NZD/USD: New Zealand dollar declines

02 August 2019, 09:59

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6570, 0.6585 |

| Take Profit | 0.6685 |

| Stop Loss | 0.6532, 0.6620 |

| Key Levels | 0.6463, 0.6480, 0.6500, 0.6532, 0.6566, 0.6580, 0.6614, 0.6640 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6530 |

| Take Profit | 0.6463, 0.6440 |

| Stop Loss | 0.6570 |

| Key Levels | 0.6463, 0.6480, 0.6500, 0.6532, 0.6566, 0.6580, 0.6614, 0.6640 |

Current trend

Yesterday, the NZD/USD pair traded ambiguously but renewed the lows since June 20. The decrease was due to ambiguous macroeconomic statistics and the aggravation of the situation around the US-Chinese trade negotiations after the next statements of Donald Trump in his Twitter. Also, investors react to the Fed’s interest rates decision. On Wednesday, it, as expected, lowered the interest rate by 25 basis points and announced the termination of the balance reduction program. The head of the regulator Jerome Powell, commenting on the decision, noted that this easing of monetary policy is not the beginning of a new cycle of rate reduction but is only a way to stimulate the economy against the background of rapidly changing external factors. Today, investors are awaiting the publication of the July report on the US labor market.

Support and resistance

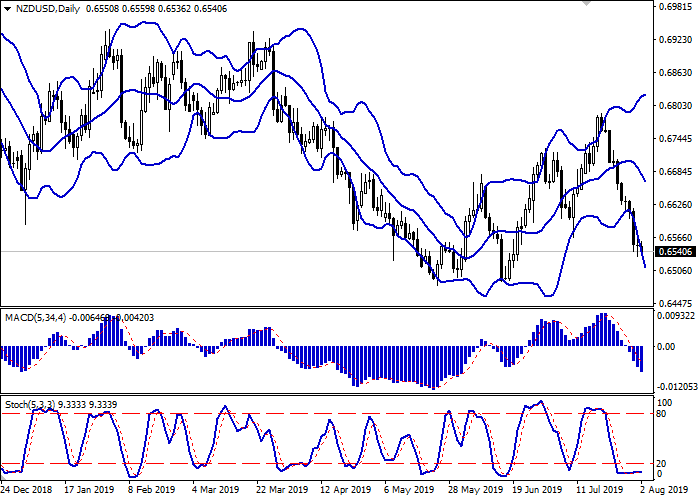

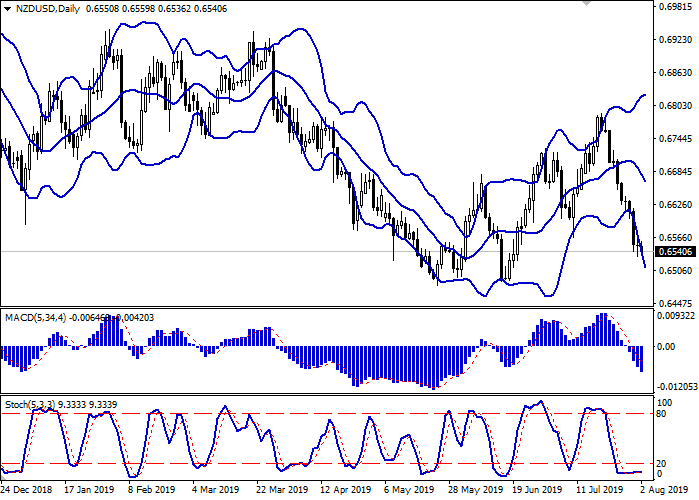

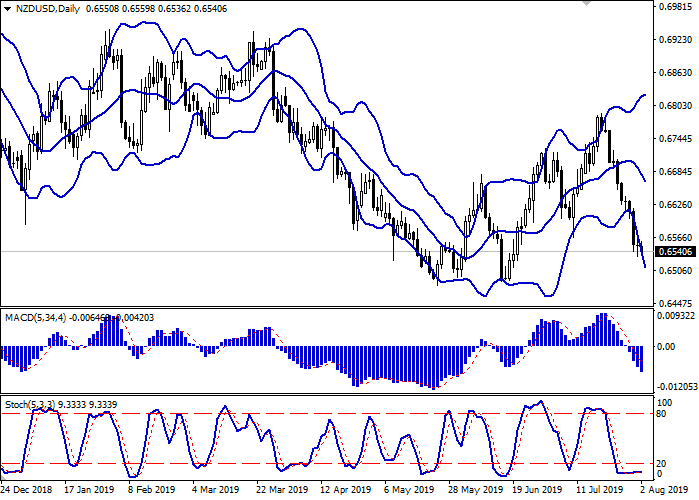

On the daily chart, Bollinger Bands actively decline. The price range expands but not as fast as the downtrend develops in the short term. The MACD falls, keeping a strong sell signal (the histogram is below the signal line). Having reached its lows, Stochastic is in the horizontal plane, signaling the risks of corrective growth in the ultra-short term.

