AUD/USD: the instrument is consolidating

02 August 2019, 09:59

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6835 |

| Take Profit | 0.6900, 0.6920, 0.6933 |

| Stop Loss | 0.6794 |

| Key Levels | 0.6720, 0.6758, 0.6794, 0.6830, 0.6860, 0.6883, 0.6900 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6790 |

| Take Profit | 0.6720 |

| Stop Loss | 0.6830 |

| Key Levels | 0.6720, 0.6758, 0.6794, 0.6830, 0.6860, 0.6883, 0.6900 |

Current trend

AUD ended yesterday’s session with a steady decline against USD, updating local lows of January 3. The instrument was pressured by another sharp statement by Donald Trump, who accused Chinese President Xi Jinping of sluggishness in the process of concluding a trade agreement. Trump has also announced the phased introduction of higher import duties on the remaining Chinese imports from September. It is proposed to start with 10% duty, after which the US president, depending on the progress made in the negotiations, can regulate this level.

During today's Asian session, AUD is showing corrective growth. Macroeconomic statistics from Australia provides certain support for the instrument. The volume of retail sales in August grew by 0.4% MoM after rising by 0.1% MoM in the previous month. Australia's Producer Price Index in Q2 2019 showed an increase of 0.4% QoQ and 2.0% YoY, which was better than market expectations (+0.2% QoQ and +1.9% YoY).

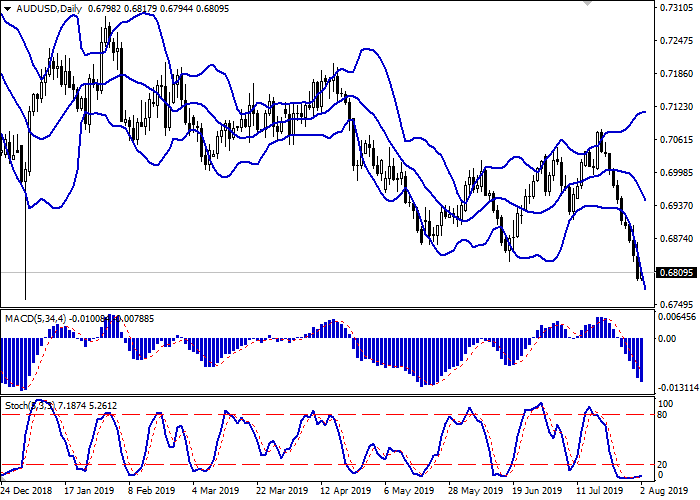

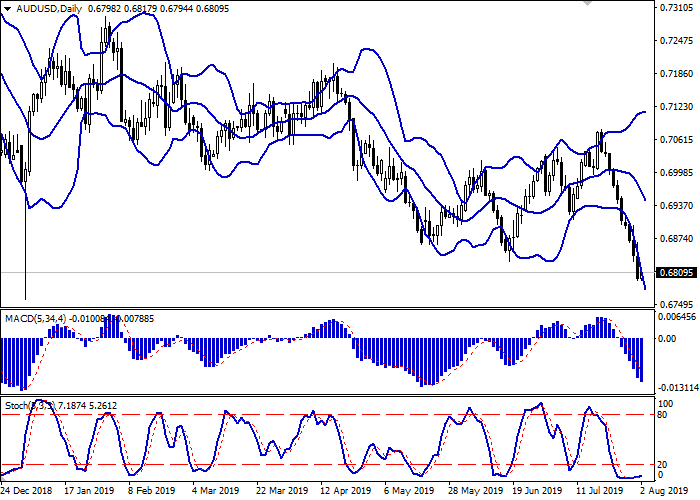

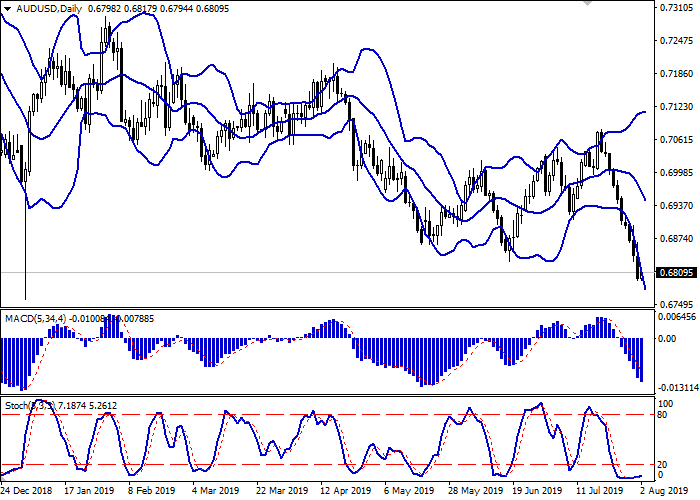

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is actively expanding, but the instrument has been located outside of its boundaries for a long time. MACD is going down preserving a strong sell signal (located below the signal line). Stochastic, having reached its lows, reversed to the horizontal plane, indicating strongly oversold AUD in the short and ultra-short term.

