USD/CHF: the pair is growing

08 July 2019, 09:42

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9935 |

| Take Profit | 1.0000, 1.0020 |

| Stop Loss | 0.9900 |

| Key Levels | 0.9775, 0.9800, 0.9833, 0.9887, 0.9930, 0.9960, 1.0000, 1.0020 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9880 |

| Take Profit | 0.9800 |

| Stop Loss | 0.9930 |

| Key Levels | 0.9775, 0.9800, 0.9833, 0.9887, 0.9930, 0.9960, 1.0000, 1.0020 |

Current trend

USD rose substantially against CHF on Friday, updating local maxima of June 20. The reason for the emergence of a confident downward dynamics were strong data on the US labor market. The nonfarm payrolls in June increased by a record 224K after growth by 72K last month. Analysts had expected an acceleration only by 160K, which seemed to be a very optimistic estimate. The unemployment rate in June rose from 3.6% to 3.7%, while the average hourly wage did not change from the previous 3.1% YoY.

Franc, in turn, reacted negatively to the publication of weak macroeconomic statistics from Germany. The production orders in May decreased by 2.2% MoM and 8.6% YoY, which was significantly worse than the expected values of –0.1% MoM and −5.7% YoY. Today, investors are focused on the data on industrial output in Germany in May. Switzerland will publish the statistics on the dynamics of foreign currency reserves in June.

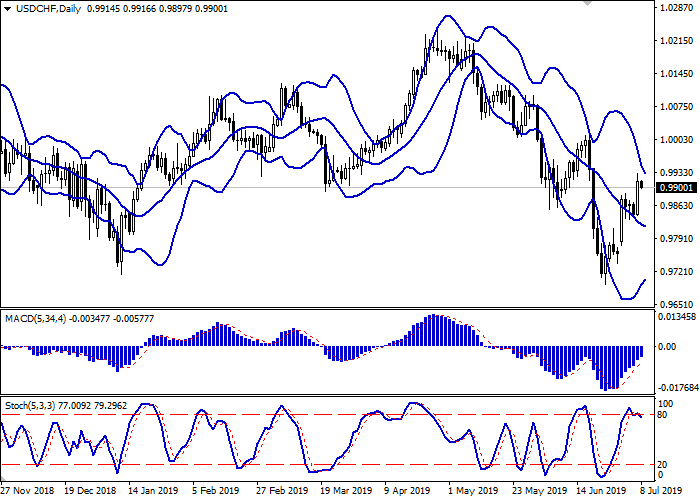

Support and resistance

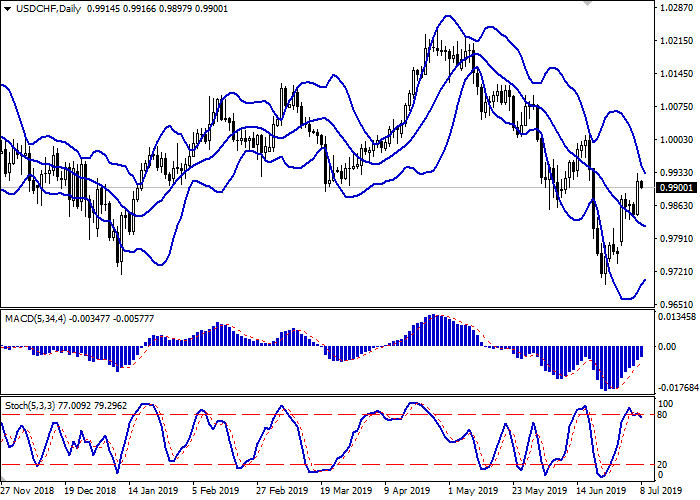

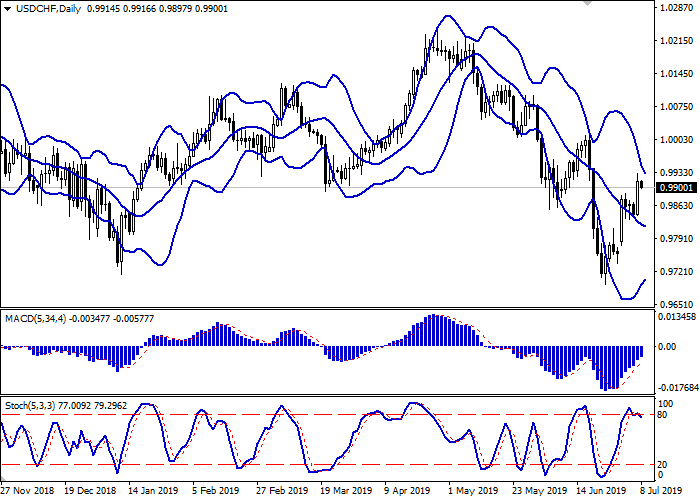

On the D1 chart, the Bollinger Bands are gradually reversing horizontally. The price range is actively narrowing, reflecting a sharp change of trend in the short/medium term. MACD indicator is growing preserving a stable buy signal (the histogram is above the signal line). Stochastic, approaching its maxima, tends to reverse downwards, signaling the growing risks of the overbought dollar in the ultra-short term.