It is better to wait until the situation is clear before opening new positions and close some of the current profitable short positions before the weekend.

Resistance levels: 0.6566, 0.6580, 0.6614, 0.6640.

Support levels: 0.6532, 0.6500, 0.6480, 0.6463.

Trading tips

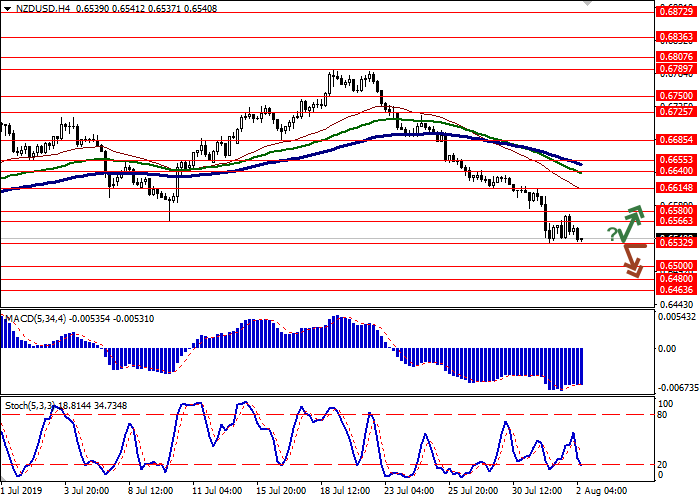

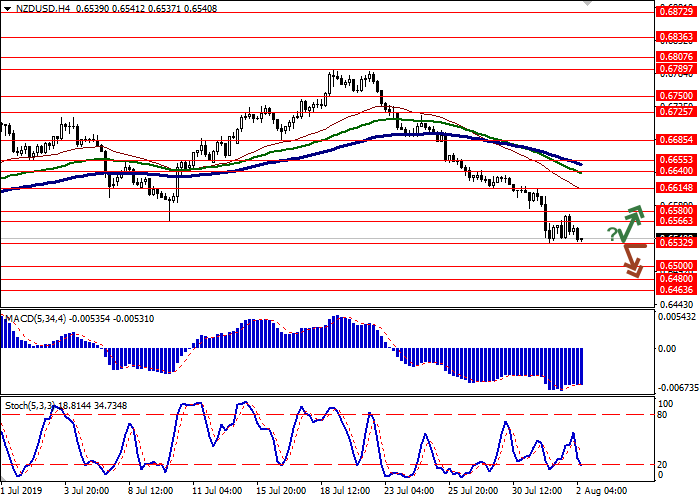

Long positions can be opened after a rebound from 0.6532 and the breakout of 0.6566 or 0.6580 with the target at 0.6685. Stop loss – 0.6532–0.6620. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of 0.6532 with the targets at 0.6463–0.6440. Stop loss – 0.6570. Implementation period: 1–2 days.

Yesterday, the NZD/USD pair traded ambiguously but renewed the lows since June 20. The decrease was due to ambiguous macroeconomic statistics and the aggravation of the situation around the US-Chinese trade negotiations after the next statements of Donald Trump in his Twitter. Also, investors react to the Fed’s interest rates decision. On Wednesday, it, as expected, lowered the interest rate by 25 basis points and announced the termination of the balance reduction program. The head of the regulator Jerome Powell, commenting on the decision, noted that this easing of monetary policy is not the beginning of a new cycle of rate reduction but is only a way to stimulate the economy against the background of rapidly changing external factors. Today, investors are awaiting the publication of the July report on the US labor market.

Support and resistance

On the daily chart, Bollinger Bands actively decline. The price range expands but not as fast as the downtrend develops in the short term. The MACD falls, keeping a strong sell signal (the histogram is below the signal line). Having reached its lows, Stochastic is in the horizontal plane, signaling the risks of corrective growth in the ultra-short term.

It is better to wait until the situation is clear before opening new positions and close some of the current profitable short positions before the weekend.

Resistance levels: 0.6566, 0.6580, 0.6614, 0.6640.

Support levels: 0.6532, 0.6500, 0.6480, 0.6463.

Trading tips

Long positions can be opened after a rebound from 0.6532 and the breakout of 0.6566 or 0.6580 with the target at 0.6685. Stop loss – 0.6532–0.6620. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of 0.6532 with the targets at 0.6463–0.6440. Stop loss – 0.6570. Implementation period: 1–2 days.

No comments:

Write comments