Correctional dynamics is possible in the near future.

Resistance levels: 0.6830, 0.6860, 0.6883, 0.6900.

Support levels: 0.6794, 0.6758, 0.6720.

Trading tips

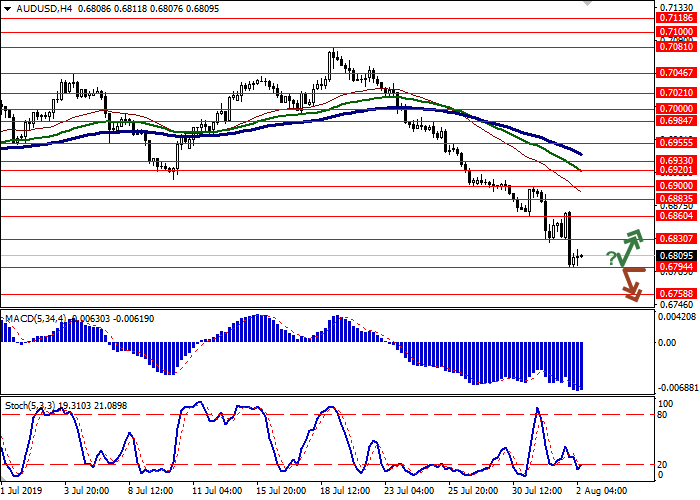

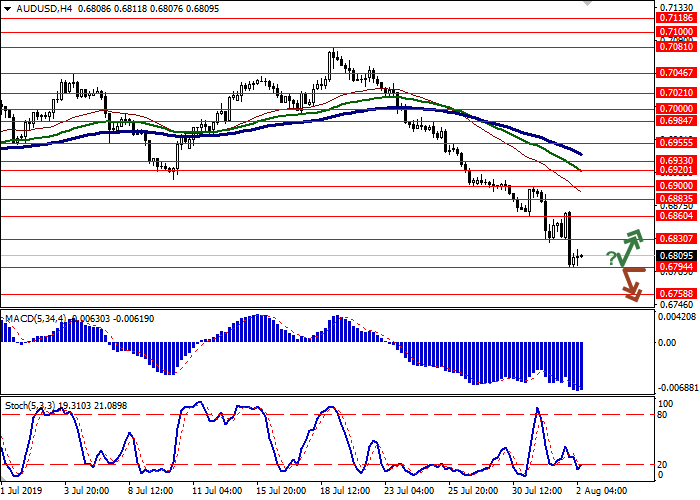

To open long positions, one can rely on the rebound from 0.6794 as from support with the subsequent breakout of 0.6830. Take profit — 0.6900 or 0.6920, 0.6933. Stop loss — 0.6794.

The breakdown of 0.6794 may serve as a signal to new sales with the target at 0.6720. Stop loss — 0.6830.

Implementation time: 2-3 days.

AUD ended yesterday’s session with a steady decline against USD, updating local lows of January 3. The instrument was pressured by another sharp statement by Donald Trump, who accused Chinese President Xi Jinping of sluggishness in the process of concluding a trade agreement. Trump has also announced the phased introduction of higher import duties on the remaining Chinese imports from September. It is proposed to start with 10% duty, after which the US president, depending on the progress made in the negotiations, can regulate this level.

During today's Asian session, AUD is showing corrective growth. Macroeconomic statistics from Australia provides certain support for the instrument. The volume of retail sales in August grew by 0.4% MoM after rising by 0.1% MoM in the previous month. Australia's Producer Price Index in Q2 2019 showed an increase of 0.4% QoQ and 2.0% YoY, which was better than market expectations (+0.2% QoQ and +1.9% YoY).

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is actively expanding, but the instrument has been located outside of its boundaries for a long time. MACD is going down preserving a strong sell signal (located below the signal line). Stochastic, having reached its lows, reversed to the horizontal plane, indicating strongly oversold AUD in the short and ultra-short term.

Correctional dynamics is possible in the near future.

Resistance levels: 0.6830, 0.6860, 0.6883, 0.6900.

Support levels: 0.6794, 0.6758, 0.6720.

Trading tips

To open long positions, one can rely on the rebound from 0.6794 as from support with the subsequent breakout of 0.6830. Take profit — 0.6900 or 0.6920, 0.6933. Stop loss — 0.6794.

The breakdown of 0.6794 may serve as a signal to new sales with the target at 0.6720. Stop loss — 0.6830.

Implementation time: 2-3 days.

No comments:

Write comments