USD/JPY: the instrument is declining

18 July 2019, 10:02

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 107.85 |

| Take Profit | 108.52 |

| Stop Loss | 107.52 |

| Key Levels | 106.75, 107.03, 107.52, 107.78, 108.14, 108.52, 108.79 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 107.45 |

| Take Profit | 107.03 |

| Stop Loss | 107.78 |

| Key Levels | 106.75, 107.03, 107.52, 107.78, 108.14, 108.52, 108.79 |

Current trend

USD returned to decline against JPY yesterday, leveling off the results of Tuesday's correctional growth. The negative dynamics was supported by the weak statistics on the housing market. Also, investors are concerned about the possible exacerbation of the US-China trade relations since the negotiations have not yet led to positive results. The rate of houses construction started in the US in June decreased by 0.9% after a decrease of 0.4% MoM last month (forecast of growth by 1.9% MoM). The number of building permits was also negative. In June, it collapsed by 6.1% after rising by 0.7% MoM last month.

Today, the pair is developing a downtrend. The import and export statistics published in Japan exert certain pressure on the yen. Exports in June fell by 6.7% after falling by 7.8% YoY last month (forecast −5.6% YoY). Imports collapsed by 5.2% after falling by 1.5% YoY in May.

Support and resistance

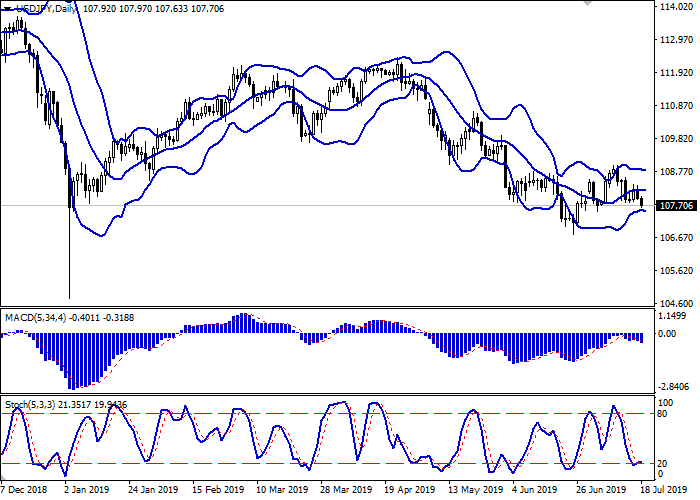

Bollinger Bands in the D1 chart show flat dynamics. The price range expands slightly from below, responding to the strengthening of "bearish" sentiment in the market. MACD indicator is falling, keeping a weak sell signal (the histogram is below the signal line). Stochastic, approaching its minima, tends to reverse up, indicating the oversold dollar in the ultra-short term.

One should look at the possibility of correctional growth at the end of the week.

Resistance levels: 107.78, 108.14, 108.52, 108.79.

Support levels: 107.52, 107.03, 106.75.

Trading tips

Long positions may be opened if the price moves away from 107.52, as from support, followed by the breakout of 107.78. Take profit – 108.52. Stop loss – 107.52. Implementation period: 2-3 days.

A confident breakdown of 107.52 may serve as a signal to further sales with the target at 107.03. Stop loss – 107.78. Implementation period: 1-2 days.

USD returned to decline against JPY yesterday, leveling off the results of Tuesday's correctional growth. The negative dynamics was supported by the weak statistics on the housing market. Also, investors are concerned about the possible exacerbation of the US-China trade relations since the negotiations have not yet led to positive results. The rate of houses construction started in the US in June decreased by 0.9% after a decrease of 0.4% MoM last month (forecast of growth by 1.9% MoM). The number of building permits was also negative. In June, it collapsed by 6.1% after rising by 0.7% MoM last month.

Today, the pair is developing a downtrend. The import and export statistics published in Japan exert certain pressure on the yen. Exports in June fell by 6.7% after falling by 7.8% YoY last month (forecast −5.6% YoY). Imports collapsed by 5.2% after falling by 1.5% YoY in May.

Support and resistance

Bollinger Bands in the D1 chart show flat dynamics. The price range expands slightly from below, responding to the strengthening of "bearish" sentiment in the market. MACD indicator is falling, keeping a weak sell signal (the histogram is below the signal line). Stochastic, approaching its minima, tends to reverse up, indicating the oversold dollar in the ultra-short term.

One should look at the possibility of correctional growth at the end of the week.

Resistance levels: 107.78, 108.14, 108.52, 108.79.

Support levels: 107.52, 107.03, 106.75.

Trading tips

Long positions may be opened if the price moves away from 107.52, as from support, followed by the breakout of 107.78. Take profit – 108.52. Stop loss – 107.52. Implementation period: 2-3 days.

A confident breakdown of 107.52 may serve as a signal to further sales with the target at 107.03. Stop loss – 107.78. Implementation period: 1-2 days.

No comments:

Write comments