USD/CHF: the dollar remains under pressure

06 August 2019, 09:30

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9780, 0.9805 |

| Take Profit | 0.9887, 0.9905 |

| Stop Loss | 0.9750, 0.9737 |

| Key Levels | 0.9600, 0.9639, 0.9702, 0.9737, 0.9775, 0.9800, 0.9833, 0.9860 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9700 |

| Take Profit | 0.9600 |

| Stop Loss | 0.9737, 0.9750 |

| Key Levels | 0.9600, 0.9639, 0.9702, 0.9737, 0.9775, 0.9800, 0.9833, 0.9860 |

Current trend

Yesterday, the USD/CHF pair fell steadily, renewing lows of June 25. The emergence of confident negative dynamics in the instrument was due to the aggravation of trade relations between the United States and China. On the other hand, Washington has clearly outlined its position in a trade dispute with the European Union. President Donald Trump noted that at the moment, the question of introducing import duties on European goods is not worth it.

Monday’s Swiss macroeconomic statistics moderately supported CHF. Thus, the Q3 consumer confidence index from SECO rose from –9 to –8 points, while analysts expected the dynamics to worsen to –10 points. In June, real retail sales rose by 0.7% YoY after declining by 1.1% YoY in May. Experts expected an improvement in the indicator but expected by –0.5% YoY.

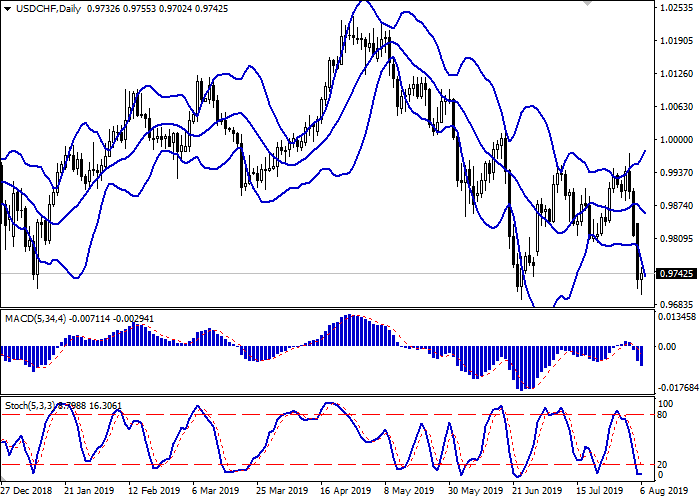

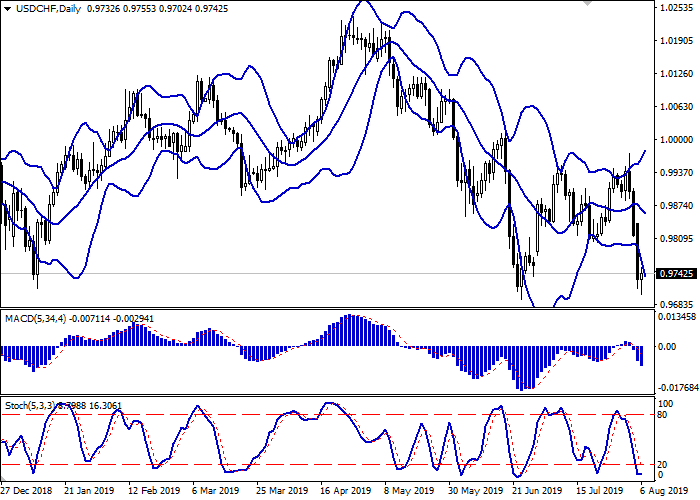

Support and resistance

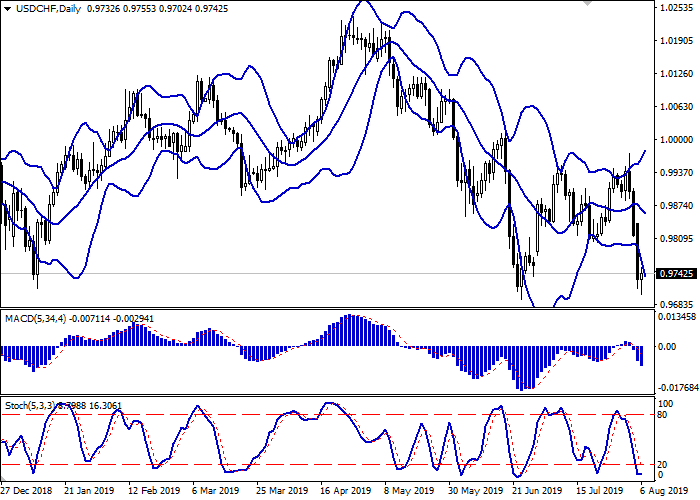

On the daily chart, Bollinger bands are steadily declining. The price range is expanding but the instrument is still outside its borders. The MACD indicator goes down, keeping a confident sell signal (the histogram is below the signal line). Stochastic reached its lows and turned in a horizontal plane, signaling in favor of the development of corrective growth in the short and/or ultra-short term.

