Stop Loss | 1.3240, 1.3228 |

| Key Levels | 1.3132,1.3157, 1.3189, 1.3228, 1.3269, 1.3300, 1.3326, 1.3347 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3235 |

| Take Profit | 1.3189, 1.3170 |

| Stop Loss | 1.3269 |

| Key Levels | 1.3132,1.3157, 1.3189, 1.3228, 1.3269, 1.3300, 1.3326, 1.3347 |

Current trend

Today, during the Asian session, the USD/CAD pair is growing moderately, adding about 0.04%.

Investors are responding to strong macroeconomic data on the US labor market, released last Friday. For November, US Nonfarm Payrolls reached 266K. The unemployment rate for the same period decreased from 3.6% to 3.5%. At the same time, Canadian data were significantly worse than the forecasts. The number of employees in Canada for November fell sharply by 71.2K jobs after a decrease of 1.8K jobs last month. Analysts counted on the appearance of the positive dynamics of +10K. The November unemployment rate grew sharply from 5.5% to 5.9% with a neutral market forecast. The share of labor in the total population decreased from 65.7% to 65.6%, which also turned out to be worse than investors expected.

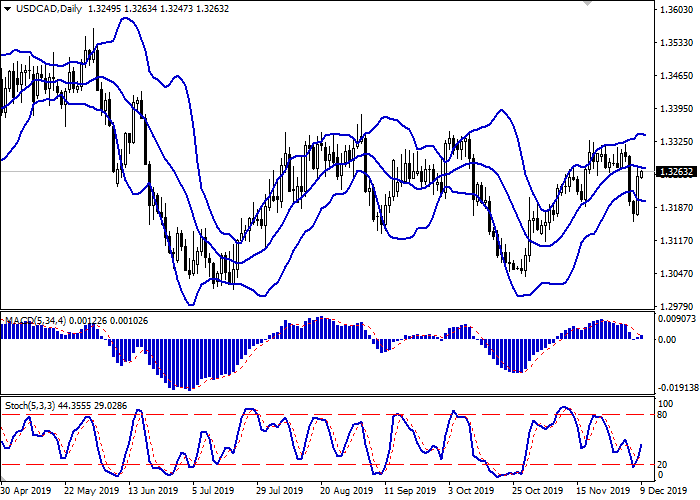

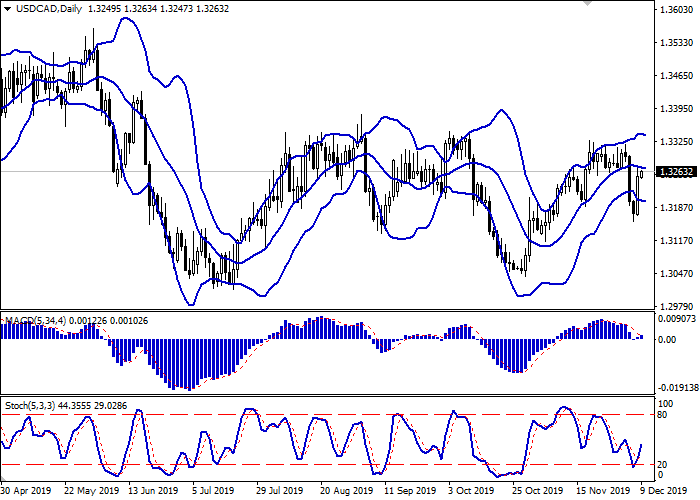

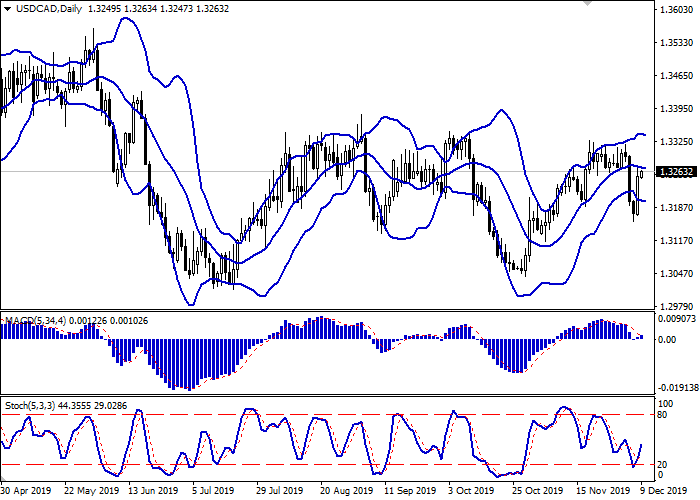

Support and resistance

On the daily chart, Bollinger Bands reverse in the horizontal plane. The price range narrows slightly from above, reflecting the appearance of ambiguous dynamics in the short term. The MACD indicator has reversed upwards and is preparing to form a new buy signal (the histogram should be located above the signal line). Stochastic’s dynamic is similar, it reversed at the level of 20 and signals in favor of the development of corrective growth in the ultra-short term.

An upward dynamics developing is possible in the short and/or ultra-short term.

Resistance levels: 1.3269, 1.3300, 1.3326, 1.3347.

Support levels: 1.3228, 1.3189, 1.3157, 1.3132.

Trading tips

Long positions may be opened after the breakout of 1.3269 with the target at 1.3326 or 1.3347. Stop loss – 1.3240–1.3228.

Short positions may be opened after a rebound from 1.3269 and a breakdown of 1.3240 with the targets at 1.3189–1.3170. Stop loss – 1.3269.

Implementation period: 2–3 days.

Today, during the Asian session, the USD/CAD pair is growing moderately, adding about 0.04%.

Investors are responding to strong macroeconomic data on the US labor market, released last Friday. For November, US Nonfarm Payrolls reached 266K. The unemployment rate for the same period decreased from 3.6% to 3.5%. At the same time, Canadian data were significantly worse than the forecasts. The number of employees in Canada for November fell sharply by 71.2K jobs after a decrease of 1.8K jobs last month. Analysts counted on the appearance of the positive dynamics of +10K. The November unemployment rate grew sharply from 5.5% to 5.9% with a neutral market forecast. The share of labor in the total population decreased from 65.7% to 65.6%, which also turned out to be worse than investors expected.

Support and resistance

On the daily chart, Bollinger Bands reverse in the horizontal plane. The price range narrows slightly from above, reflecting the appearance of ambiguous dynamics in the short term. The MACD indicator has reversed upwards and is preparing to form a new buy signal (the histogram should be located above the signal line). Stochastic’s dynamic is similar, it reversed at the level of 20 and signals in favor of the development of corrective growth in the ultra-short term.

An upward dynamics developing is possible in the short and/or ultra-short term.

Resistance levels: 1.3269, 1.3300, 1.3326, 1.3347.

Support levels: 1.3228, 1.3189, 1.3157, 1.3132.

Trading tips

Long positions may be opened after the breakout of 1.3269 with the target at 1.3326 or 1.3347. Stop loss – 1.3240–1.3228.

Short positions may be opened after a rebound from 1.3269 and a breakdown of 1.3240 with the targets at 1.3189–1.3170. Stop loss – 1.3269.

Implementation period: 2–3 days.

No comments:

Write comments