There's a possibility of an upward correction in the short and/or ultra-short term.

Resistance levels: 0.9930, 0.9960, 1.0000, 1.0020.

Support levels: 0.9887, 0.9833, 0.9800, 0.9775.

Trading tips

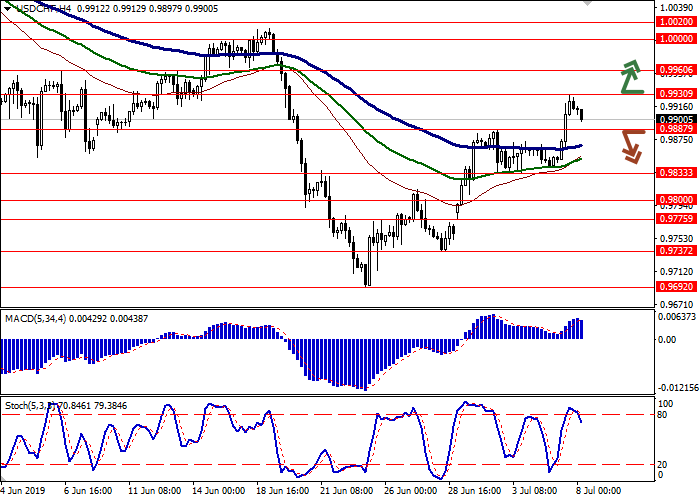

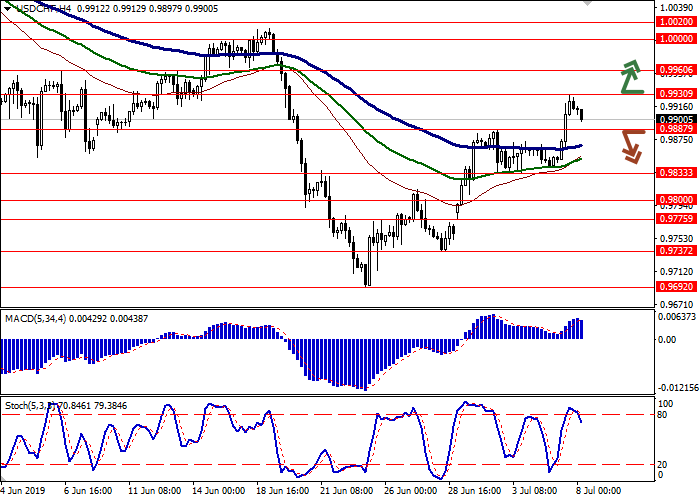

To open long positions, one can rely on the breakout of 0.9930. Take profit – 1.0000 or 1.0020. Stop loss – 0.9900.

A confident breakdown of 0.9887 may serve as a signal to further correctional sales with the target at 0.9800. Stop loss – 0.9930.

Implementation period: 2-3 days.

USD rose substantially against CHF on Friday, updating local maxima of June 20. The reason for the emergence of a confident downward dynamics were strong data on the US labor market. The nonfarm payrolls in June increased by a record 224K after growth by 72K last month. Analysts had expected an acceleration only by 160K, which seemed to be a very optimistic estimate. The unemployment rate in June rose from 3.6% to 3.7%, while the average hourly wage did not change from the previous 3.1% YoY.

Franc, in turn, reacted negatively to the publication of weak macroeconomic statistics from Germany. The production orders in May decreased by 2.2% MoM and 8.6% YoY, which was significantly worse than the expected values of –0.1% MoM and −5.7% YoY. Today, investors are focused on the data on industrial output in Germany in May. Switzerland will publish the statistics on the dynamics of foreign currency reserves in June.

Support and resistance

On the D1 chart, the Bollinger Bands are gradually reversing horizontally. The price range is actively narrowing, reflecting a sharp change of trend in the short/medium term. MACD indicator is growing preserving a stable buy signal (the histogram is above the signal line). Stochastic, approaching its maxima, tends to reverse downwards, signaling the growing risks of the overbought dollar in the ultra-short term.

There's a possibility of an upward correction in the short and/or ultra-short term.

Resistance levels: 0.9930, 0.9960, 1.0000, 1.0020.

Support levels: 0.9887, 0.9833, 0.9800, 0.9775.

Trading tips

To open long positions, one can rely on the breakout of 0.9930. Take profit – 1.0000 or 1.0020. Stop loss – 0.9900.

A confident breakdown of 0.9887 may serve as a signal to further correctional sales with the target at 0.9800. Stop loss – 0.9930.

Implementation period: 2-3 days.

No comments:

Write comments