Resistance levels: 0.9775, 0.9800, 0.9833, 0.9860.

Support levels: 0.9737, 0.9702, 0.9639, 0.9600.

Trading tips

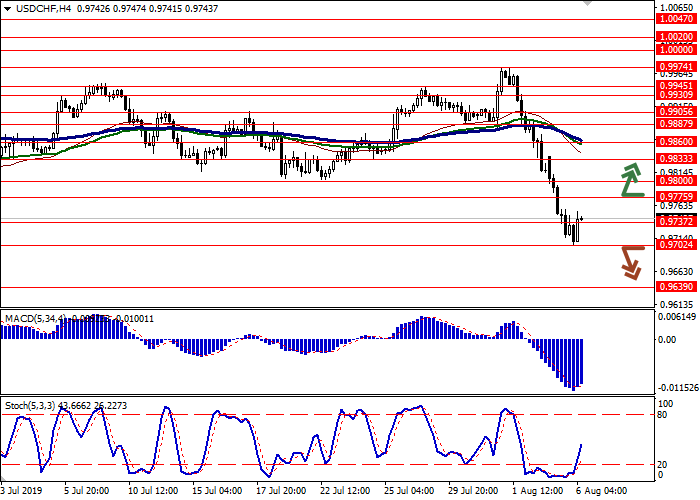

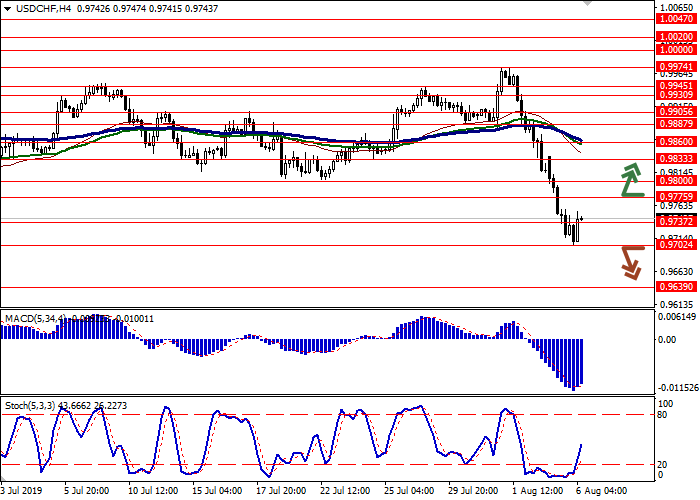

Long positions can be opened after the breakout of the level of 0.9775 or 0.9800 with the targets at 0.9860 or 0.9887–0.9905. Stop loss is 0.9750–0.9737.

Short positions can be opened after the breakdown of the level of 0.9702 with the target at 0.9600. Stop loss is 0.9737–0.9750.

Implementation period: 2–3 days.

Yesterday, the USD/CHF pair fell steadily, renewing lows of June 25. The emergence of confident negative dynamics in the instrument was due to the aggravation of trade relations between the United States and China. On the other hand, Washington has clearly outlined its position in a trade dispute with the European Union. President Donald Trump noted that at the moment, the question of introducing import duties on European goods is not worth it.

Monday’s Swiss macroeconomic statistics moderately supported CHF. Thus, the Q3 consumer confidence index from SECO rose from –9 to –8 points, while analysts expected the dynamics to worsen to –10 points. In June, real retail sales rose by 0.7% YoY after declining by 1.1% YoY in May. Experts expected an improvement in the indicator but expected by –0.5% YoY.

Support and resistance

On the daily chart, Bollinger bands are steadily declining. The price range is expanding but the instrument is still outside its borders. The MACD indicator goes down, keeping a confident sell signal (the histogram is below the signal line). Stochastic reached its lows and turned in a horizontal plane, signaling in favor of the development of corrective growth in the short and/or ultra-short term.

Resistance levels: 0.9775, 0.9800, 0.9833, 0.9860.

Support levels: 0.9737, 0.9702, 0.9639, 0.9600.

Trading tips

Long positions can be opened after the breakout of the level of 0.9775 or 0.9800 with the targets at 0.9860 or 0.9887–0.9905. Stop loss is 0.9750–0.9737.

Short positions can be opened after the breakdown of the level of 0.9702 with the target at 0.9600. Stop loss is 0.9737–0.9750.

Implementation period: 2–3 days.

No comments:

Write comments